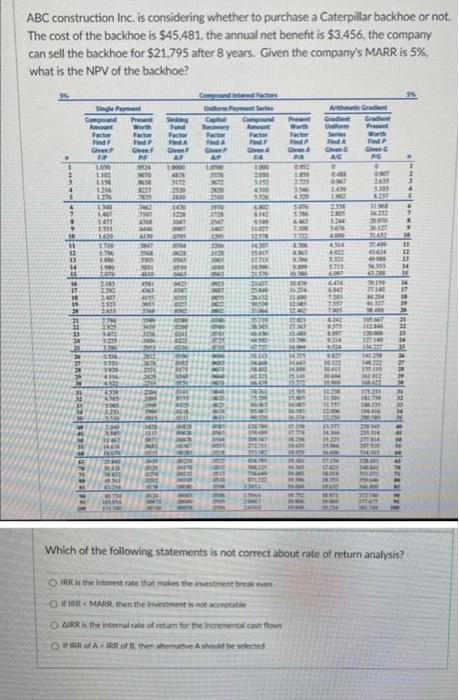

Question: please i need help urgent ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $45,481,

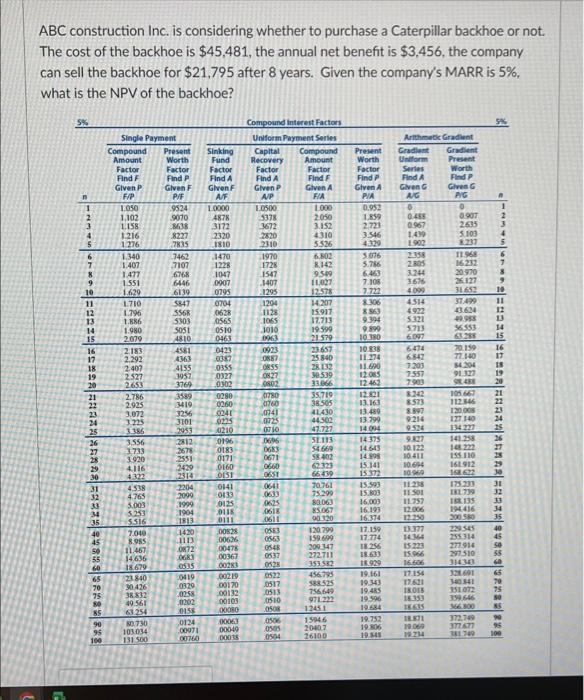

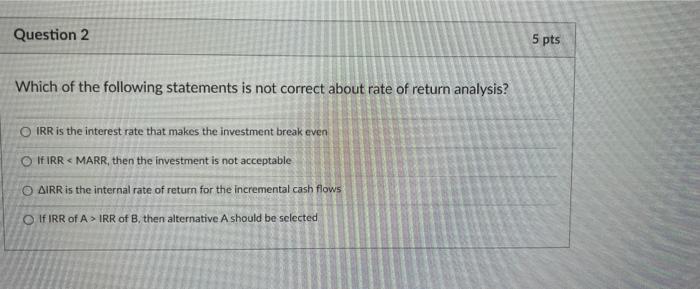

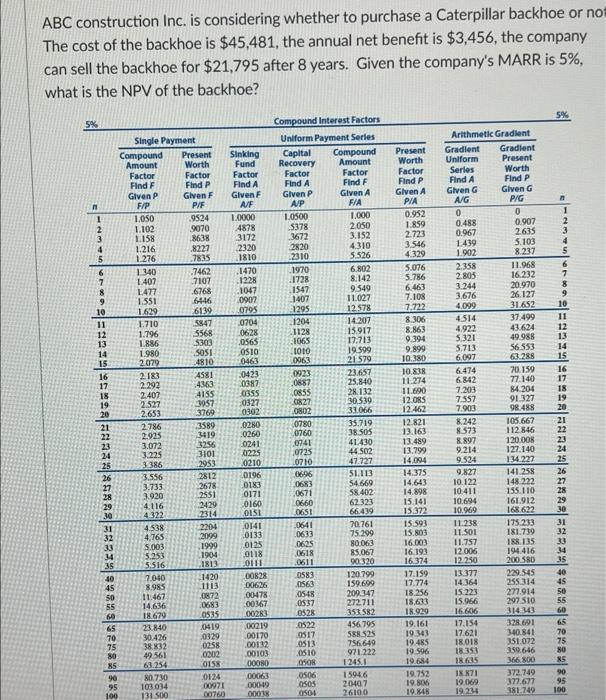

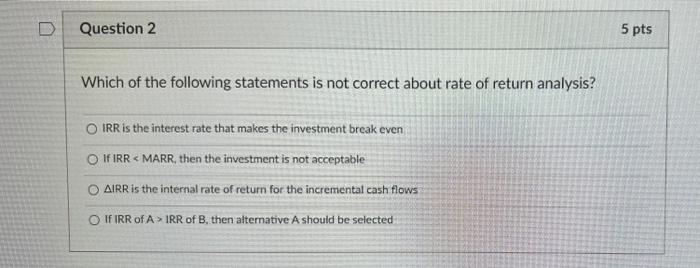

ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $45,481, the annual net benefit is $3,456, the company can sell the backhoe for $21,795 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? Single Payment Pement Series Arthmetic Gradient Gradient Gradient Worth Fund Present Factor Factor Factor Worth Find A Fiend F Fed Find P GhmF Given Given & Given Given G M FA AG AG 9524 10000 1000 9070 4878 2050 838 3172 3152 8323 2520 205 1430 2462 100 1 : . 9 10 11 12 13 H 16 16 IT BERADARRARBURES SPERURER Amount Factor Find F Given P 1.8 1.800 1.102 1156 1216 1276 1340 1.407 LATT 2.531 1429 1710 MCT 1.866 1.980 3.829 2.385 2.293 LOVE 3523 2653 23M 2025 -sar 325 3.356 3733 2929 4316 4.59 VACK soes 320 1386 2040 XD45 MAN PRI PADVI ME VILK www 6139 3667 3548 3000 FUN 430 4381 AL15 3957 3500 3419 ME 300 33 2011 300 AZZE 1047 PORT SACR 8004 JACK 0545 3010 6420 Find Oliven AP 3830 1970 DILY 2009 8342 $549 11827 12376 14317 DIST ITTO 26.509 21.09 ZAST OFFIC 2012 MIN SUMC 15729 www 4.00 WAND Serp 5410 SAMS 24412 en 22 2631 354 MONT MENT ME120 WICACH ISLAN 2017 HIDE SETO 300325 Worth Factor Find P Given & PA 0952 LAN 2725 3.346 580% WYKL WELF GMY 1.00 1333 8.306 KMT MICS IND 0400 8T PER THE ST SIST SWIVE CAM 3676 4.009 4304 4902 5321 1.30 5713 26300 6.007 BLEN 6474 6.842 11.34 11.00 1201 125 7357 0 48.242 9.375 KIT 8214 9304 14375 WAST MAKS MAZZ 14.300 10411 10454 NEU 18.20 11411 19.30 . SAPAL 14 14.306 www 2969 WWW LAN 1902 2398 AL 301 BETT 12000 3279 36.34 13.09 Dan 1434 115.22 SINE 1344 AW SE PRESE 17294 STADE HOW 16391 0 www 0907 2635 5.305 19611 TV T 30124 JANTE nam Which of the following statements is not correct about rate of return analysis? O IRR is the interest rate that makes the investment break even OI IRR MARR, then the investment is not acceptable O AIRR is the internal rate of return for the incremental cash flows ORR of A IRR of B, then alternative A should be selected 16.232 26127 . 11452 14 11 37.400 43424 www 36.355 613798 78399 77140 84200 91.327 105.4647 21 21 112.346 23 TING 24 13277 140.218 24 148.222 27 115.100 28 M 29 354 422 175.213 31 18179 18 135 194416 200340 32 33 34 NICE is SPENCE 221314 201310 114.341 TOKARE INFO CUNG 3 6 L " 21 D 14 15 16 17 18 29 K K ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $45,481, the annual net benefit is $3,456, the company can sell the backhoe for $21,795 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? 5% Compound Interest Factors Single Payment Uniform Payment Series Arithmetic Gradient Gradient Sinking Capital Compound Present Gradient Fund Recovery Amount Worth Uniform Present Factor Factor Factor Find A Factor Series Worth Find A Find P Find A Find P Find F Given A Given F Given A Given G Given G Given P A/P A/F F/A PIA A/G PG 10000 10500 1.000 0.952 0 0 4878 5378 2050 1.859 0.455 0.907 3172 3672 3.152 2,723 0.967 2635 2320 2820 4310 3.546 1.439 5.103 1810 2310 5.526 4:329 1902 8.237 1470 1970 6.802 5.076 2.358 11.968 1228 1728 8.142 5.786 2.805 16232 1047 1547 9.549 6.463 3.244 20.970 26.127 0907 1407 11.027 7.108 3676 0795 1295 12.578 7.722 4.099 31652 0704 1204 14.207 8.306 4.514 37.499 0628 1128 15.917 8863 4922 43.624 49.998 0565 1065 37.713 9.394 5321 0510 3010 19.599 9.899 5.713 36.553 0463 21 579 10.380 6097 63.288 0423 23657 10.838 6.474 70.159 0387 25.840 11:274 6847 77.140 84204 0355 28 132 11.690 7203 0327 30.539 12.085 7557 91.327 0302 33.066 12 462 7.903 SARE 0280 35,719 12.821 8242 105.667 112.346 0260 38.505 13.163 8.573 0241 4L430 13.489 8.897 120.005 127.140 0225 44502 13.799 9.214 0210 47.727 14.004 9.524 134 227 51113 14.375 9.827 141.258 54669 14.643 148 222 155.110 58.402 14.908 62.323 15.141 161.912 66439 15.372 168622 70.761 15.593 75.299 15.803 175.233 181.739 188.135 194,416 80.063 16.003 85.067 16.193 90 120 16.374 200 580 229.545 120.299 17.159 159.699 17.774 235.314 200.347 18.256 277.914 272.711 18.633 297,510 353.582 18.929 314343 456.795 19.161 328.601 588.525 19.343 340.541 756,649 19.485 351.072 971.222 19.596 399 646 19.684 366.800 19.752 372,749 377.677 381.749 n 1 6 7 6 10 11 12 13 14 15 883 23 25 26 35 55 60 65 06 $6 100 Compound Amount Factor Find F Given P F/P 1.050 1,102 1.158 1.216 1276 1.340 1.407 1.477 1.551 1.629 1710 1.796 1.886 1.980 2.079 2.183 2.292 2407 2.527 2653 2.786 2.925 3.072 3.225 3.386 3.556 3.733 3.920 4.116 4322 4.538 4.765 5.003 5.253 5516 7.040 8.985 11.467 14.636 18.679 23.840 30.426 38.832 49.561 63.254 80.730 103.034 131 500 Present Worth Factor Find P Given F P/F 9524 9070 8638 8227 7835 7462 7107 6768 6446 6139 5847 5568 5303 5051 4810 4581 A363 4155 3957 3769 3589 3419 3256 3101 2953 2812 2678 2551 2429 2314 2204 2099 1999 1904 1813 1420 CHE 0872 0683 0535 30419 0329 0258 0202 0158 0124 00971 00760 9610 0183 0171 0910 0151 0141 0133 0125 3110 0111 00828 00626 00478 00367 00283 00219 00170 00132 00103 00080 00063 00049 00018 1960 0923 0887 0855 0827 0802 0780 0760 0741 0725 0710 0696 0683 0671 0660 1590 0641 0633 0625 0618 0611 0583 0563 0548 0537 0528 0522 0517 0513 0510 0508 0506 0505 0504 12451 15946 2040.7 26100 90861 19.845 10.122 10.411 10.694 10960 11.238 11.501 11.757 12.006 12.250 13.377 14.364 15.223 15.966 16.606 17.154 17.621 18.015 18.353 18635 18.871 19.069 19.234 V 1 2 5 6 6159 7 8 19 11 12 ========AARRRRR 13 15 16 18 19 20 21 23 24 25 26 27 25 29 30 32 33 34 35 40 45 9333322228 50 55 09 65 70 75 50 85 90 56 100 Question 2 Which of the following statements is not correct about rate of return analysis? O IRR is the interest rate that makes the investment break even O IF IRR IRR of B, then alternative A should be selected 5 pts ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not The cost of the backhoe is $45,481, the annual net benefit is $3,456, the company can sell the backhoe for $21,795 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? 5% 5% Compound Interest Factors Uniform Payment Series Single Payment Arithmetic Gradient Gradient Gradient Compound Capital Present Compound Present Amount Sinking Fund Worth Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Worth Factor Series Find F Find P Find A Find A Find P Find P Find A Find F Given A Given F Given G Given F A/F Given P Given P F/P Given A P/A Given G P/G P/F A/P F/A A/G 1,050 9524 1.0000 1.0500 1.000 0.952 0 0 1.102 9070 4878 5378 0.907 1.859 2.050 0.488 1158 3672 8638 3.152 2.723 0.967 2.63 1.216 8227 2820 4.310 5.103 3,546 1.439 1.276 7835 2310 5.526 4.329 1.902 8.237 1340 7462 6.802 1970 11.968 5.076 2.358 1.407 7107 1728 8.142 5.786 2.805 16.232 1477 6768 1547 9.549 6.463 3.244 20.970 1.551 6446 1407 26.127 7.108 11.027 3.676 1.629 6139 1295 12.578 7.722 4.099 31.652 1.710 5847 1204 14.207 8.306 37.499 4.514 1.796 5568 1128 15.917 8.863 4.922 43.624 1.886 5303 1065 17,713 9.394 5.321 49.988 1.980 5051 1010 19.599 9.899 5.713 56.553 2.079 4810 0963 21 579 10.380 6.097 63.288 4581 0923 23.657 10,838 6.474 70.159 2.183 2.292 0687 25.840 11.274 6.842 77.140 0855 28.132 11.690 7.203 84,204 2.407 2527 2.653 0827 30.539 12.085 7557 91.327 0802 33.066 12.462 7.903 98.488 2.786 0780 35.719 12.821 8.242 105.667 2.925 0760 38.505 13.163 8.573 3.072 0741 41.430 13.489 8.897 112.846 120.008 127.140 0725 44.502 13.799 9.214 3.225 3.386 0710 47.727 14.094 9.524 134.227 0696 51.113 14.375 9.827 0683 54.669 14.643 10.122 0671 58.402 14.898 10.411 141.258 148.222 155.110 161.912 168.622 0660 62.323 15.141 3.556 3.733 3.920 4.116 4.322 4.538 4,765 5.003 10.694 0651 66.439 15.372 10.969 0641 70.761 15.593 11.238 175.233 0633 75.299 15.803 11.501 181.739 188.135 0625 80.063 16.003 11.757 5.253 0618 85,067 16.193 12.006 194.416 5.516 0611 90.320 16.374 12.250 7.040 0583 120.799 17.159 13.377 8.985 01563 159.699 17.774 14.364 209.347 18.256 15.223 11.467 14.636 272.711 18.633 15.966 353.582 18.929 16.606 18.679 23.840 30.426 456.795 19.161 17.154 200.580 229.545 255.314 277.914 297 510 314.343 328.691 340.841 351.072 359.646 366.800 372.749 377.677 588.525 19.343 17.621 38.832 756.649 19.485 18.018 971.222 19.596 18.353 49.561 63.254 19.684 18.635 80.730 19,752 18.871 19.806 19.069 103.034 131.500 19.848 19.234 381.749 n 1 2 5 6 7 9 10 11 12 13 14 15 16 BEHERASASKECHESCENCCESS 18 19 20 24 35 40 75 4363 4155 3957 3769 3589 3419 3256 3101 2953 2812 2678 2551 2429 2314 2204 2099 1999 1904 1813 1420 1113 0872 0683 0535 0419 0329 0258 0202 0158 0124 00971 00760 3172 2320 1810 1470 1228 1047 0907 0795 0704 0628 0565 0510 0463 0423 0387 0355 0327 0302 0280 0260 0241 01225 0210 0196 0183 0171 0160 0151 0141 0133 0125 0118 0111 00828 00626 00478 00367 00283 00219 00170 00132 00103 00080 00063 00049 00038 0548 0537 0528 0522 0517 0513 0510 0508 0506 0505 0504 1245.1 1594.6 20407 26100 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 283AASAASERRES 19 20 21 22 24 25 26 27 29 30 31 33 34 35 998883282828 40 45 50 55 60 65 70 75 80 85 90 95 100 D Question 2 Which of the following statements is not correct about rate of return analysis? IRR is the interest rate that makes the investment break even If IRR IRR of B, then alternative A should be selected 5 pts ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not The cost of the backhoe is $45,481, the annual net benefit is $3,456, the company can sell the backhoe for $21,795 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? 5% 5% Compound Interest Factors Uniform Payment Series Single Payment Arithmetic Gradient Gradient Gradient Compound Capital Present Compound Present Amount Sinking Fund Worth Recovery Amount Worth Uniform Present Factor Factor Factor Factor Factor Worth Factor Series Find F Find P Find A Find A Find P Find P Find A Find F Given A Given F Given G Given F A/F Given P Given P F/P Given A P/A Given G P/G P/F A/P F/A A/G 1,050 9524 1.0000 1.0500 1.000 0.952 0 0 1.102 9070 4878 5378 0.907 1.859 2.050 0.488 1158 3672 8638 3.152 2.723 0.967 2.63 1.216 8227 2820 4.310 5.103 3,546 1.439 1.276 7835 2310 5.526 4.329 1.902 8.237 1340 7462 6.802 1970 11.968 5.076 2.358 1.407 7107 1728 8.142 5.786 2.805 16.232 1477 6768 1547 9.549 6.463 3.244 20.970 1.551 6446 1407 26.127 7.108 11.027 3.676 1.629 6139 1295 12.578 7.722 4.099 31.652 1.710 5847 1204 14.207 8.306 37.499 4.514 1.796 5568 1128 15.917 8.863 4.922 43.624 1.886 5303 1065 17,713 9.394 5.321 49.988 1.980 5051 1010 19.599 9.899 5.713 56.553 2.079 4810 0963 21 579 10.380 6.097 63.288 4581 0923 23.657 10,838 6.474 70.159 2.183 2.292 0687 25.840 11.274 6.842 77.140 0855 28.132 11.690 7.203 84,204 2.407 2527 2.653 0827 30.539 12.085 7557 91.327 0802 33.066 12.462 7.903 98.488 2.786 0780 35.719 12.821 8.242 105.667 2.925 0760 38.505 13.163 8.573 3.072 0741 41.430 13.489 8.897 112.846 120.008 127.140 0725 44.502 13.799 9.214 3.225 3.386 0710 47.727 14.094 9.524 134.227 0696 51.113 14.375 9.827 0683 54.669 14.643 10.122 0671 58.402 14.898 10.411 141.258 148.222 155.110 161.912 168.622 0660 62.323 15.141 3.556 3.733 3.920 4.116 4.322 4.538 4,765 5.003 10.694 0651 66.439 15.372 10.969 0641 70.761 15.593 11.238 175.233 0633 75.299 15.803 11.501 181.739 188.135 0625 80.063 16.003 11.757 5.253 0618 85,067 16.193 12.006 194.416 5.516 0611 90.320 16.374 12.250 7.040 0583 120.799 17.159 13.377 8.985 01563 159.699 17.774 14.364 209.347 18.256 15.223 11.467 14.636 272.711 18.633 15.966 353.582 18.929 16.606 18.679 23.840 30.426 456.795 19.161 17.154 200.580 229.545 255.314 277.914 297 510 314.343 328.691 340.841 351.072 359.646 366.800 372.749 377.677 588.525 19.343 17.621 38.832 756.649 19.485 18.018 971.222 19.596 18.353 49.561 63.254 19.684 18.635 80.730 19,752 18.871 19.806 19.069 103.034 131.500 19.848 19.234 381.749 n 1 2 5 6 7 9 10 11 12 13 14 15 16 BEHERASASKECHESCENCCESS 18 19 20 24 35 40 75 4363 4155 3957 3769 3589 3419 3256 3101 2953 2812 2678 2551 2429 2314 2204 2099 1999 1904 1813 1420 1113 0872 0683 0535 0419 0329 0258 0202 0158 0124 00971 00760 3172 2320 1810 1470 1228 1047 0907 0795 0704 0628 0565 0510 0463 0423 0387 0355 0327 0302 0280 0260 0241 01225 0210 0196 0183 0171 0160 0151 0141 0133 0125 0118 0111 00828 00626 00478 00367 00283 00219 00170 00132 00103 00080 00063 00049 00038 0548 0537 0528 0522 0517 0513 0510 0508 0506 0505 0504 1245.1 1594.6 20407 26100 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 283AASAASERRES 19 20 21 22 24 25 26 27 29 30 31 33 34 35 998883282828 40 45 50 55 60 65 70 75 80 85 90 95 100 D Question 2 Which of the following statements is not correct about rate of return analysis? IRR is the interest rate that makes the investment break even If IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts