Question: please if you can help me with both, it would help alot Michigan Mining Co.'s ore reserves are declining so its sales and profits are

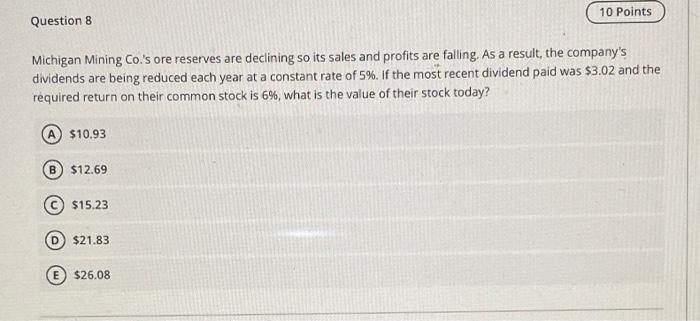

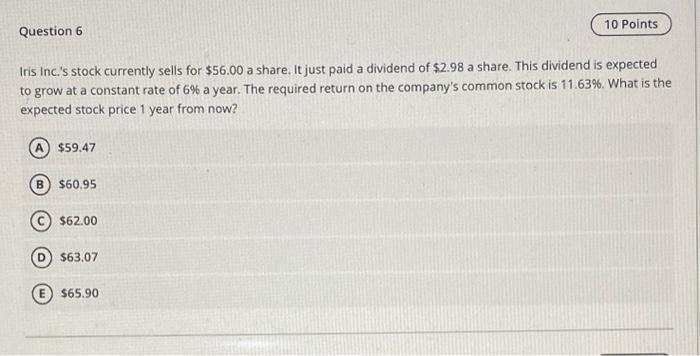

Michigan Mining Co.'s ore reserves are declining so its sales and profits are falling. As a result, the company's dividends are being reduced each year at a constant rate of 5%. If the most recent dividend paid was $3.02 and the required return on their common stock is 6%, what is the value of their stock today? $10.93 (B) $12.69 (C) $15.23 (D) $21.83 (E) $26.08 Iris inc.'s stock currently sells for $56.00 a share. It just paid a dividend of $2.98 a share. This dividend is expected to grow at a constant rate of 6% a year. The required return on the company's common stock is 11.63%. What is the expected stock price 1 year from now? $59.47 $60.95 $62.00 (D) $63.07 (E) $65.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts