Question: please include any excek functions and steps taken. thank you! (2) Capex Corporation is considering the introduction of a new product which requires the initial

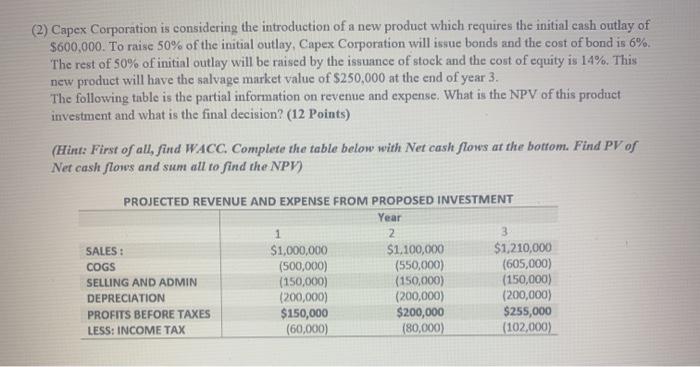

(2) Capex Corporation is considering the introduction of a new product which requires the initial cash outlay of $600,000. To raise 50% of the initial outlay, Capex Corporation will issue bonds and the cost of bond is 6% The rest of 50% of initial outlay will be raised by the issuance of stock and the cost of equity is 14%. This new product will have the salvage market value of $250,000 at the end of year 3. The following table is the partial information on revenue and expense. What is the NPV of this product investment and what is the final decision? (12 Points) (Hint: First of all, find WACC. Complete the table below with Net cash flows at the bottom. Find PV of Net cash flows and sum all to find the NPV) PROJECTED REVENUE AND EXPENSE FROM PROPOSED INVESTMENT Year 1 2 SALES: $1,000,000 $1.100,000 $1,210,000 COGS (500,000) (550,000) (605,000) SELLING AND ADMIN (150,000) (150,000) (150,000) DEPRECIATION (200,000) (200,000) (200,000) PROFITS BEFORE TAXES $150,000 $200,000 $255,000 LESS: INCOME TAX (60,000) (80,000) (102,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts