Question: Please include all steps/work and reasoning. Thank you! Problem 3. (6 points) Let B(0) - 100 and B(1) - 110. Suppose the prices of stocks

Please include all steps/work and reasoning. Thank you!

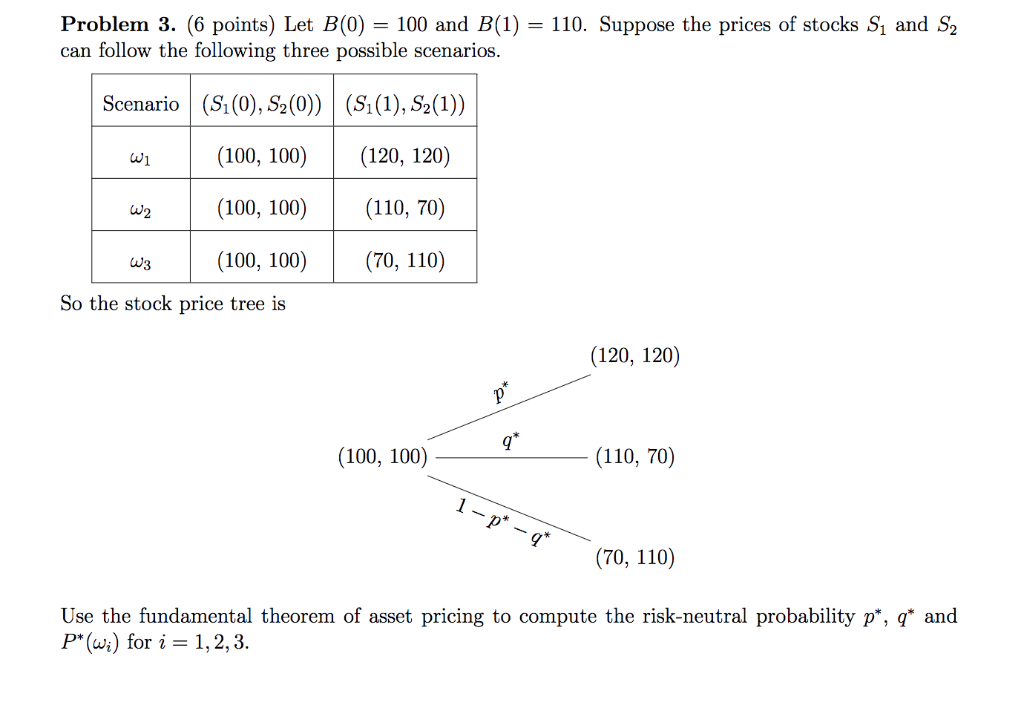

Problem 3. (6 points) Let B(0) - 100 and B(1) - 110. Suppose the prices of stocks S1 and S2 can follow the following three possible scenarios. Scenario S S2(0)) (S1(1), S2(1)) w100, 100(120, 120) 2 (100, 100(110, 70) ws (100, 100(70, 110) So the stock price tree is 120, 120) (100, 100) (110, 70) 9" 9(70, 110) Use the fundamental theorem of asset pricing to compute the risk-neutral probability p, q and P(wi) for i 1,2,3. Problem 3. (6 points) Let B(0) - 100 and B(1) - 110. Suppose the prices of stocks S1 and S2 can follow the following three possible scenarios. Scenario S S2(0)) (S1(1), S2(1)) w100, 100(120, 120) 2 (100, 100(110, 70) ws (100, 100(70, 110) So the stock price tree is 120, 120) (100, 100) (110, 70) 9" 9(70, 110) Use the fundamental theorem of asset pricing to compute the risk-neutral probability p, q and P(wi) for i 1,2,3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts