Question: Please I need help with this and I don't know how to prepare the capital statement and partial balance sheet E12.5 (LO2), AP Coburn (beginning

Please I need help with this and I don't know how to prepare the capital statement and partial balance sheet

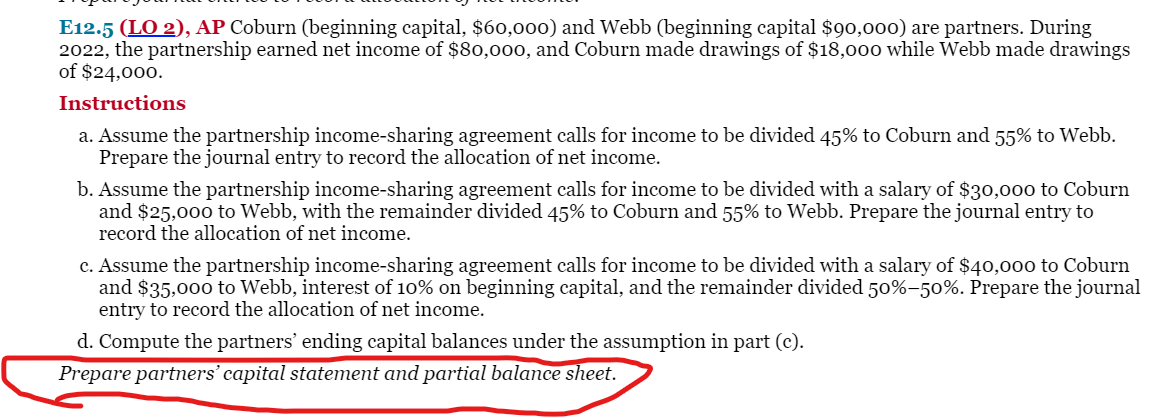

E12.5 (LO2), AP Coburn (beginning capital, \$60,000) and Webb (beginning capital $90,000 ) are partners. During 2022, the partnership earned net income of $80,000, and Coburn made drawings of $18,000 while Webb made drawings of $24,000. Instructions a. Assume the partnership income-sharing agreement calls for income to be divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income. b. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $30,000 to Coburn and $25,000 to Webb, with the remainder divided 45% to Coburn and 55% to Webb. Prepare the journal entry to record the allocation of net income. c. Assume the partnership income-sharing agreement calls for income to be divided with a salary of $40,000 to Coburn and $35,000 to Webb, interest of 10% on beginning capital, and the remainder divided 50%50%. Prepare the journal entry to record the allocation of net income. d. Compute the partners' ending capital balances under the assumption in part (c). Prepare partners' capital statement and partial balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts