Question: Please, I need the answer and the approaches step by step( all the information about how to get the data) in an easy way for

Please, I need the answer and the approaches step by step( all the information about how to get the data) in an easy way for my understanding Thanks!

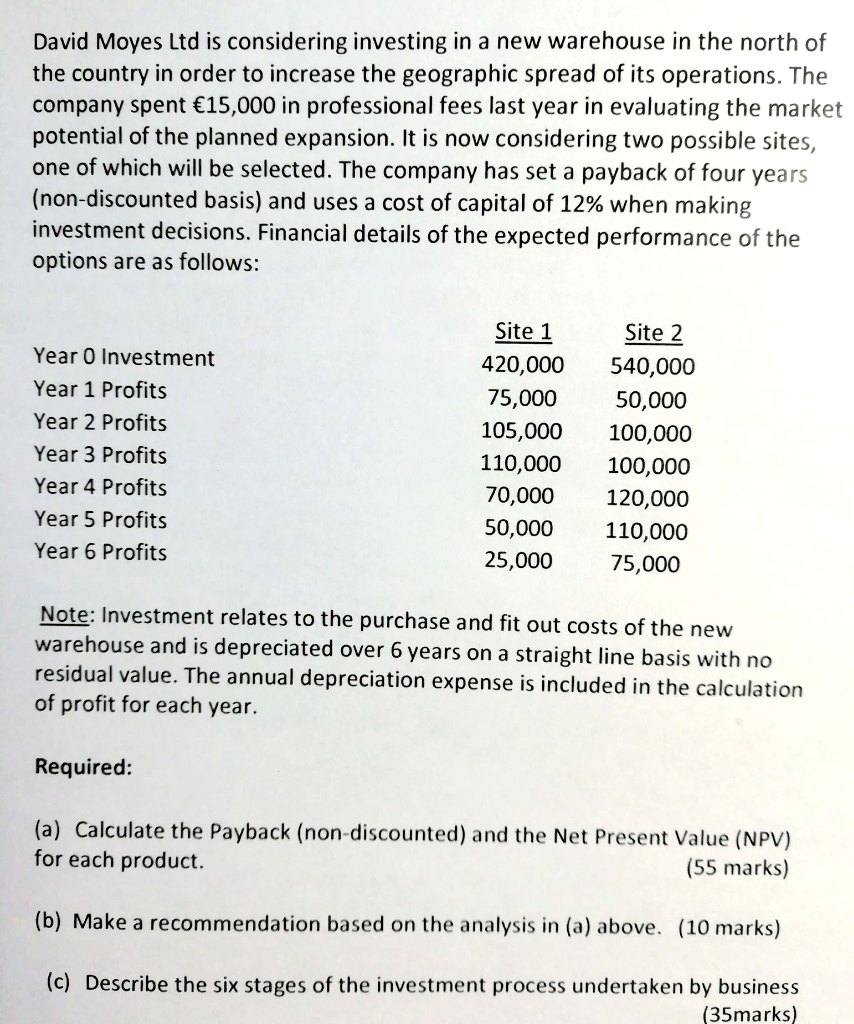

David Moyes Ltd is considering investing in a new warehouse in the north of the country in order to increase the geographic spread of its operations. The company spent 15,000 in professional fees last year in evaluating the market potential of the planned expansion. It is now considering two possible sites, one of which will be selected. The company has set a payback of four years (non-discounted basis) and uses a cost of capital of 12% when making investment decisions. Financial details of the expected performance of the options are as follows: Site 1 Site 2 Year 0 Investment 420,000 540,000 Year 1 Profits 75,000 50,000 105,000 100,000 Year 2 Profits Year 3 Profits 110,000 100,000 Year 4 Profits 70,000 120,000 Year 5 Profits 50,000 110,000 Year 6 Profits 25,00075,000 Note: Investment relates to the purchase and fit out costs of the new warehouse and is depreciated over 6 years on a straight line basis with no residual value. The annual depreciation expense is included in the calculation of profit for each year. Required: (a) Calculate the Payback (non-discounted) and the Net Present Value (NPV) for each product. (55 marks) (b) Make a recommendation based on the analysis in (a) above. (10 marks) (c) Describe the six stages of the investment process undertaken by business (35marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts