Question: please solve : - please use the same format when solving the problem. - show on excel - show work - show formulas -explain Thank

please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

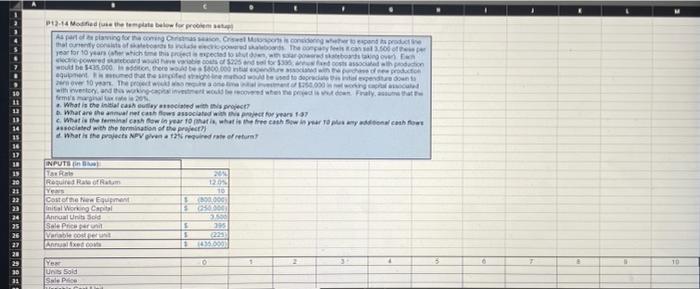

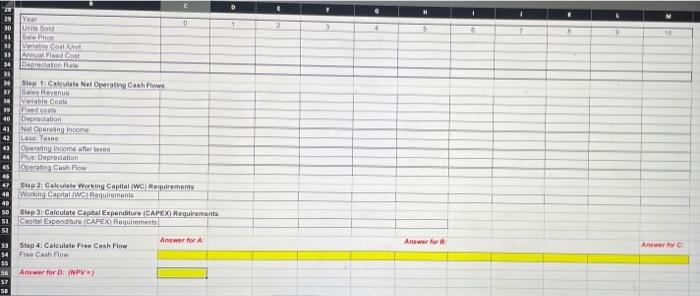

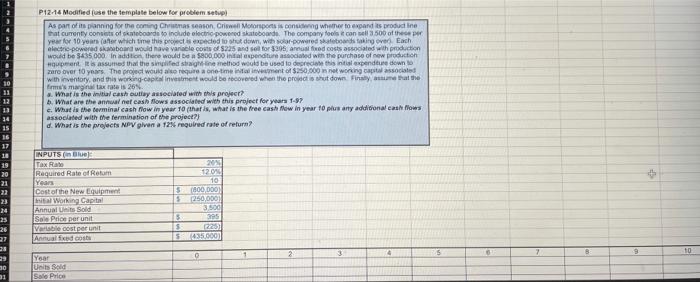

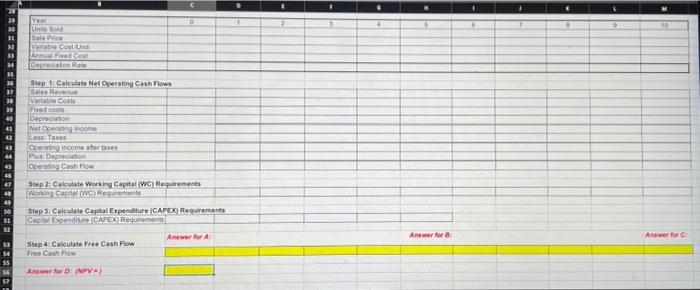

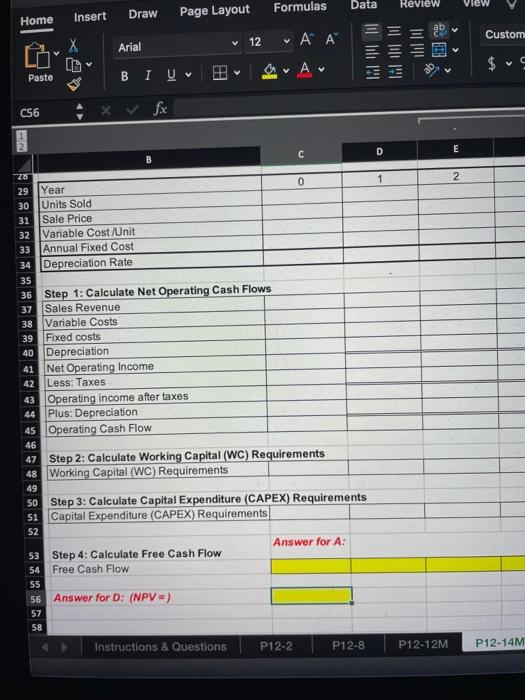

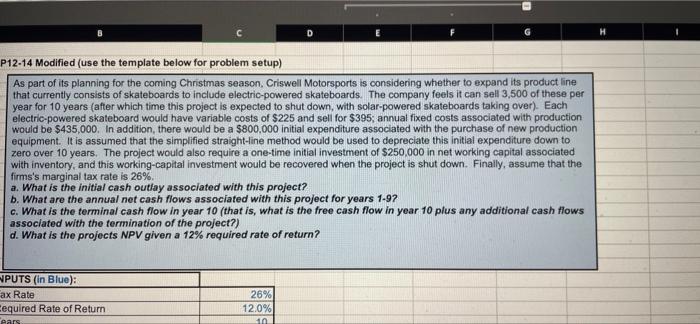

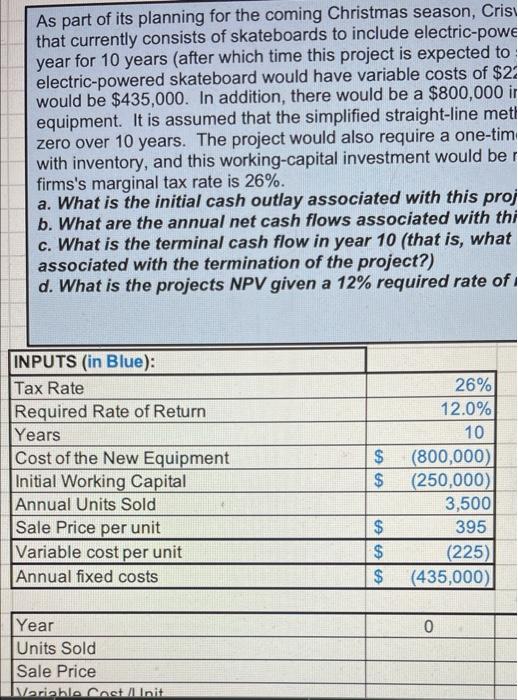

13:14 Modified use the template below for problem As part of a forma congrua Crescand produce that only on the company of year for 10 years which the cardboarding perd wees 2000. i poden de 000 ton there 100.000 person quote de dades perdenis rower 10 year. The woman 20.000 with toda certo cover when it to Fralyst firm's What is the cash ouilly scaled with this project? What are the annual cash flows associadas 157 What is the terminal cashow in year to maris, where a wiser Tony walch associated with the termination of the project 4 What is the projects NPV tregirerate of return INPUTATIN BAR 19 20 23 22 23 24 1201 10 300.000 Rogutud Raftum Castofnun Inital Working Capital Anna United Sale Price Varatecoste Annet 25 26 27 S 1 TRRRREO 0 5 10 Yen Un sold SNP 31 SEESEE Year Une Lee Vares AUSTRIA BENITORI Step Cake Net Operating Cash Flow Denue Van Com 10 fo 40 Depreciation 41 Net Oparing income 42 La Yes - Opening income and 4 Ps Depreciation es Operating Cash Flow 46 47 Step 2: Cakute Working Capital (WC) Requirements 48 Woning Capital Requirements 49 SD SapCalculate Capital Expenditure (CAPEX) Requirements 51 Capits. Expenditure (CAPEX) Requirements 52 Answer for 53 Step 4: Calculate Free Cash Flow 54 Cash Flow 35 56 Answer for DNV 37 56 HABEEB Answer for Autre P12.14 Modified use the template below for problem setup As part of its planning for the coming Chris season. Crie Monosports is what to expand its producine that current conset of skateboards to include electric powered toboards. The company fools consell 3 500 of the per year for 10 years after which time this project is expected to shut down with powered salebo taking over Each electric powered band would have variable cous 5225 and sell for $905, aneu fred costs associated with production would be 3435.000. In addition there would be a $800.000 inapenditure asociated with the purchase of new production pants assumed that the sidste metod would be used to decrecientexpenditure down to zare over 10 years. The project would also require a one-timevement of $250,000 wing capacited with inventory, and this working-capital investment would be recovered when the proti put downs. First seat the immaginatax rate is 20 3. What is the initial cash outlay associated with this project? 1. What are the annual nel cash flows associated with this project for years 1-97 c. What is the terminal cash flow in year 10 (that is what is the free cash Mow in year to plusarty addicional calows associated with the termination of the project?) d. What is the projects NPV given a 128 required rate of return 10 11 22 23 14 15 16 17 19 20 21 $ INPUTS (Blue) Tax Rate Required Rate of Retum Years Cost of the New Equipment Inital Working Capital Annuai Unt Sold Sale Price per unit Variable cost per unit Annual fixed cost 23 24 25 26 27 2012 12.09 10 800,000 250,000 3500 395 1225) 435.000) 5 S 5 10 Year 29 30 31 Unit Sold Sale Price TO 31 VAN une Sale Price Vanato con un Acost Deprem 35 36 11 31 Step 1 Calculate Net Operating Cash Flows Sales Reven le cose Depreciso Net Operating room Los Tams Operating income taxes Depilation Operating Cash Flow SEXGB Step 2 Calculate Working Capital (WC) Requirements Working Capital (W) Rent Step 3. Calculate Capital Expenditure (CAPEXO Requirements Capital Expandir (CAPEXI Requirements A for A Step 4: Calculate Free Cash Flow Free Chow Answer for Aer for Answer for B: MPV Formulas Data Review View Insert Draw Page Layout Home 12 101 Custom to Arial 111 lili 1989 Lo v C v V Paste B I UB A V C56 fx D 1 2 20 0 29 Year 30 Units Sold 31 Sale Price 32 Variable Cost/Unit 33 Annual Fixed Cost 34 Depreciation Rate 35 36 Step 1: Calculate Net Operating Cash Flows 37 Sales Revenue 38 Variable Costs 39 Fixed costs 40 Depreciation 41 Net Operating Income 42 Less: Taxes 43 Operating income after taxes 44 Plus: Depreciation 45 Operating Cash Flow 46 47 Step 2: Calculate Working Capital (WC) Requirements 48 Working Capital (WC) Requirements 49 50 Step 3: Calculate Capital Expenditure (CAPEX) Requirements 51 Capital Expenditure (CAPEX) Requirements 52 Answer for A: 53 Step 4: Calculate Free Cash Flow 54 Free Cash Flow 55 56 Answer for D: (NPV =) 57 58 Instructions & Questions P12-2 P12-8 P12-12M P12-14M P12-14 Modified (use the template below for problem setup) As part of its planning for the coming Christmas season. Criswell Motorsports is considering whether to expand its product line that currently consists of skateboards to include electric powered skateboards. The company feels it can sell 3,500 of these per year for 10 years (after which time this project is expected to shut down, with solar powered skateboards taking over). Each electric-powered skateboard would have variable costs of $225 and sell for $395; annual fixed costs associated with production would be $435,000. In addition, there would be a $800,000 initial expenditure associated with the purchase of new production equipment. It is assumed that the simplified straight-line method would be used to depreciate this initial expenditure down to zero over 10 years. The project would also require a one-time initial investment of $250,000 in net working capital associated with inventory, and this working-capital investment would be recovered when the project is shut down. Finally, assume that the firms's marginal tax rate is 26% a. What is the initial cash outlay associated with this project? b. What are the annual net cash flows associated with this project for years 1-97 c. What is the terminal cash flow in year 10 (that is, what is the free cash flow in year 10 plus any additional cash flows associated with the termination of the project?) d. What is the projects NPV given a 12% required rate of return? PUTS (in Blue): ax Rate equired Rate of Return Pars 26% 12.0% 10 As part of its planning for the coming Christmas season, Crisi that currently consists of skateboards to include electric-powe year for 10 years (after which time this project is expected to electric-powered skateboard would have variable costs of $22 would be $435,000. In addition, there would be a $800,000 ir equipment. It is assumed that the simplified straight-line met zero over 10 years. The project would also require a one-tim with inventory, and this working-capital investment would be r firms's marginal tax rate is 26%. a. What is the initial cash outlay associated with this proj b. What are the annual net cash flows associated with thi c. What is the terminal cash flow in year 10 (that is, what associated with the termination of the project?) d. What is the projects NPV given a 12% required rate of INPUTS (in Blue): Tax Rate Required Rate of Return Years Cost of the New Equipment Initial Working Capital Annual Units Sold Sale Price per unit Variable cost per unit Annual fixed costs $ $ 26% 12.0% 10 (800,000) (250,000) 3,500 395 (225) (435,000) AAA $ $ $ 0 Year Units Sold Sale Price Variable Castill init 13:14 Modified use the template below for problem As part of a forma congrua Crescand produce that only on the company of year for 10 years which the cardboarding perd wees 2000. i poden de 000 ton there 100.000 person quote de dades perdenis rower 10 year. The woman 20.000 with toda certo cover when it to Fralyst firm's What is the cash ouilly scaled with this project? What are the annual cash flows associadas 157 What is the terminal cashow in year to maris, where a wiser Tony walch associated with the termination of the project 4 What is the projects NPV tregirerate of return INPUTATIN BAR 19 20 23 22 23 24 1201 10 300.000 Rogutud Raftum Castofnun Inital Working Capital Anna United Sale Price Varatecoste Annet 25 26 27 S 1 TRRRREO 0 5 10 Yen Un sold SNP 31 SEESEE Year Une Lee Vares AUSTRIA BENITORI Step Cake Net Operating Cash Flow Denue Van Com 10 fo 40 Depreciation 41 Net Oparing income 42 La Yes - Opening income and 4 Ps Depreciation es Operating Cash Flow 46 47 Step 2: Cakute Working Capital (WC) Requirements 48 Woning Capital Requirements 49 SD SapCalculate Capital Expenditure (CAPEX) Requirements 51 Capits. Expenditure (CAPEX) Requirements 52 Answer for 53 Step 4: Calculate Free Cash Flow 54 Cash Flow 35 56 Answer for DNV 37 56 HABEEB Answer for Autre P12.14 Modified use the template below for problem setup As part of its planning for the coming Chris season. Crie Monosports is what to expand its producine that current conset of skateboards to include electric powered toboards. The company fools consell 3 500 of the per year for 10 years after which time this project is expected to shut down with powered salebo taking over Each electric powered band would have variable cous 5225 and sell for $905, aneu fred costs associated with production would be 3435.000. In addition there would be a $800.000 inapenditure asociated with the purchase of new production pants assumed that the sidste metod would be used to decrecientexpenditure down to zare over 10 years. The project would also require a one-timevement of $250,000 wing capacited with inventory, and this working-capital investment would be recovered when the proti put downs. First seat the immaginatax rate is 20 3. What is the initial cash outlay associated with this project? 1. What are the annual nel cash flows associated with this project for years 1-97 c. What is the terminal cash flow in year 10 (that is what is the free cash Mow in year to plusarty addicional calows associated with the termination of the project?) d. What is the projects NPV given a 128 required rate of return 10 11 22 23 14 15 16 17 19 20 21 $ INPUTS (Blue) Tax Rate Required Rate of Retum Years Cost of the New Equipment Inital Working Capital Annuai Unt Sold Sale Price per unit Variable cost per unit Annual fixed cost 23 24 25 26 27 2012 12.09 10 800,000 250,000 3500 395 1225) 435.000) 5 S 5 10 Year 29 30 31 Unit Sold Sale Price TO 31 VAN une Sale Price Vanato con un Acost Deprem 35 36 11 31 Step 1 Calculate Net Operating Cash Flows Sales Reven le cose Depreciso Net Operating room Los Tams Operating income taxes Depilation Operating Cash Flow SEXGB Step 2 Calculate Working Capital (WC) Requirements Working Capital (W) Rent Step 3. Calculate Capital Expenditure (CAPEXO Requirements Capital Expandir (CAPEXI Requirements A for A Step 4: Calculate Free Cash Flow Free Chow Answer for Aer for Answer for B: MPV Formulas Data Review View Insert Draw Page Layout Home 12 101 Custom to Arial 111 lili 1989 Lo v C v V Paste B I UB A V C56 fx D 1 2 20 0 29 Year 30 Units Sold 31 Sale Price 32 Variable Cost/Unit 33 Annual Fixed Cost 34 Depreciation Rate 35 36 Step 1: Calculate Net Operating Cash Flows 37 Sales Revenue 38 Variable Costs 39 Fixed costs 40 Depreciation 41 Net Operating Income 42 Less: Taxes 43 Operating income after taxes 44 Plus: Depreciation 45 Operating Cash Flow 46 47 Step 2: Calculate Working Capital (WC) Requirements 48 Working Capital (WC) Requirements 49 50 Step 3: Calculate Capital Expenditure (CAPEX) Requirements 51 Capital Expenditure (CAPEX) Requirements 52 Answer for A: 53 Step 4: Calculate Free Cash Flow 54 Free Cash Flow 55 56 Answer for D: (NPV =) 57 58 Instructions & Questions P12-2 P12-8 P12-12M P12-14M P12-14 Modified (use the template below for problem setup) As part of its planning for the coming Christmas season. Criswell Motorsports is considering whether to expand its product line that currently consists of skateboards to include electric powered skateboards. The company feels it can sell 3,500 of these per year for 10 years (after which time this project is expected to shut down, with solar powered skateboards taking over). Each electric-powered skateboard would have variable costs of $225 and sell for $395; annual fixed costs associated with production would be $435,000. In addition, there would be a $800,000 initial expenditure associated with the purchase of new production equipment. It is assumed that the simplified straight-line method would be used to depreciate this initial expenditure down to zero over 10 years. The project would also require a one-time initial investment of $250,000 in net working capital associated with inventory, and this working-capital investment would be recovered when the project is shut down. Finally, assume that the firms's marginal tax rate is 26% a. What is the initial cash outlay associated with this project? b. What are the annual net cash flows associated with this project for years 1-97 c. What is the terminal cash flow in year 10 (that is, what is the free cash flow in year 10 plus any additional cash flows associated with the termination of the project?) d. What is the projects NPV given a 12% required rate of return? PUTS (in Blue): ax Rate equired Rate of Return Pars 26% 12.0% 10 As part of its planning for the coming Christmas season, Crisi that currently consists of skateboards to include electric-powe year for 10 years (after which time this project is expected to electric-powered skateboard would have variable costs of $22 would be $435,000. In addition, there would be a $800,000 ir equipment. It is assumed that the simplified straight-line met zero over 10 years. The project would also require a one-tim with inventory, and this working-capital investment would be r firms's marginal tax rate is 26%. a. What is the initial cash outlay associated with this proj b. What are the annual net cash flows associated with thi c. What is the terminal cash flow in year 10 (that is, what associated with the termination of the project?) d. What is the projects NPV given a 12% required rate of INPUTS (in Blue): Tax Rate Required Rate of Return Years Cost of the New Equipment Initial Working Capital Annual Units Sold Sale Price per unit Variable cost per unit Annual fixed costs $ $ 26% 12.0% 10 (800,000) (250,000) 3,500 395 (225) (435,000) AAA $ $ $ 0 Year Units Sold Sale Price Variable Castill init

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts