Question: please I need the method how you did to find the answer CONCEPT CHECKERS 1 A company has $5 million in debt outstanding with a

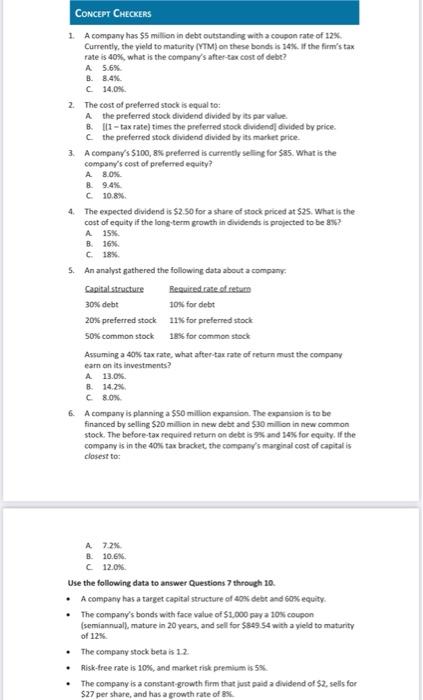

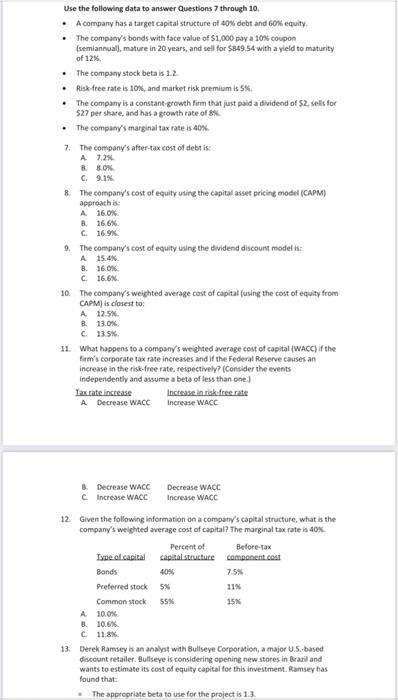

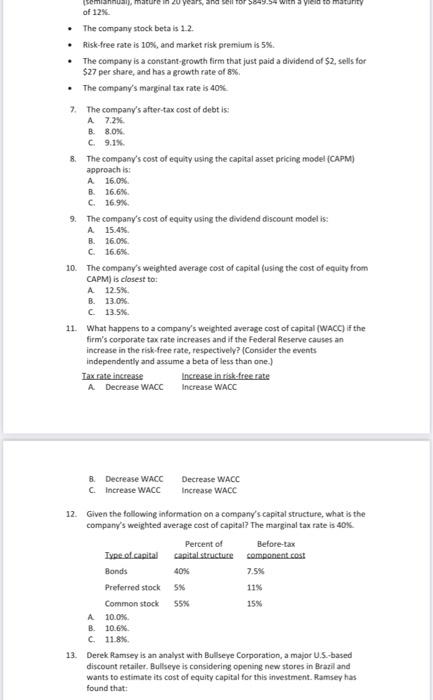

CONCEPT CHECKERS 1 A company has $5 million in debt outstanding with a coupon rate of 12% Currently, the yield to maturity (YTM on these bonds is 14%. If the firm's tax rate is 40%, what is the company's after-tax cost of debt? A 5.6% B. 8.4% C 14.0% 2. The cost of preferred stock is equal to: A the preferred stock dividend divided by its par value B. 111 - tax rate) times the preferred stock dividend divided by price. the preferred stock dividend divided by its market price 3. A company's $100,8% preferred is currently seling for $85. What is the company's cost of preferred equity? A 8.0% B 9.4% C10.8% 4 The expected dividend is 52.50 for a share of stock priced at $25. What is the cost of equity if the long-term growth in dividends is projected to be 8? A 15% B. 16% C18% 5. An analyst gathered the following data about a company, Capital structure Required rate at retum 30% debt 10% for debt 20% preferred stock 115 for preferred stock 50% common stock 1856 for common stock Assuming a 40% tax rate, what after tax rate of return must the company earn on its investments? A 13.0% B. 14.2% 8.0% 6. A company is planning a $50 milion expansion. The expansion is to be financed by selling $20 million in new debt and $30 million in new common stock. The before-tax required return on debt is 9% and 34% for equity. If the company is in the 40% tax bracket the company's marginal cost of capital is closest to: A 7.2% B. 10.6% C 12.0% Use the following data to answer Questions through 10. A company has a target capital structure of cox debt and to equity The company's bonds with face value of 51.000 paya 10% coupon semiannuali, mature in 20 years, and sell for 584954 with a yield to maturity of 12% The company stock betais 12 Risk-free rate is 10%, and market risk premium is 5% The company is a constant growth firm that just paida dividend of 52, sells for $27 per share, and has a growth rate of Use the following data to answer Questions through 10. A company has a target capital structure of 40% debt and 60% equity The company's bonds with face value of $1.000 pay a 10% coupon semiannual), mature in 20 years, and sell for $84954 with a yield to maturity of 12% The company stock beta is 12 Risk free rate is 10%, and market risk premium is 5% The company is a constant-growth firm that just paid a dividend of 52, sells for $27 per share, and has a growth rate of 8% The company's marginal tax rate is 40% 7. The company's after-tax cost of debt is: A 72% B. 80% c. 9.1% & The company's cost of equity using the capital asset pricing model (CAPM) approach is: A 16.0% 8 16.6 C 16.9% 9. The company's cost of equity using the dividend discount model is: A 15.4% 8. 16.0% c. 16.6% 10. The company's weighted average cost of capital fusing the cost of equity from CAPM) is closest to A 12.5% B. 13.0% C 13.5% 11. What happens to a company's weighted average cost of capital (WACC) if the firm's corporate tax rate increases and if the Federal Reserve causes an increase in the risk-free rate, respectively? (Consider the events independently and assume a bets of less than one.) Tax rate increase Increase in risk free rate A Decrease WACC Increase WACC & Decrease WACC Cincrease WACC Decrease WACC Increase WACC 7.55 12 Given the following information on a company's capital structure, what is the company's weighted average cost of capital? The marginal tax rate is 40% Percent of Before-tax Type of capital capital structure component cost Bonds 40% Preferred stock 5% 11 Common stock 85% 15% A 10.0% B. 10.6% c 11.8% 13. Derek Ramsey is an analyst with Bullseye Corporation, a major US-based discount retailer. Bullseye is considering opening new stores in Brazil and wants to estimate its cost of equity capital for this investment. Ramsey has found that The appropriate beta to use for the project is 1.3. maturity semianne of 12% The company stock betais 1.2. Risk-free rate is 10%, and market risk premium is 5% The company is a constant-growth firm that just paid a dividend of $2, sells for $27 per share, and has a growth rate of 8% The company's marginal tax rate is 40% 7. The company's after-tax cost of debt is A 7.2% B. 8.0% C 9.1% & The company's cost of equity using the capital asset pricing modet (CAPM) approach is: A 16.0% 8. 16.6% C. 16.9% 9. The company's cost of equity using the dividend discount model is: A 15.4% B 16.0% C 16.6% 10. The company's weighted average cost of capital (using the cost of equity from CAPM) is closest to: A 12.5% B. 13.0% C 13.5% 11. What happens to a company's weighted average cost of capital (WACC) if the firm's corporate tax rate increases and if the Federal Reserve causes an increase in the risk-free rate, respectively? (Consider the events independently and assume a beta of less than one.) Tax rate increase Increase in risk-free rate A Decrease WACC Increase WACC B. Decrease WACC C. Increase WACC Decrease WACC Increase WACC 12. Given the following information on a company's capital structure, what is the company's weighted average cost of capital? The marginal tax rate is 40% Percent of Before-tax Type of capital capital structure component cost Bonds 40% 7.5% Preferred stock 5% 11% Common stock 55% A 10.0% B. 10.6% C 11.8% 13. Derek Ramsey is an analyst with Bullseye Corporation, a major U.S.-based discount retailer. Bullseye is considering opening new stores in Brazil and wants to estimate its cost of equity capital for this investment. Ramsey has found that: 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts