Question: Please include explanations. Information regarding the defined benefit pension plan of Candy Services included he following for 2021 ($ in millions): Plan assets, January 1,

Please include explanations.

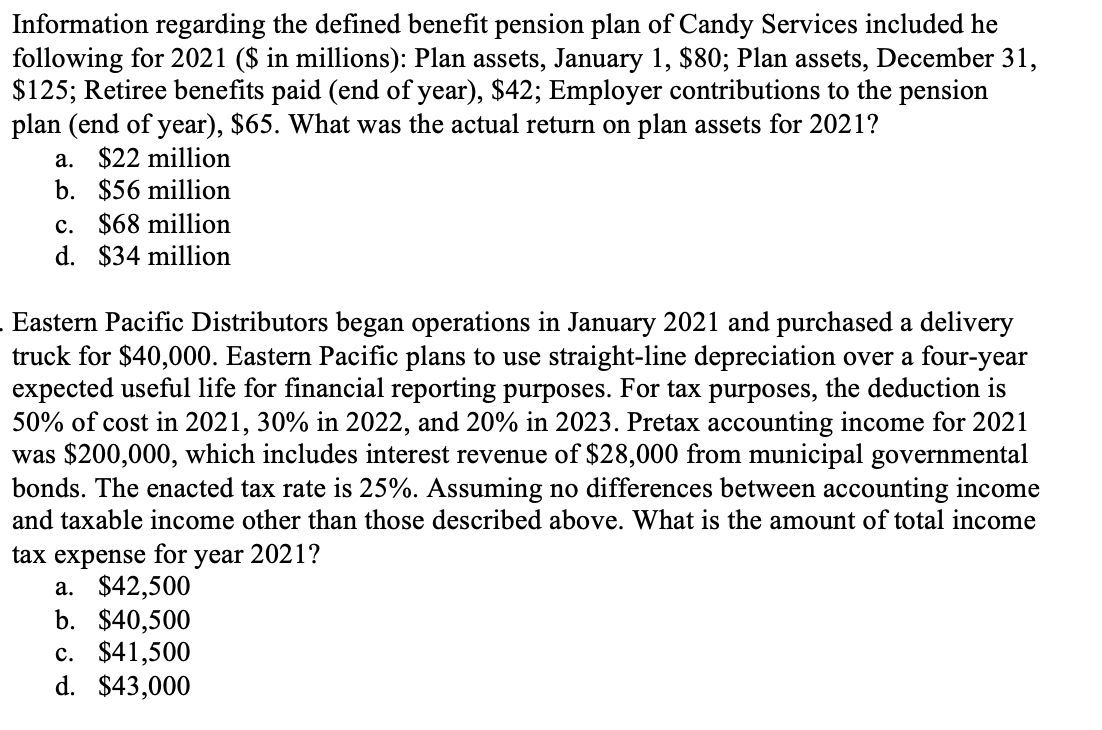

Information regarding the defined benefit pension plan of Candy Services included he following for 2021 ($ in millions): Plan assets, January 1, $80; Plan assets, December 31, $125; Retiree benefits paid (end of year), $42; Employer contributions to the pension plan (end of year), $65. What was the actual return on plan assets for 2021? a. $22 million b. $56 million c. $68 million d. $34 million - Eastern Pacific Distributors began operations in January 2021 and purchased a delivery truck for $40,000. Eastern Pacific plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2021, 30% in 2022, and 20% in 2023. Pretax accounting income for 2021 was $200,000, which includes interest revenue of $28,000 from municipal governmental bonds. The enacted tax rate is 25%. Assuming no differences between accounting income and taxable income other than those described above. What is the amount of total income tax expense for year 2021? a. $42,500 b. $40,500 c. $41,500 d. $43,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts