Question: please i need it as excel formulas! step by steps please i have been getting a lot of wrong answers . Jiminy's Cricket Farm issued

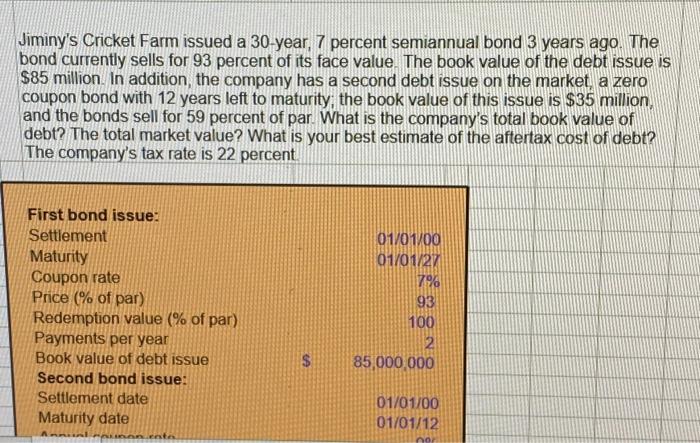

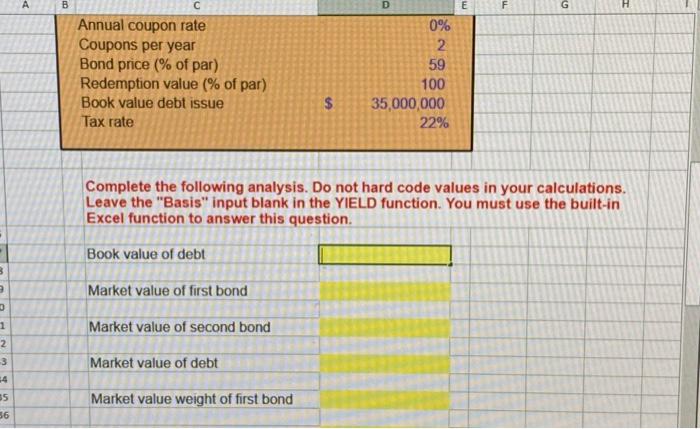

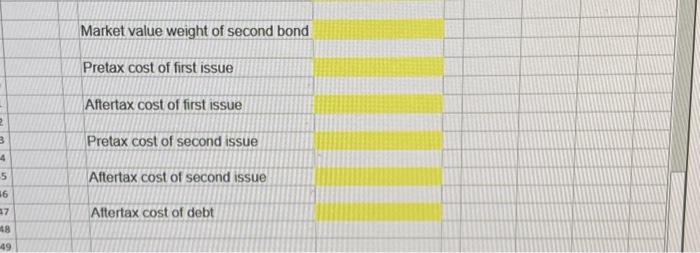

Jiminy's Cricket Farm issued a 30 -year, 7 percent semiannual bond 3 years ago. The bond currently sells for 93 percent of its face value. The book value of the debt issue is $85 million. In addition, the company has a second debt issue on the market, a zero coupon bond with 12 years left to maturity; the book value of this issue is $35 million, and the bonds sell for 59 percent of par. What is the company's total book value of debt? The total market value? What is your best estimate of the aftertax cost of debt? The company's tax rate is 22 percent Complete the following analysis. Do not hard code values in your calculations. Leave the "Basis" input blank in the YIELD function. You must use the built-in Excel function to answer this question. Market value weight of second bond Pretax cost of first issue Aftertax cost of first issue Pretax cost of second issue Aftertax cost of second issue Aftertax cost of debt

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts