Question: Please I want a correct and written solution in text format for all paragraphs. what ? 7- Cash receipt from customers 8- will be schedule

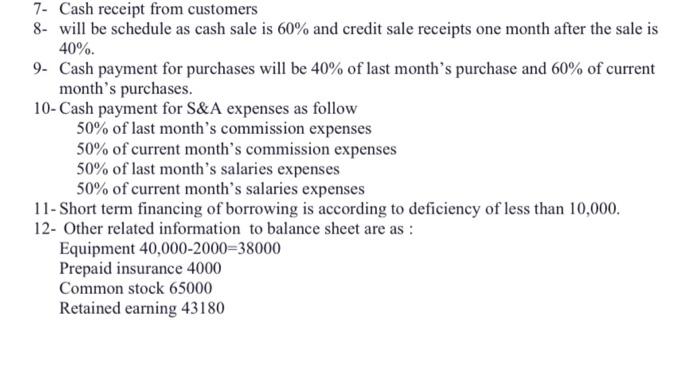

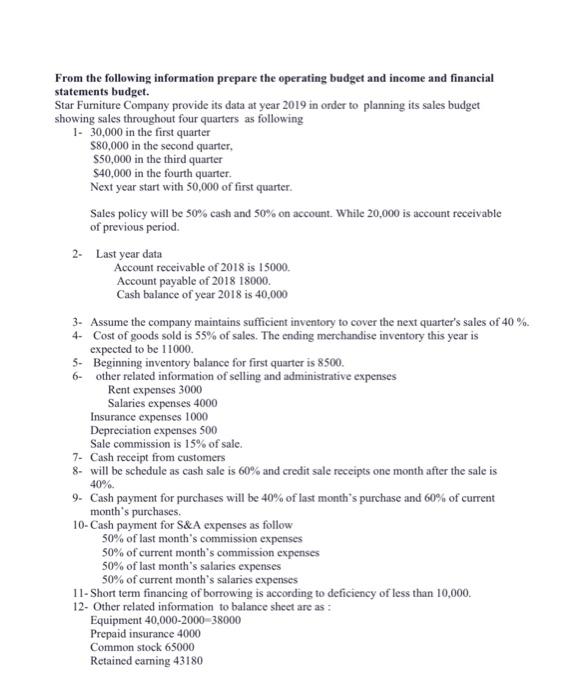

7- Cash receipt from customers 8- will be schedule as cash sale is 60% and credit sale receipts one month after the sale is 40%. 9- Cash payment for purchases will be 40% of last month's purchase and 60% of current month's purchases. 10- Cash payment for S\&A expenses as follow 50% of last month's commission expenses 50% of current month's commission expenses 50% of last month's salaries expenses 50% of current month's salaries expenses 11-Short term financing of borrowing is according to deficiency of less than 10,000 . 12- Other related information to balance sheet are as : Equipment 40,0002000=38000 Prepaid insurance 4000 Common stock 65000 Retained earning 43180 From the following information prepare the operating budget and income and financial statements budget. Star Furniture Company provide its data at year 2019 in order to planning its sales budget showing sales throughout four quarters as following 1- 30,000 in the first quarter $80,000 in the second quarter, $50,000 in the third quarter $40,000 in the fourth quarter. Next year start with 50,000 of first quarter. Sales policy will be 50% cash and 50% on account. While 20,000 is account receivable of previous period. 2. Last year data Account receivable of 2018 is 15000 . Account payable of 201818000 . Cash balance of year 2018 is 40,000 3. Assume the company maintains sufficient inventory to cover the next quarter's sales of 40%. 4- Cost of goods sold is 55% of sales. The ending merchandise inventory this year is expected to be 11000 . 5- Beginning inventory balance for first quarter is 8500 . 6- other related information of selling and administrative expenses Rent expenses 3000 Salaries expenses 4000 Insurance expenses 1000 Depreciation expenses 500 Sale commission is 15% of sale. 7. Cash receipt from customers 8. will be schedule as cash sale is 60% and credit sale receipts one month after the sale is 40% 9. Cash payment for purchases will be 40% of last month's purchase and 60% of current month's purchases. 10- Cash payment for S\&A expenses as follow 50% of last month's commission expenses 50% of current month's commission expenses 50% of last month's salaries expenses 50% of current month's salaries expenses 11-Short term financing of borrowing is according to deficiency of less than 10,000 . 12- Other related information to balance sheet are as : Equipment 40,0002000=38000 Prepaid insurance 4000 Common stock 65000 Retained earning 43180 7- Cash receipt from customers 8- will be schedule as cash sale is 60% and credit sale receipts one month after the sale is 40%. 9- Cash payment for purchases will be 40% of last month's purchase and 60% of current month's purchases. 10- Cash payment for S\&A expenses as follow 50% of last month's commission expenses 50% of current month's commission expenses 50% of last month's salaries expenses 50% of current month's salaries expenses 11-Short term financing of borrowing is according to deficiency of less than 10,000 . 12- Other related information to balance sheet are as : Equipment 40,0002000=38000 Prepaid insurance 4000 Common stock 65000 Retained earning 43180 From the following information prepare the operating budget and income and financial statements budget. Star Furniture Company provide its data at year 2019 in order to planning its sales budget showing sales throughout four quarters as following 1- 30,000 in the first quarter $80,000 in the second quarter, $50,000 in the third quarter $40,000 in the fourth quarter. Next year start with 50,000 of first quarter. Sales policy will be 50% cash and 50% on account. While 20,000 is account receivable of previous period. 2. Last year data Account receivable of 2018 is 15000 . Account payable of 201818000 . Cash balance of year 2018 is 40,000 3. Assume the company maintains sufficient inventory to cover the next quarter's sales of 40%. 4- Cost of goods sold is 55% of sales. The ending merchandise inventory this year is expected to be 11000 . 5- Beginning inventory balance for first quarter is 8500 . 6- other related information of selling and administrative expenses Rent expenses 3000 Salaries expenses 4000 Insurance expenses 1000 Depreciation expenses 500 Sale commission is 15% of sale. 7. Cash receipt from customers 8. will be schedule as cash sale is 60% and credit sale receipts one month after the sale is 40% 9. Cash payment for purchases will be 40% of last month's purchase and 60% of current month's purchases. 10- Cash payment for S\&A expenses as follow 50% of last month's commission expenses 50% of current month's commission expenses 50% of last month's salaries expenses 50% of current month's salaries expenses 11-Short term financing of borrowing is according to deficiency of less than 10,000 . 12- Other related information to balance sheet are as : Equipment 40,0002000=38000 Prepaid insurance 4000 Common stock 65000 Retained earning 43180

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts