Question: please include all steps. no excel solutions bit financial calculat computations are OK You are planning to retire in 30 years. Once you retire, you

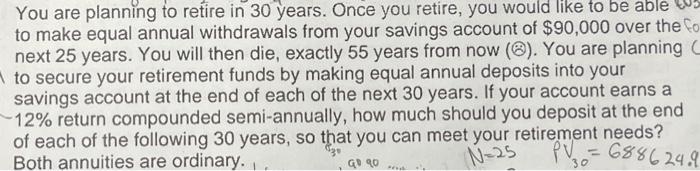

You are planning to retire in 30 years. Once you retire, you would like to be able to make equal annual withdrawals from your savings account of $90,000 over the next 25 years. You will then die, exactly 55 years from now (8). You are planning to secure your retirement funds by making equal annual deposits into your savings account at the end of each of the next 30 years. If your account earns a 12% return compounded semi-annually, how much should you deposit at the end of each of the following 30 years, so that you can meet your retirement needs? Both annuities are ordinary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts