Question: Please i need this ASAP, thank you These problems need to be done in Excel, step by step process Remember all these problems need to

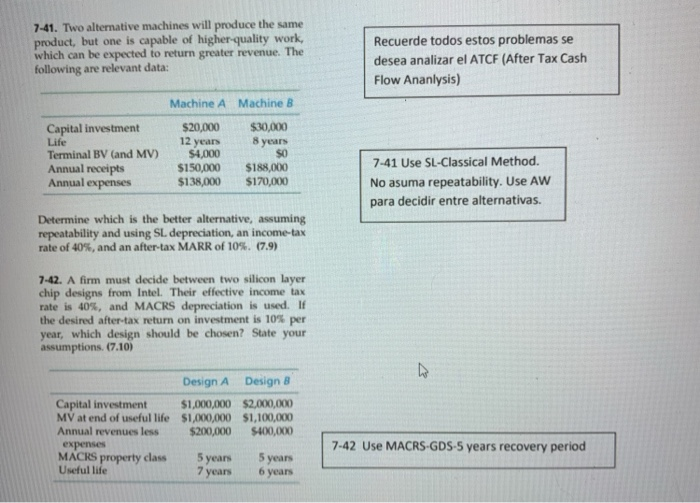

7-41. Two alternative machines will produce the same product, but one is capable of higher quality work, which can be expected to return greater revenue. The following are relevant data: Recuerde todos estos problemas se desea analizar el ATCF (After Tax Cash Flow Ananlysis) Machine A Machine B Capital investment Life Terminal BV (and MV) Annual receipts Annual expenses $20,000 12 years $4,000 $150,000 $138,000 $30,000 8 years SO $188,000 $170,000 7-41 Use SL-Classical Method. No asuma repeatability. Use AW para decidir entre alternativas. Determine which is the better alternative, assuming repeatability and using SL depreciation, an income tax rate of 40%, and an after-tax MARR of 10%. (7.9) 7-42. A firm must decide between two silicon layer chip designs from Intel. Their effective income tax rate is 40%, and MACRS depreciation is used. If the desired after-tax return on investment is 10% per year, which design should be chosen? State your assumptions. (7.10) w Design A Design 8 Capital investment $1,000,000 $2,000,000 MV at end of useful life $1,000,000 $1,100,000 Annual revenues less $200,000 $400,000 expenses MACRS property class 5 years 5 years Useful life 6 years 7-42 Use MACRS-GDS-5 years recovery period 7 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts