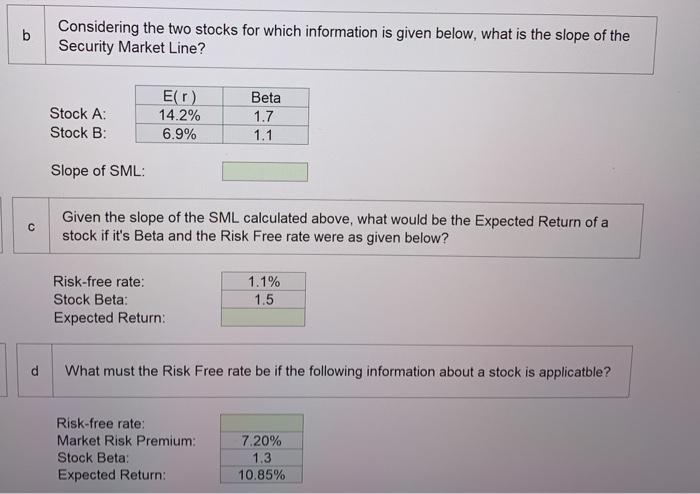

Question: please provide excel formulas! will thumbs up b Considering the two stocks for which information is given below, what is the slope of the Security

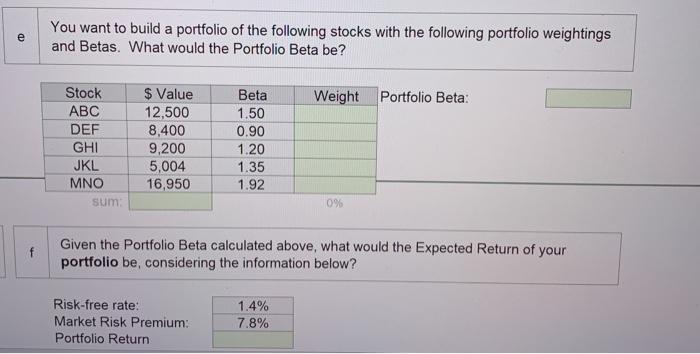

b Considering the two stocks for which information is given below, what is the slope of the Security Market Line? Stock A: Stock B: En 14.2% 6.9% Beta 1.7 1.1 Slope of SML: Given the slope of the SML calculated above, what would be the Expected Return of a stock if it's Beta and the Risk Free rate were as given below? Risk-free rate: Stock Beta: Expected Return: 1.1% 1.5 d What must the Risk Free rate be if the following information about a stock is applicatble? Risk-free rate Market Risk Premium: Stock Beta: Expected Return: 7.20% 1.3 10.85% You want to build a portfolio of the following stocks with the following portfolio weightings and Betas. What would the Portfolio Beta be? Weight Portfolio Beta: Stock ABC DEF GHI JKL MNO sum $ Value 12,500 8,400 9,200 5,004 16,950 Beta 1.50 0.90 1.20 1.35 1.92 0% f Given the Portfolio Beta calculated above, what would the Expected Return of your portfolio be, considering the information below? Risk-free rate: Market Risk Premium: Portfolio Return 1.4% 7.8%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts