Question: please i need help solving this ant by default risk in bonds, and how do investors respond to it? differences between a bond's coupon rate,

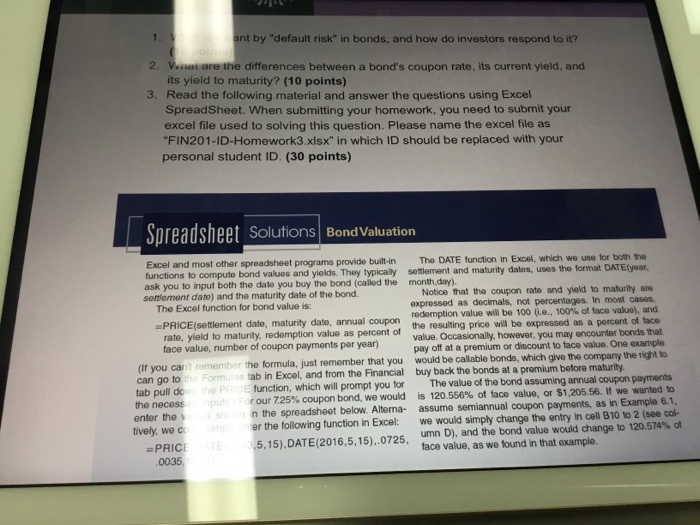

ant by "default risk" in bonds, and how do investors respond to it? differences between a bond's coupon rate, its current yield, and its yield to maturity? (10 points) Read the following material and answer the questions using Excel SpreadSheet. When submitting your homework, you need to submit your excel file used to solving this question. Please name the excel file as FIN201-1D-Homework3.xlsx" in which ID should be replaced with your personal student ID. (30 points) 3. Spreadsheet Solutions Bond Valuation unction in Excel, which we use for both the Excel and most other spreadsheet programs provide built-in The DATE functions to computo bond values and yiolds. They typicaly settlement and maturity dates, uses ask you to input both the date you buy the bond (called the month day) sottlement date) and the maturity date of the bond. the format DATE(year, Notice that the coupon rate and yiekd to maturity are exprossed as decimals, not percentages. In most cases, redemption value will be 100 (.e., 100% of face value), anvd The Excel function for bond value is PRICE(settlement date, maturity date, annual coupon rate, yield to maturity, redemption value as percent of value. Occasionally, however, you may encounter face value, number of coupon payments per year) bonds that rate, yield to maturity, redemption value as percent of he resulting price will be expressed as a percent of face pay off at a premium or discount to tace value. One example which give the company the right to (If you can't remember the formula, just remember that you would be callable bonds, can go to the Formulas tab in Excel, and from the Financial buy back the bonds at a premium betore maturity tab pull dow the PRICE function, which will prompt you for The value of the the necess enter the tively, we C bond assuming annual coupon payments rou r725% coupon bond, we would is 120.556% of face value, or $1.20556. " we wanted to n the spreadsheet below. Alterna- assume semiannual coupon payments, as in Example 6.1 pu er the following function in Excel: we would simply change the entry in cell B10 to 2 (see col- hange to 120574% of umn D), and the bond value would face value, as we found in that example 5, 15), DATE(201 6,5,15),0725, PRICE 003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts