Question: Please provide explanations. Information regarding the defined benefit pension plan of Brandon Company included the following for 2021 ($ in millions): Service cost, $480; Interest

Please provide explanations.

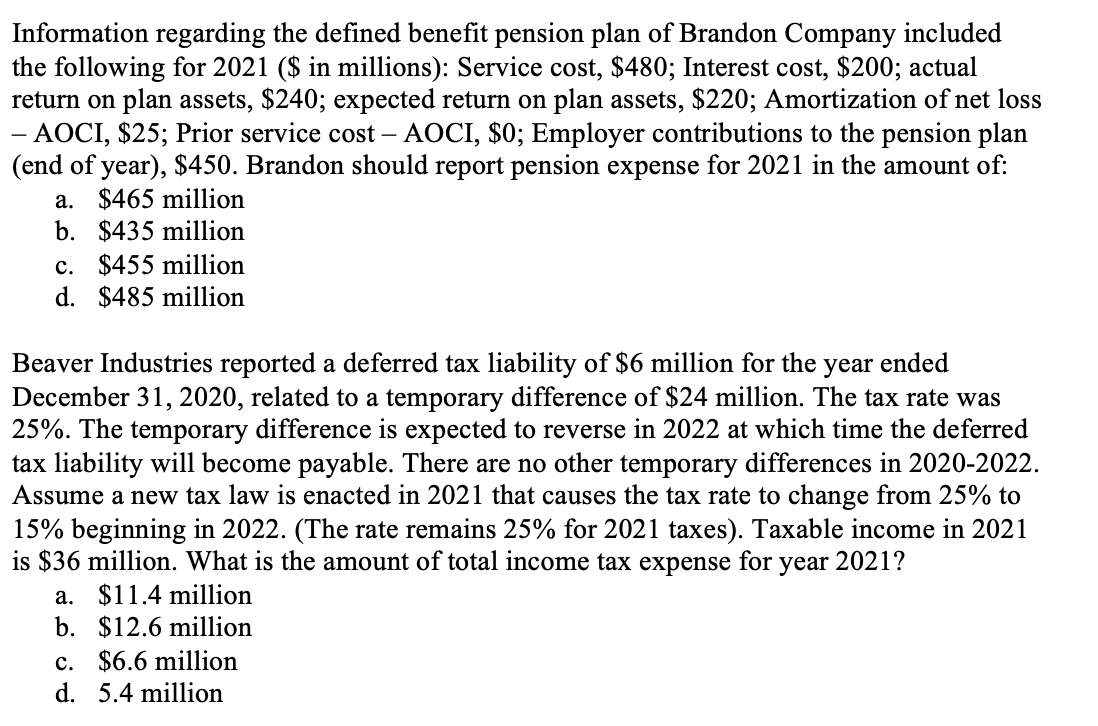

Information regarding the defined benefit pension plan of Brandon Company included the following for 2021 ($ in millions): Service cost, $480; Interest cost, $200; actual return on plan assets, $240; expected return on plan assets, $220; Amortization of net loss AOCI, $25; Prior service cost AOCI, $0; Employer contributions to the pension plan (end of year), $450. Brandon should report pension expense for 2021 in the amount of: a. $465 million b. $435 million c. $455 million d. $485 million Beaver Industries reported a deferred tax liability of $6 million for the year ended December 31, 2020, related to a temporary difference of $24 million. The tax rate was 25%. The temporary difference is expected to reverse in 2022 at which time the deferred tax liability will become payable. There are no other temporary differences in 2020-2022. Assume a new tax law is enacted in 2021 that causes the tax rate to change from 25% to 15% beginning in 2022. (The rate remains 25% for 2021 taxes). Taxable income in 2021 is $36 million. What is the amount of total income tax expense for year 2021? a. $11.4 million b. $12.6 million c. $6.6 million d. 5.4 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts