Question: need step by step help in solving this problem will up vote please and thank you Problem 1 (11 points): Consider a multi-factor key rate

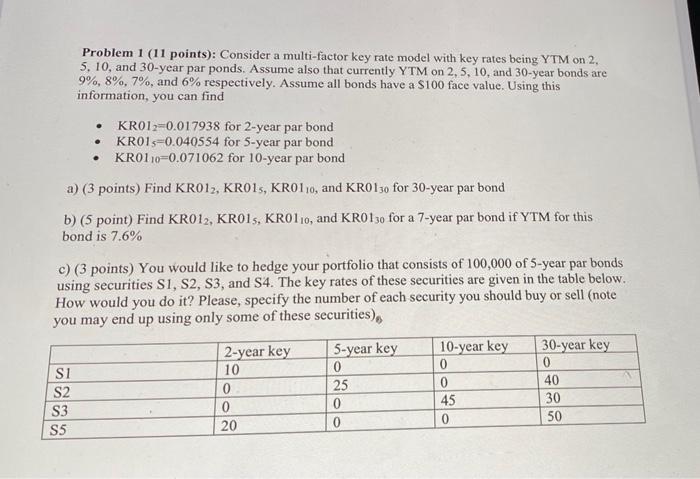

Problem 1 (11 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5. 10, and 30-year par ponds. Assume also that currently YTM on 2, 5, 10, and 30-year bonds are 9%, 8%, 7%, and 6% respectively. Assume all bonds have a $100 face value. Using this information, you can find KR012-0.017938 for 2-year par bond KR015-0.040554 for 5-year par bond KR0110=0.071062 for 10-year par bond . . a) (3 points) Find KR012, KRO1S, KR0110, and KRO130 for 30-year par bond b) (5 point) Find KR012, KROIS, KR0110, and KR0130 for a 7-year par bond if YTM for this bond is 7.6% c) (3 points) You would like to hedge your portfolio that consists of 100,000 of 5-year par bonds using securities S1, S2, S3, and S4. The key rates of these securities are given in the table below. How would you do it? Please, specify the number of each security you should buy or sell (note you may end up using only some of these securities), 10-year key 0 SI S2 S3 S5 2-year key 10 0 0 20 5-year key 0 25 0 0 30-year key 0 40 30 50 45 0 Problem 1 (11 points): Consider a multi-factor key rate model with key rates being YTM on 2, 5. 10, and 30-year par ponds. Assume also that currently YTM on 2, 5, 10, and 30-year bonds are 9%, 8%, 7%, and 6% respectively. Assume all bonds have a $100 face value. Using this information, you can find KR012-0.017938 for 2-year par bond KR015-0.040554 for 5-year par bond KR0110=0.071062 for 10-year par bond . . a) (3 points) Find KR012, KRO1S, KR0110, and KRO130 for 30-year par bond b) (5 point) Find KR012, KROIS, KR0110, and KR0130 for a 7-year par bond if YTM for this bond is 7.6% c) (3 points) You would like to hedge your portfolio that consists of 100,000 of 5-year par bonds using securities S1, S2, S3, and S4. The key rates of these securities are given in the table below. How would you do it? Please, specify the number of each security you should buy or sell (note you may end up using only some of these securities), 10-year key 0 SI S2 S3 S5 2-year key 10 0 0 20 5-year key 0 25 0 0 30-year key 0 40 30 50 45 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts