Question: please include formulas used You have collected the following information about your firm. Its 50 million shares of common stock have a book value of

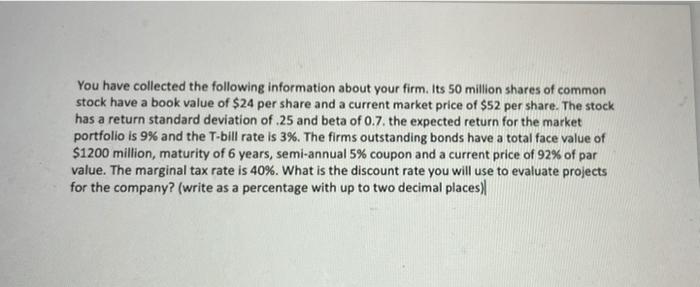

You have collected the following information about your firm. Its 50 million shares of common stock have a book value of $24 per share and a current market price of $52 per share. The stock has a return standard deviation of 25 and beta of 0.7. the expected return for the market portfolio is 9% and the T-bill rate is 3%. The firms outstanding bonds have a total face value of $1200 million, maturity of 6 years, semi-annual 5% coupon and a current price of 92% of par value. The marginal tax rate is 40%. What is the discount rate you will use to evaluate projects for the company? (write as a percentage with up to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts