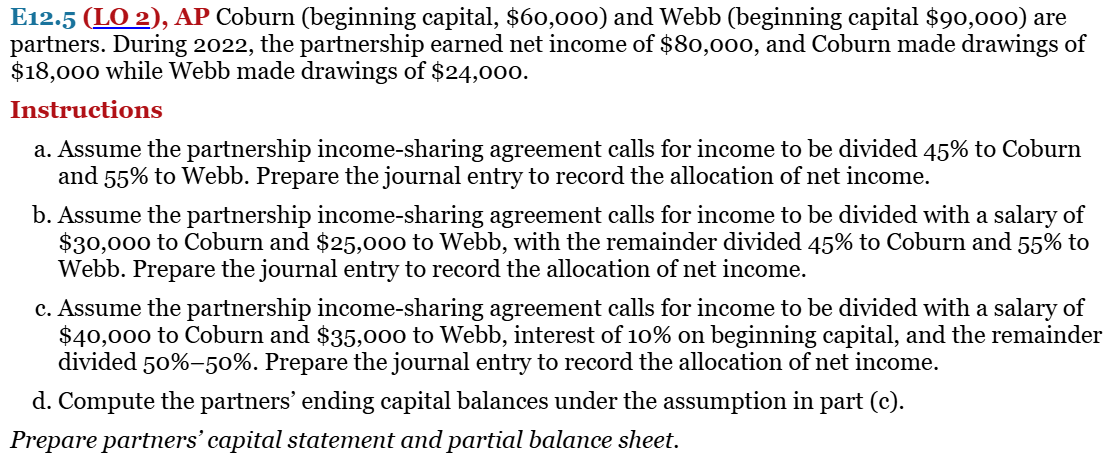

Question: E 1 2 . 5 ( LO 2 ) , AP Coburn ( beginning capital, $ 6 0 , 0 0 0 ) and Webb

ELO AP Coburn beginning capital, $ and Webb beginning capital $ are partners. During the partnership earned net income of $ and Coburn made drawings of $ while Webb made drawings of $

Instructions

a Assume the partnership incomesharing agreement calls for income to be divided to Coburn and to Webb. Prepare the journal entry to record the allocation of net income.

b Assume the partnership incomesharing agreement calls for income to be divided with a salary of $ to Coburn and $ to Webb, with the remainder divided to Coburn and to Webb. Prepare the journal entry to record the allocation of net income.

c Assume the partnership incomesharing agreement calls for income to be divided with a salary of $ to Coburn and $ to Webb, interest of on beginning capital, and the remainder divided Prepare the journal entry to record the allocation of net income.

d Compute the partners ending capital balances under the assumption in part c

Prepare partners capital statement and partial balance sheet.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock