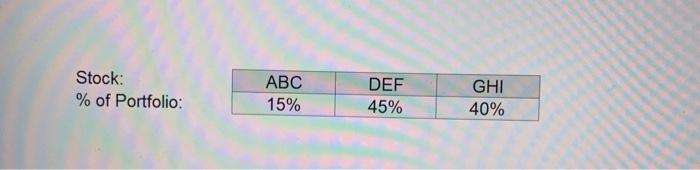

Question: please include excel formulas! will thumbs up Stock: % of Portfolio: ABC 15% DEF 45% GHI 40% 1 Portfolio Return: Return of ABC Return of

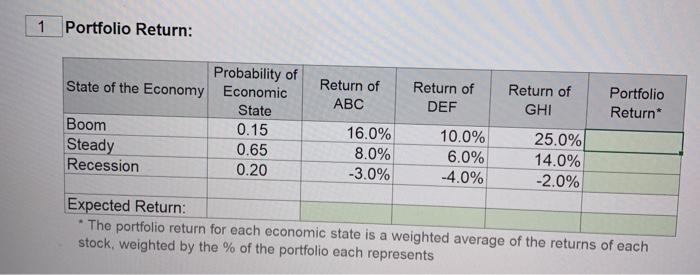

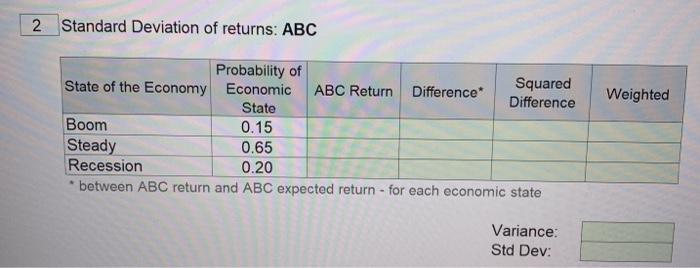

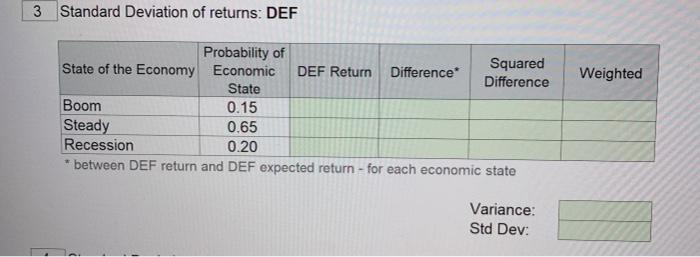

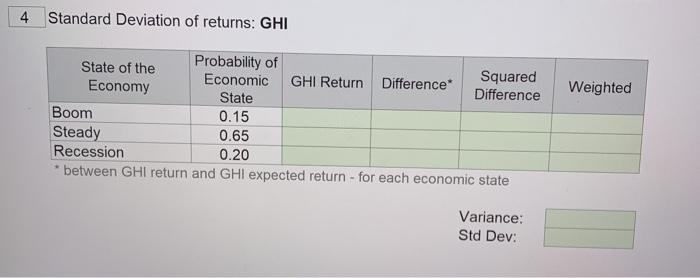

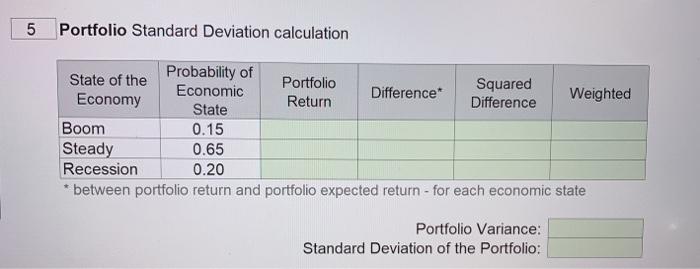

Stock: % of Portfolio: ABC 15% DEF 45% GHI 40% 1 Portfolio Return: Return of ABC Return of DEF Probability of State of the Economy Economic State Boom 0.15 Steady 0.65 Recession 0.20 Return of GHI Portfolio Return 16.0% 8.0% -3.0% 10.0% 6.0% -4.0% 25.0% 14.0% -2.0% Expected Return: * The portfolio return for each economic state a weighted average of the returns of each stock, weighted by the % of the portfolio each represents 2 Standard Deviation of returns: ABC Weighted Probability of State of the Economy Economic ABC Return Difference Squared Difference State Boom 0.15 Steady 0.65 Recession 0.20 between ABC return and ABC expected return - for each economic state Variance: Std Dev: 3 Standard Deviation of returns: DEF Weighted Probability of Squared State of the Economy Economic DEF Return Difference Difference State Boom 0.15 Steady 0.65 Recession 0.20 * between DEF return and DEF expected return - for each economic state Variance: Std Dev: 4 Standard Deviation of returns: GHI Weighted State of the Probability of Economy Economic Squared GHI Return Difference Difference State Boom 0.15 Steady 0.65 Recession 0.20 between GHI return and GHI expected return - for each economic state Variance Std Dev: 5 Portfolio Standard Deviation calculation State of the Probability of Portfolio Economic Squared Difference Economy Return Weighted State Difference Boom 0.15 Steady 0.65 Recession * between portfolio return and portfolio expected return - for each economic state 0.20 Portfolio Variance: Standard Deviation of the Portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts