Question: Please if you can not answer both question do #21 For $5 answers - round to the whole dollar 20. Greeson Corp. signed a three-month,

Please if you can not answer both question do #21

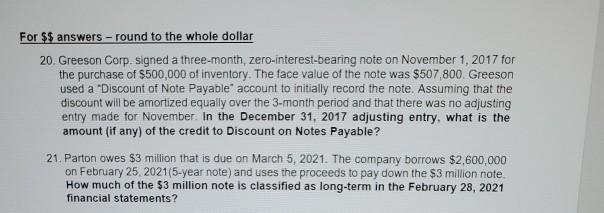

For $5 answers - round to the whole dollar 20. Greeson Corp. signed a three-month, zero-interest-bearing note on November 1, 2017 for the purchase of $500,000 of inventory. The face value of the note was $507,800. Greeson used a "Discount of Note Payable account to initially record the note. Assuming that the discount will be amortized equally over the 3-month period and that there was no adjusting entry made for November. In the December 31, 2017 adjusting entry, what is the amount (if any) of the credit to Discount on Notes Payable? 21. Parton owes $3 million that is due on March 5, 2021. The company borrows $2,600,000 on February 25, 2021(5-year note) and uses the proceeds to pay down the $3 million note. How much of the $3 million note is classified as long-term in the February 28, 2021 financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts