Question: please include excel functions and or steps to solve thank you!! 6-5. A capital investment at San Francisco Marine Electric requires an initial outlay of

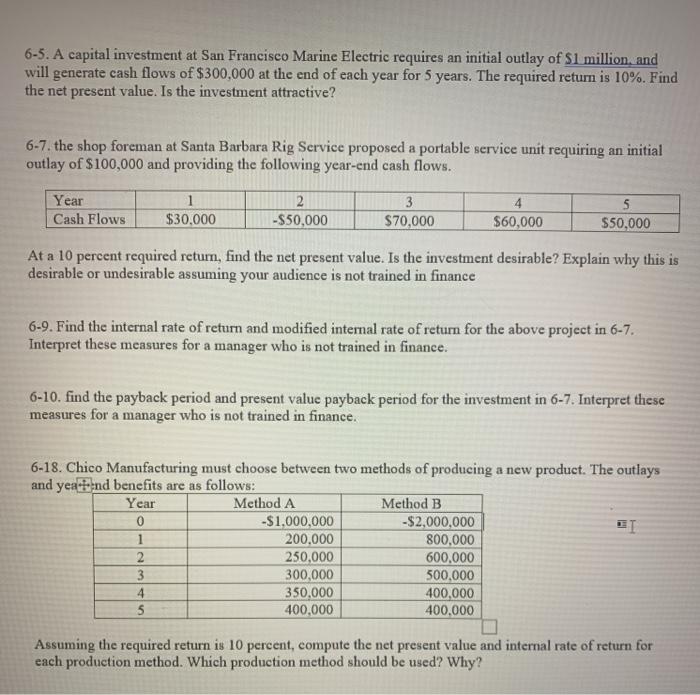

6-5. A capital investment at San Francisco Marine Electric requires an initial outlay of $1 million, and will generate cash flows of $300,000 at the end of each year for 5 years. The required return is 10%. Find the net present value. Is the investment attractive? 6-7. the shop foreman at Santa Barbara Rig Service proposed a portable service unit requiring an initial outlay of $100,000 and providing the following year-end cash flows. Year Cash Flows 1 $30,000 2 -$50,000 3 $70,000 4 $60,000 5 $50,000 At a 10 percent required return, find the net present value. Is the investment desirable? Explain why this is desirable or undesirable assuming your audience is not trained in finance 6-9. Find the internal rate of return and modified internal rate of return for the above project in 6-7. Interpret these measures for a manager who is not trained in finance. 6-10. find the payback period and present value payback period for the investment in 6-7. Interpret these measures for a manager who is not trained in finance. 6-18. Chico Manufacturing must choose between two methods of producing a new product. The outlays and yeand benefits are as follows: Year Method A Method B 0 -$1,000,000 -$2,000,000 200,000 800,000 250,000 600,000 3 300,000 500,000 4 350.000 400,000 5 400,000 400,000 Assuming the required return is 10 percent, compute the net present value and internal rate of return for each production method. Which production method should be used? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts