Question: please include cell references, thank you in advance! A D E G You own a portfolio consisting of the stocks presented in the table below.

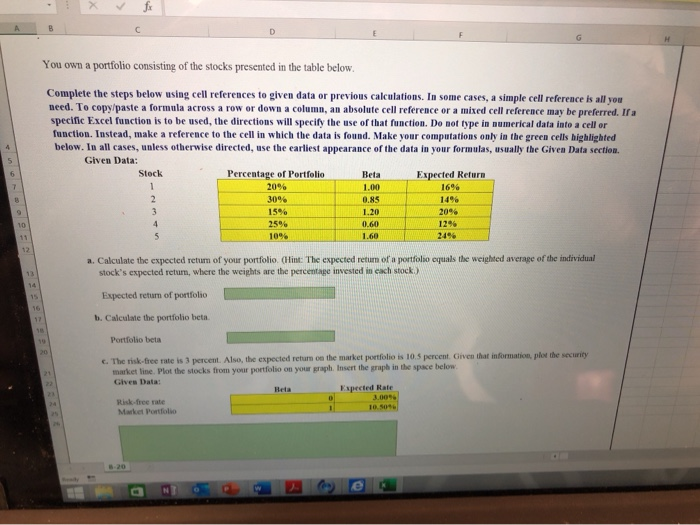

A D E G You own a portfolio consisting of the stocks presented in the table below. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the green cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Given Data: Stock Percentage of Portfolio Expected Return Beta 20% 1.00 16% 2 30% 0.85 14% 15% 20% 1.20 12% 25% 0.60 1C 24% 10% 1.60 11 12 a. Calculate the expected retum of your portfolio. (Hint: The expected return of a portfolio equals the weighted average of the individual stock's expected return, where the weights are the percentage invested in cach stock.) 1 14 Expected return of portfolio 15 16 b. Calculate the portfolio beta. 18 Portfolio beta 20 c. The risk-free rate is 3 percent. Also, the expected returm on the market portfolio is 10.5 percent. Given that information, plot the security market line. Plot the stocks from your portfolio on your graph. Insert the graph in the space below Given Data: 21 22 Expected Rate Beta 3.00% Risk-free rate 24 10.50% Market Portfolio 25 8-20 NT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts