Question: please urgent ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $45,481, the annual net

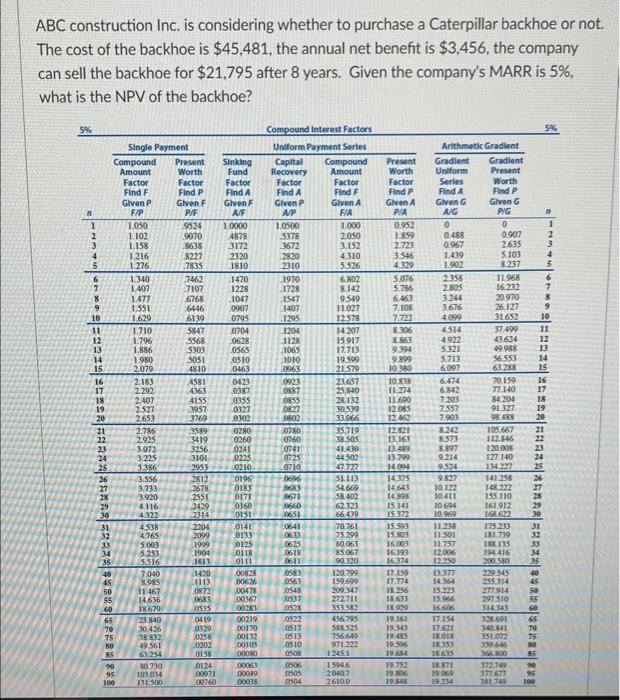

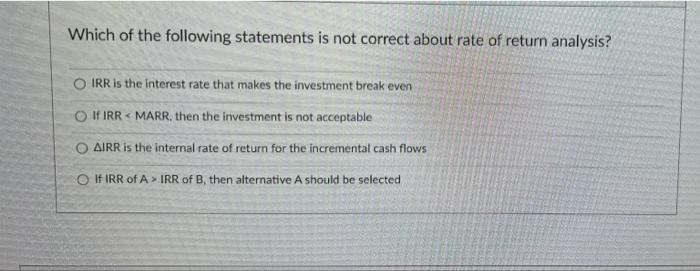

ABC construction Inc. is considering whether to purchase a Caterpillar backhoe or not. The cost of the backhoe is $45,481, the annual net benefit is $3,456, the company can sell the backhoe for $21,795 after 8 years. Given the company's MARR is 5%, what is the NPV of the backhoe? 5% Compound Interest Factors 5% Single Payment Uniform Payment Series Arithmetic Gradient Capital Compound Gradient Gradient Compound Present Amount Sinking Fund Worth Recovery Amount Uniform Present Factor Factor Factor Factor Factor Series Worth Find F Find P Find A Find A Find F Find A Find P Given F Given F Given P Given A Given G Given P F/P Given G P/G P/F A/F A/P F/A A/G 1.050 9524 1.0000 10500 1.000 0 0 1.102 9070 4878 5378 2.050 0.488 0.907 1.158 8638 3172 3672 3.152 0.967 2635 1.216 8227 2320 2820 4310 1.439 5.103 1.276 7835 1810 2310 5.526 1.902 8.237 1.340 7462 1470 1970 6.802 2.358 11.968 1.407 7107 1228 1728 8.142 2.805 16.232 1.477 6768 1047 1547 9.549 3.244 20.970 1.551 6446 0907 1407 11.027 3.676 26.127 1.629 6139 0795 1295 12.578 4.099 31.652 1.710 5847 0704 1204 14.207 4514 37.499 1.796 5568 0628 1128 15.917 4922 43.624 49 988 1.886 5303 0565 1065 17.713 5.321 1.980 5051 0510 1010 19.599 5.713 56.553 2.079 4810 0463 0963 21.579 6.097 63.288 15 2.183 4581 0423 0923 23.657 6474 70.159 77.140 2.292 4363 0387 0887 25,840 6842 2.407 4155 0355 0855 28.132 7203 84,204 2.527 3957 0327 0827 30.539 7.557 19 91.327 98.488 20 2.653 3769 0302 0802 33,066 7.903 2.786 3589 0280 0780 35.719 8.242 2.925 3419 0260 0760 38.505 8573 3.072 3156 0241 0741 41.430 8.897 3.225 3101 0225 0725 44.502 9.214 3.386 2953 0210 0710 47 727 9.524 3.556 2812 0196 0696 51.113 9.827 3.733 2678 0183 3683 54.669 10.122 3.920 2551 0171 0671 58.402 10,411 4.116 2429 20160 0660 62.323 10.694 4.322 7314 0151 0651 66439 10.969 4.538 2204 0141 0641 70.761 11.238 4.765 2099 0133 0633 75.299 11.501 5.003 1999 0125 06:25 80063 11.757 5.253 1904 0118 0618 15.067 12.006 5316 1813 0111 0611 90.320 12.250 7.040 1420 00828 9583 120.799 13.377 8.985 1113 00626 0563 159.699 14.364 0872 00478 0548 209.347 15.223 11:467 14.636 18.679 0683 00367 0537 272711 15.966 0535 00283 0528 353.582 16.606 0419 00219 0522 456.795 17.154 23.840 30.426 0329 00170 0517 388.525 17.621 38.832 0258 00132 0513 756649 18.018 49.561 0202 00103 0510 971.222 18.353 63.254 0158 00080 0508 18635 0124 00063 0506 18.871 80.730 103.034 131 500 00971 00049 0505 19.069 00760 00038 0504 19.234 n 2 3 4 5 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 28 31 35 40 45 BREMEMUASHERS 50 60 65 70 75 80 85 90 95 100 1245.1 15946 20407 26100 Present Worth Factor Find P Given A P/A 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 8.863 9.394 9.899 10:380 10.838 11.274 11.690 12.085 12.462 12.821 13.163 13.489 13.299 14.004 14.375 14,643 14.998 15.141 15.372 15.593 15,803 16.003 16.193 16.374 17.159 17.774 18.256 18.633 18929 19.161 19.343 19.485 19.596 19.484 19,752 19.306 19.548 105.667 112.846 120.008 127.140 134 227 141.258 148.222 155.110 161.912 168. 622 175.233 181.739 188.135 194.416 200.580 229 545 255.314 277.914 297.310 314,343 328.691 340 341 351.072 359.646 366 800 372749 377.677 381.749 EUH5|KDDR=BH==RHS #65 21 10 11 12 16 22 13 14 23 24 25 26 17 18 27 28 29 n 30 31 1 6 7 8 9 32 50 60 65 70 75 80 85 90 95 100 2 3 4 5 33 34 35 40 45 Which of the following statements is not correct about rate of return analysis? O IRR is the interest rate that makes the investment break even O If IRR MARR, then the investment is not acceptable AIRR is the internal rate of return for the incremental cash flows O If IRR of A > IRR of B, then alternative A should be selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts