Question: Please I need step by step clear solution: II (20 points) Wonder Diaper is considering two possible capital structures, A and B Source of Capital

Please I need step by step clear solution:

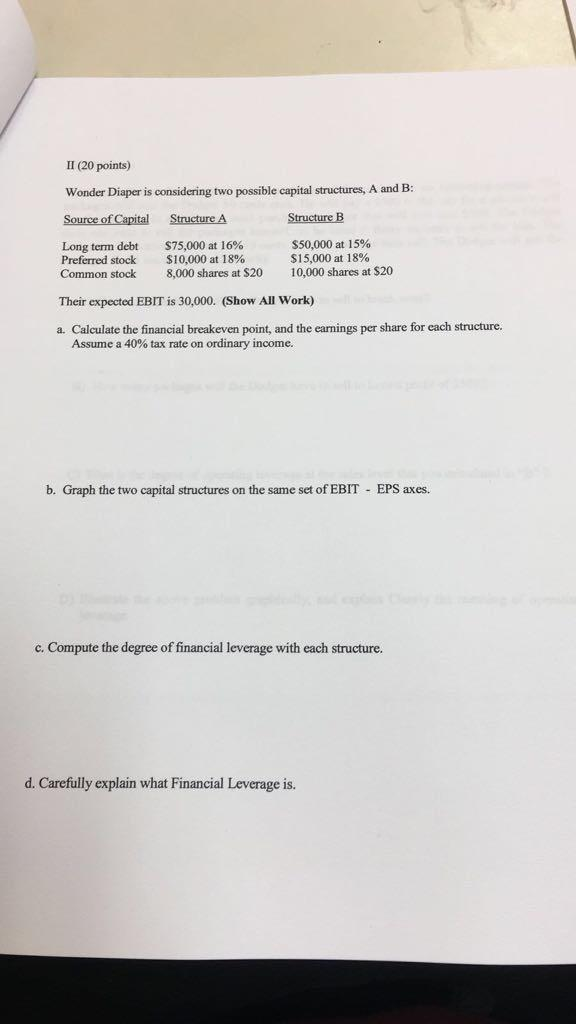

II (20 points) Wonder Diaper is considering two possible capital structures, A and B Source of Capital Stracture A Structure EB Long temm debt Preferred stock Common stock $75,000 at 16% $10,000 at 18% 8,000 shares at $20 50,000 at 15% $ 15,000 at 18% 10,000 shares at $20 Their expected EBIT is 30,000. (Show All Work) a. Calculate the financial breakeven point, and the earnings per share for each structure. Assume a 40% tax rate on ordinary income. b. Graph the two capital structures on the same set of EBIT EPS axes. c. Compute the degree of financial leverage with each structure. d. Carefully explain what Financial Leverage is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts