Question: please include excel formulas 1 0 lluing the option in this period? 1. (Profit margin from underlying asset and a call option) You've decided to

please include excel formulas

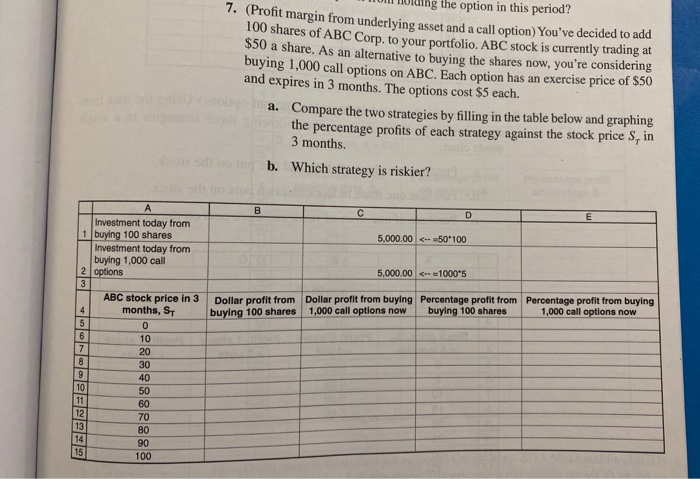

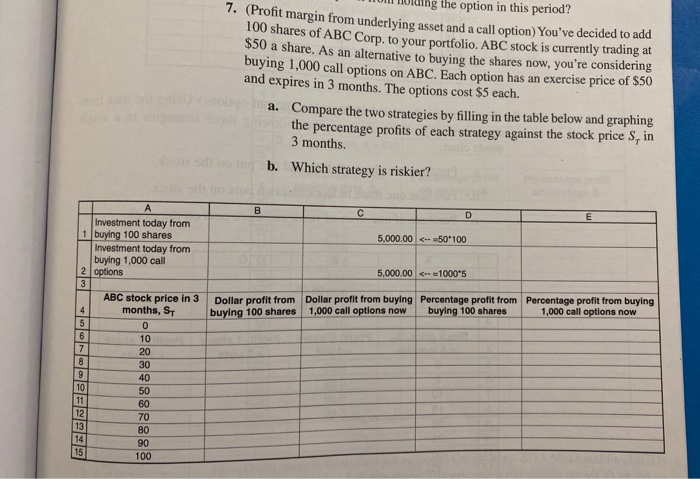

1 0 lluing the option in this period? 1. (Profit margin from underlying asset and a call option) You've decided to add 100 shares of ABC Corp. to your portfolio. ABC stock is currently trading at $50 a share. As an alternative to buying the shares now, you're considering buying 1,000 call options on ABC. Each option has an exercise price of $50 and expires in 3 months. The options cost $5 each. a. Compare the two strategies by filling in the table below and graphing the percentage profits of each strategy against the stock price S, in 3 months. b. Which strategy is riskier? 5,000.00

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock