Question: Please include diagrams. Q2 a (2 points) This question will explore a couple of government policies and how they influence individual budget constraints. Imagine an

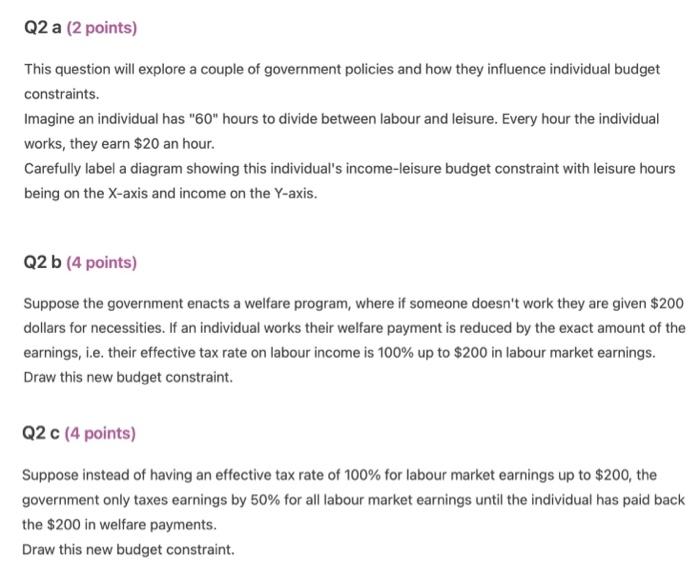

Q2 a (2 points) This question will explore a couple of government policies and how they influence individual budget constraints. Imagine an individual has "60" hours to divide between labour and leisure. Every hour the individual works, they earn $20 an hour. Carefully label a diagram showing this individual's income-leisure budget constraint with leisure hours being on the X-axis and income on the Y-axis. Q2 b (4 points) Suppose the government enacts a welfare program, where if someone doesn't work they are given $200 dollars for necessities. If an individual works their welfare payment is reduced by the exact amount of the earnings, i.e. their effective tax rate on labour income is 100% up to $200 in labour market earnings. Draw this new budget constraint. Q2 c (4 points) Suppose instead of having an effective tax rate of 100% for labour market earnings up to $200, the government only taxes earnings by 50% for all labour market earnings until the individual has paid back the $200 in welfare payments. Draw this new budget constraint

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts