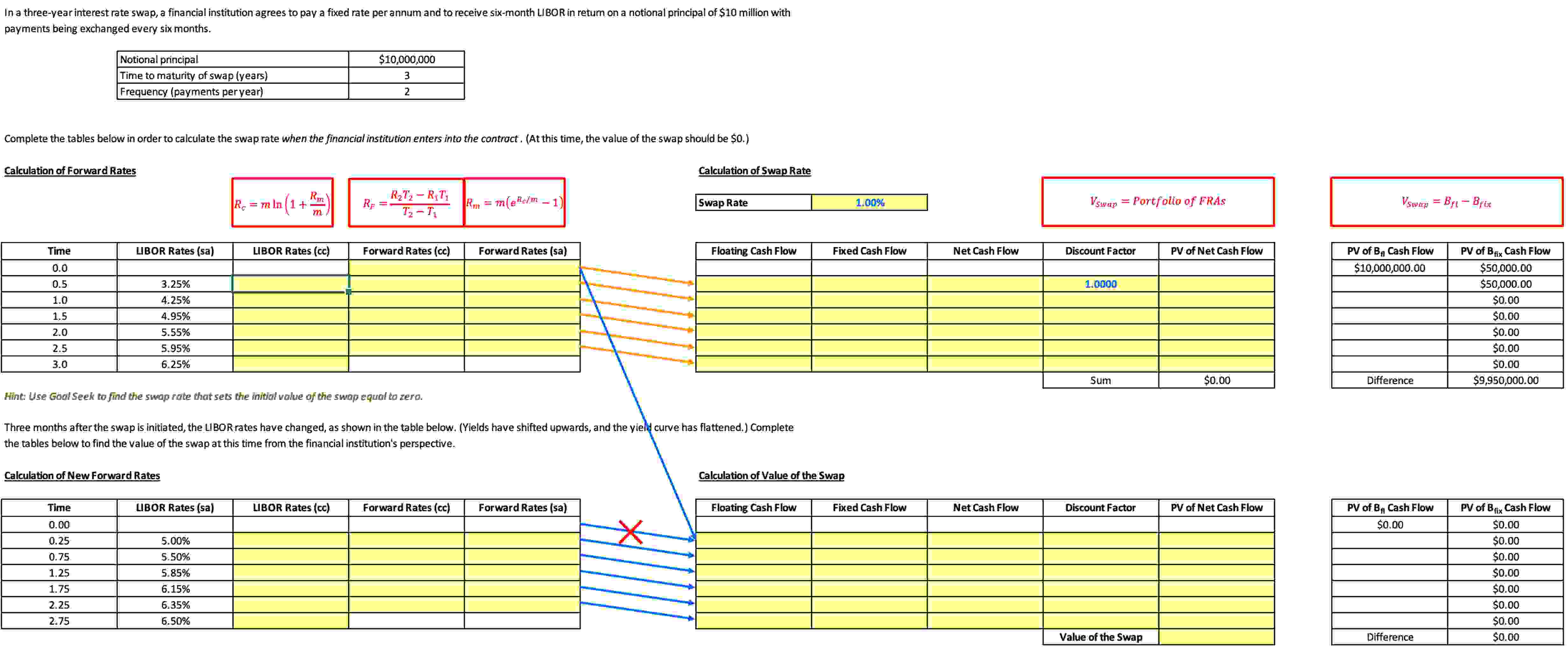

Question: Please include excel formulas! Thank you!! In a three - vear interest rate swap, a financial institution agrees to pay a fixed rate per annum

Please include excel formulas! Thank you!! In a threevear interest rate swap, a financial institution agrees to pay a fixed rate per annum and to receive sixmonth LIBOR in retum on a notional principal of $ million with

payments being exchanged every six months.

Complete the tables below in order to calculate the swap rate when the financial institution enters into the contract. At this time, the value of the swap should be $

Calculation of Forward Rates

Calculation of Swap Rate

Portfollo FRAs

Hint: Use Gool Seek to find the swap rate that sets the initiol volue of the swap equal to zero.

Three months after the swap is initiated, the LIBOR rates have changed, as shown in the table below. Yields have shifted upwards, and the yie

the tables below to find the value of the swap at this time from the financial institution's perspective.

Calculation of New Forward Rates

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock