Question: Please include a step by step explanation about how to do these problems! Thank you! :) Problem 1. Suppose that in the financial market there

Please include a step by step explanation about how to do these problems! Thank you! :)

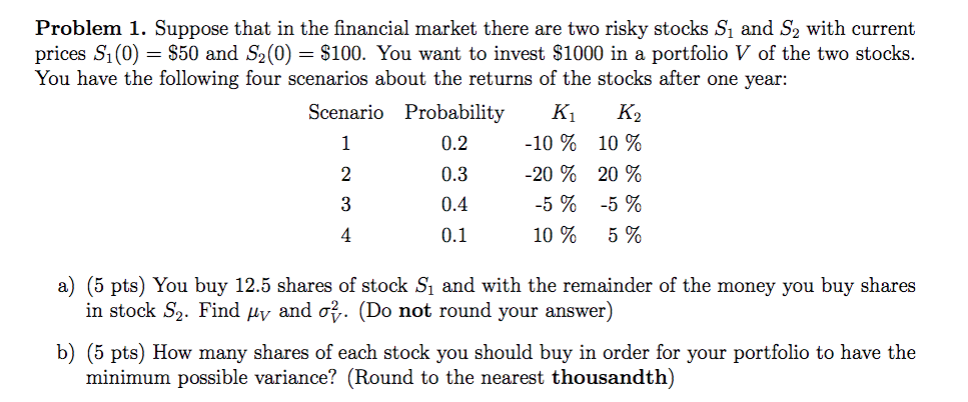

Problem 1. Suppose that in the financial market there are two risky stocks Si and S2 with current prices Si (0) = S50 and S2(0) = $100. You want to invest $1000 in a portfolio V of the two stocks. You have the following four scenarios about the returns of the stocks after one year: Scenario Probability K -10 % 0.2 0.3-20% 0.4 0.1 10 % 20% -5% 5% -5% 10% 4 a) (5 pts) You buy 12.5 shares of stock S1 and with the remainder of the money you buy shares in stock S2. Find uy and o. (Do not round your answer) b) (5 pts) How many shares of each stock you should buy in order for your portfolio to have the minimum possible variance? (Round to the nearest thousandth)

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to work through part a and part b step by step Part a You buy 125 shares of stock S1 and with the remainder of the money ... View full answer

Get step-by-step solutions from verified subject matter experts