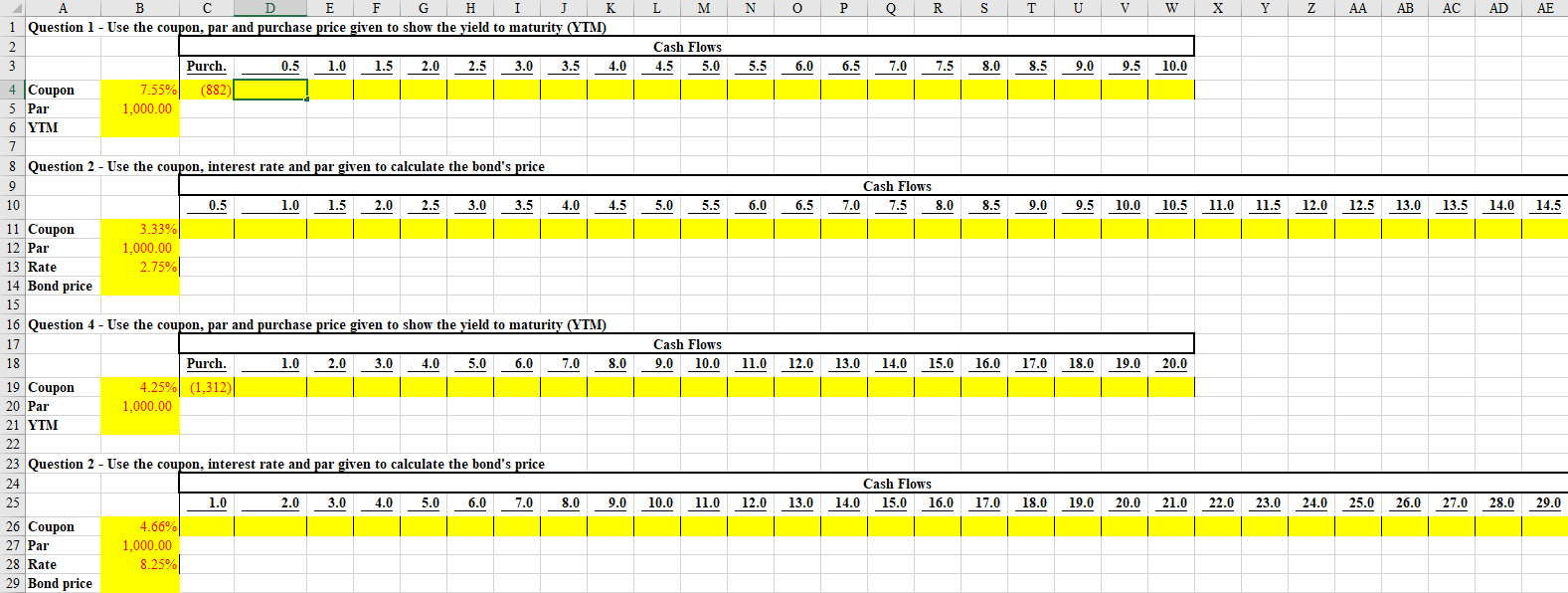

Question: ***PLEASE INCLUDE FORMULAS*** L M N o P Q R S U V W w X Y Y Z AB AC AD AE Cash Flows

***PLEASE INCLUDE FORMULAS***

L M N o P Q R S U V W w X Y Y Z AB AC AD AE Cash Flows 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 8.5 9.0 9.5 10.0 Cash Flows 7.0 7.5 8.0 5.0 5.5 6.0 6.5 8.5 9.0 9.5 10.0 10.5 11.0 11.5 12.0 12.5 13.0 13.5 14.0 14.5 A B D E E F G H I J K 1 Question 1 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) 2 3 Purch. 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4 Coupon 7.55% (882) 5 Par 1,000.00 6 YTM 7 8 Question 2 - Use the coupon, interest rate and par given to calculate the bond's price 9 9 10 0.5 1.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 11 Coupon 3.33% 12 Par 1,000.00 13 Rate 2.75% 14 Bond price 15 16 Question 4 - Use the coupon, par and purchase price given to show the yield to maturity (YTM) 17 18 Purch. 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 19 Coupon 4.25% (1,312) 20 Par 1,000.00 21 YTM 22 23 Question 2 - Use the coupon, interest rate and par given to calculate the bond's price 24 25 1.0 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 26 Coupon 4.66% 27 Par 1,000.00 28 Rate 8.25% 29 Bond price Cash Flows 9.0 10.0 11.0 12.0 13.0 14.0 15.0 16.0 17.0 18.0 19.0 20.0 Cash Flows 14.0 15.0 16.0 10.0 11.0 12.0 13.0 17.0 18.0 19.0 20.0 21.0 22.0 23.0 24.0 25.0 26.0 27.0 28.0 29.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts