Question: show me how to solve this please without excel. 6. U-Haul is evaluating a potential lease agreement on a truck that costs $500 and falls

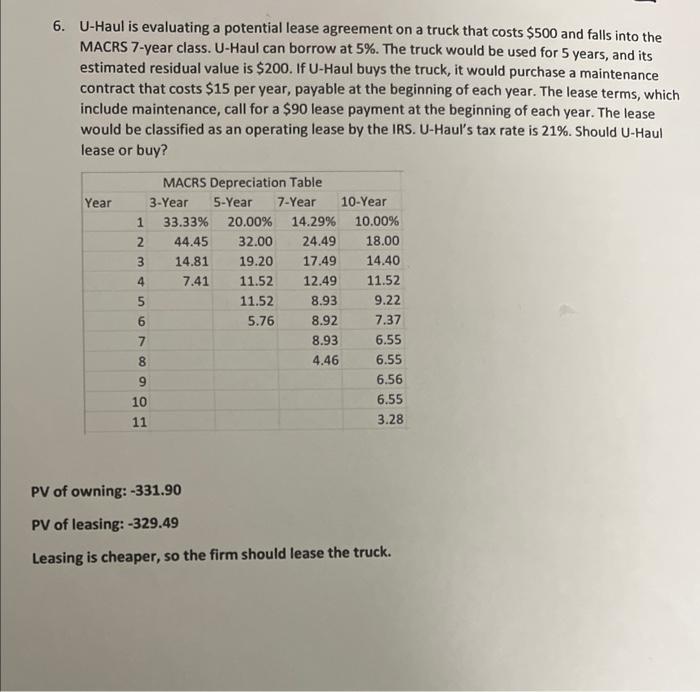

6. U-Haul is evaluating a potential lease agreement on a truck that costs $500 and falls into the MACRS 7 -year class. U-Haul can borrow at 5%. The truck would be used for 5 years, and its estimated residual value is $200. If U-Haul buys the truck, it would purchase a maintenance contract that costs $15 per year, payable at the beginning of each year. The lease terms, which include maintenance, call for a $90 lease payment at the beginning of each year. The lease would be classified as an operating lease by the IRS. U-Haul's tax rate is 21%. Should U-Haul lease or buy? PV of owning: 331.90 PV of leasing: 329.49 Leasing is cheaper, so the firm should lease the truck

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts