Question: please include excel formulas 7. (Profit margin from underlying asset and a 100 shares of ABC Corp. to your port $50 a share. As an

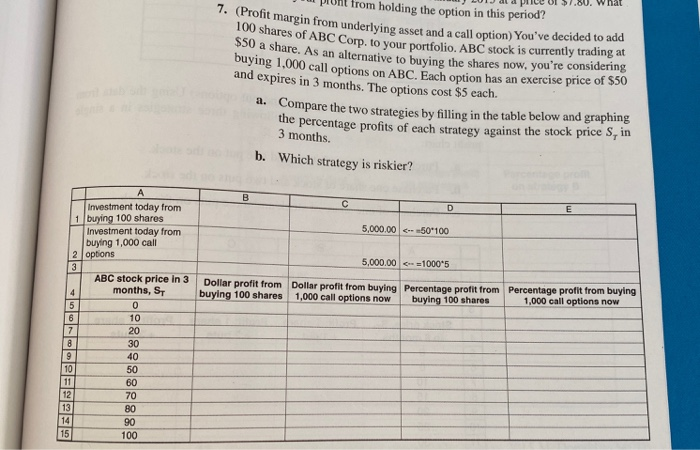

7. (Profit margin from underlying asset and a 100 shares of ABC Corp. to your port $50 a share. As an alternative to buying the buying 1,000 call options on ABC. Each and expires in 3 months. The options cost $5 each. J LUIJ al aprILU UI $7.80. What punt from holding the option in this period? om underlying asset and a call option) You've decided to add es of ABC Corp. to your portfolio ABC stock is currently trading at te. As an alternative to buying the shares now, you're considering U call options on ABC. Each option has an exercise price of $50 a. Compar . Compare the two strategies by filling in the table below and graphing e percentage profits of each strategy against the stock price S, in 3 months. b. Which strategy is riskier? Investment today from 1 buying 100 shares Investment today from buying 1,000 call 2 options 5,000.00 - -50-100 5,000.00 =10005 ABC stock price in 3 months, ST Dollar profit from buying 100 shares Dollar profit from buying Percentage profit from 1,000 call options now buying 100 shares Percentage profit from buying 1,000 call options now 0 10 20 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts