Question: please if you know you are know going to answer everything ...please do not start. Urban Drapers Inc., a draperies company, has been successfully doing

please if you know you are know going to answer everything ...please do not start.

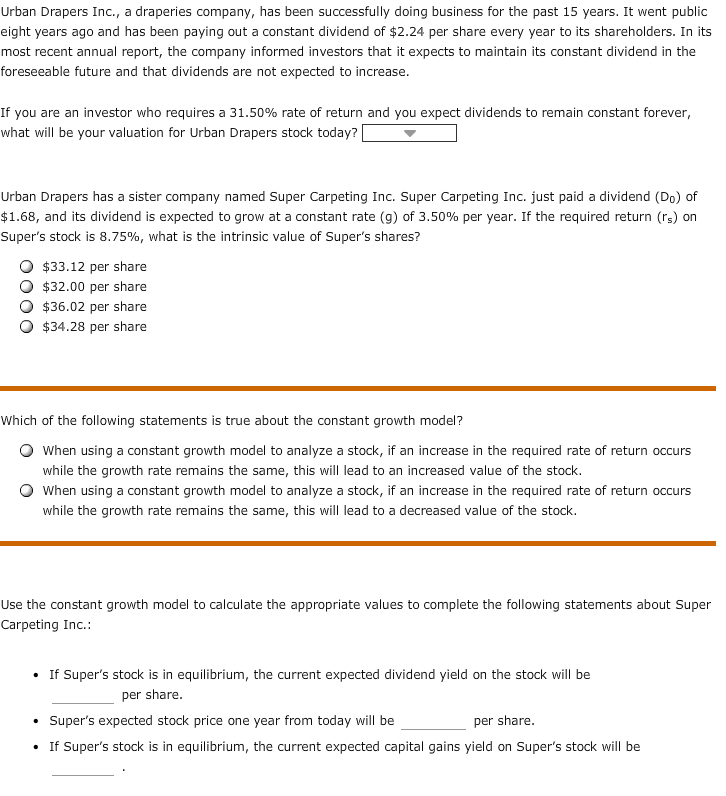

Urban Drapers Inc., a draperies company, has been successfully doing business for the past 15 years. It went public eight years ago and has been paying out a constant dividend of $2.24 per share every year to its shareholders. In its most recent annual report, the company informed investors that it expects to maintain its constant dividend in the foreseeable future and that dividends are not expected to increase. If you are an investor who requires a 31.50% rate of return and you expect dividends to remain constant forever, what will be your valuation for Urban Drapers stock today? Urban Drapers has a sister company named Super Carpeting Inc. Super Carpeting Inc. just paid a dividend (D_0) of $1.68, and its dividend is expected to grow at a constant rate (g) of 3.50% per year. If the required return (r_s) on Super's stock is 8.75%, what is the intrinsic value of Super's shares? $33.12 per share $32.00 per share $36.02 per share $34.28 per share Which of the following statements is true about the constant growth model? When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to an increased value of the stock. When using a constant growth model to analyze a stock, if an increase in the required rate of return occurs while the growth rate remains the same, this will lead to a decreased value of the stock. Use the constant growth model to calculate the appropriate values to complete the following statements about Super Carpeting Inc.: If Super's stock is in equilibrium, the current expected dividend yield on the stock will be per share. Super's expected stock price one year from today will be per share. If Super's stock is in equilibrium, the current expected capital gains yield on Super's stock will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts