Question: Please include how you solved this Q 1: Q2: Compute the net pay for each employee using the federal income tax withholding table included. Assume

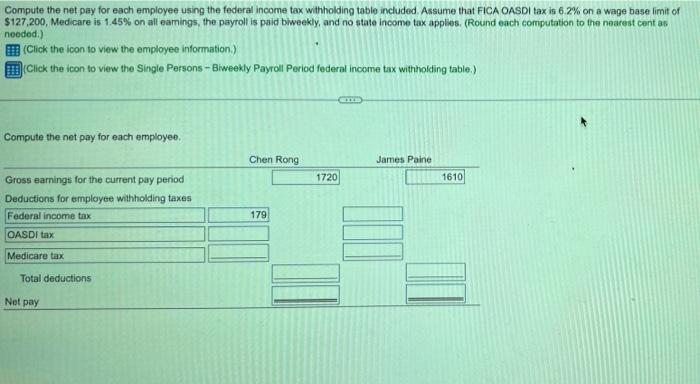

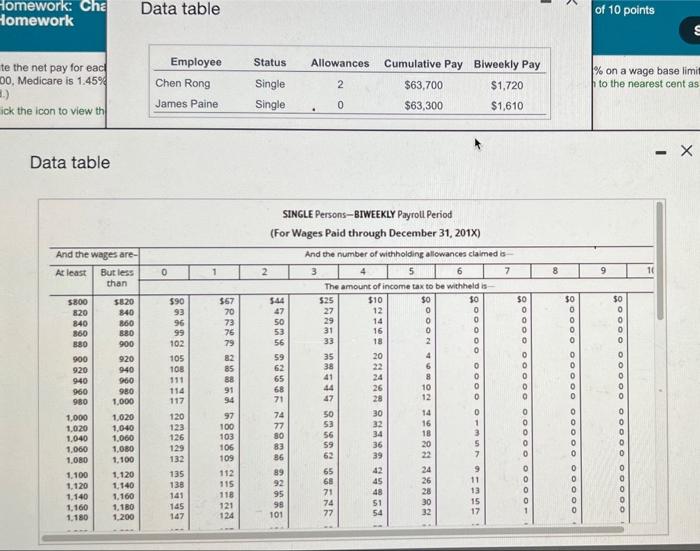

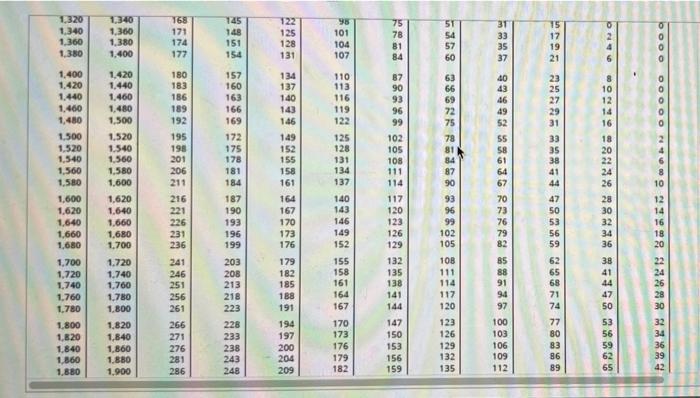

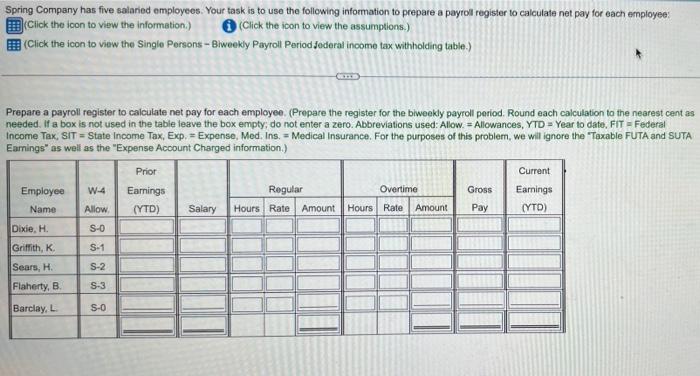

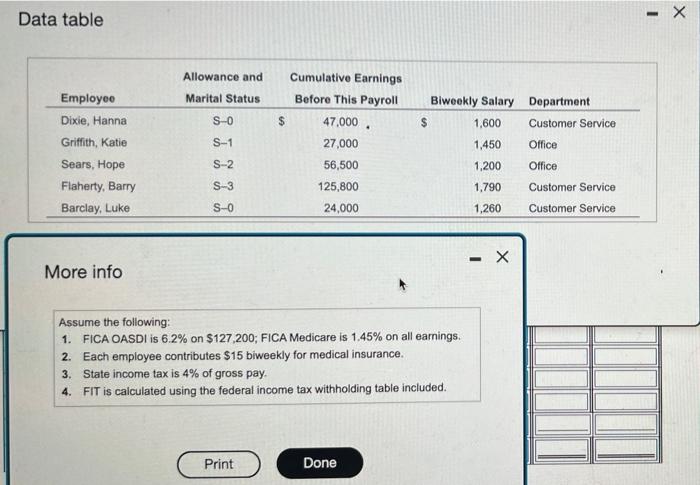

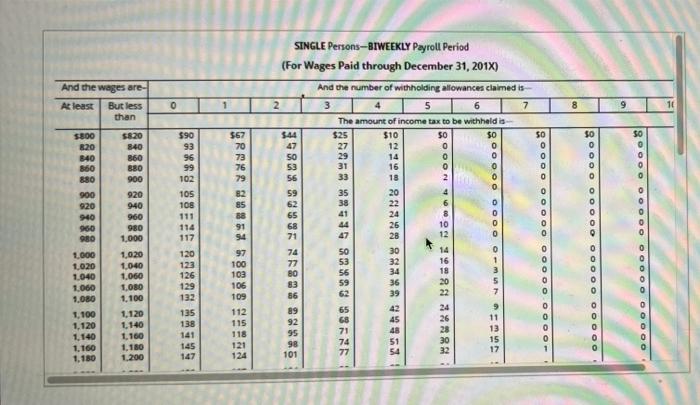

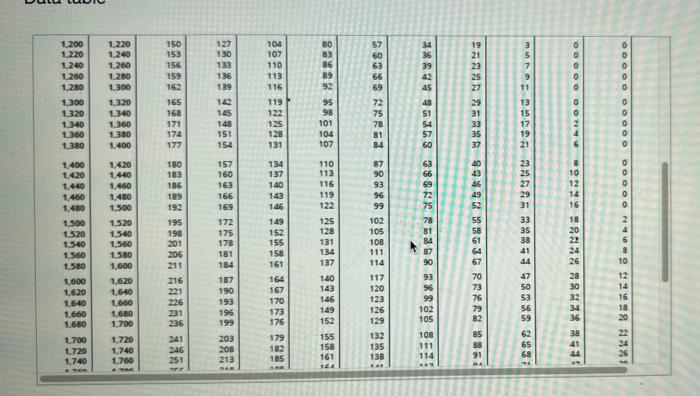

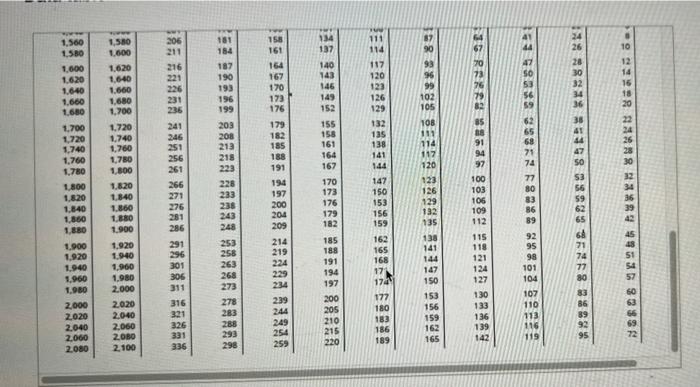

Compute the net pay for each employee using the federal income tax withholding table included. Assume that FICA OASDI tax is 6.2% on a wage base limit of $127,200, Medicare is 1.45% on all earnings, the payroll is paid biweekly, and no state income tax applies. (Round each computation to the nearest cent as needed.) (Click the icon to view the employee information.) (Click the icon to view the Single Persons -Biweekly Payroll Period federal income tax withholding table.) Compute the net pay for each employee. Chen Rong James Paine Gross earnings for the current pay period 1720 Deductions for employee withholding taxes Federal income tax 179 OASDI tax Medicare tax Total deductions Net pay 1610 Homework: Cha Homework te the net pay for eac 00, Medicare is 1.45% .) ick the icon to view th Data table And the wages are- At least But less than $800 $820 820 840 840 860 860 880 880 900 900 920 920 940 940 960 960 980 980 1,000 1,000 1,020 1,020 1,040 1,040 1,060 1,000 1,080 1,080 1,100 1,100 1,120 1,120 1,140 1,140 1,160 1,160 1,180 1,180 1,200 Data table Employee Chen Rong James Paine 0 $90 93 96 99 102 105 108 111 114 117 120 123 126 129 132 135 138 141 145 147 1 $67 70 73 76 79 82 GRRRR 885 8888 2 E7035 45 5 7 35 31 385 8 447 0555 PER * =** 9995 91 94 97 100 103 106 109 Status Allowances Cumulative Pay Biweekly Pay Single 2 $63,700 $1,720 Single 0 $63,300 $1,610 . SINGLE Persons BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X) 2 112 115 118 121 124 $44 47 56 59 62 65 68 71 74 77 80 83 86 89 92 95 98 And the number of withholding allowances claimed is 3 4 5 6 The amount of income tax to be withheld is- 7 $0 $10 12 14 16 101 $25 27 29 33 38 41 53 56 59 62 65 68 71 74 77 18 20 22 24 26 28 30 32 34 36 39 42 45 48 51 54 GOOON AF R2 32882 $0 0 2 4 6 8 10 12 14 16 18 20 22 24 26 30 gooooo oooo omUT TIRSD 11 13 15 17 10000 ooooooooooooooo 0 0 0 0 8 50 90000 0.000 ooooo ooooo 90000 ooo oo ooo oo ooooo 0 of 10 points % on a wage base limit to the nearest cent as - X 0 $0 0 1,320 1.340 1,340 1,360 1,360 1,380 1,380 1,400 1,400 1,420 1,420 1.440 1,440 1,460 1,460 1.480 1,480 1,500 1,500 1,520 1,520 1.540 1,540 1,560 1,560 1,580 1.580 1,600 1,600 1,620 1,620 1.640 1,640 1,660 1,660 1,680 1,680 1,700 1,700 1,720 1,720 1,740 1,740 1,760 1,760 1,780 1,780 1,800 1,800 1,820 1,820 1,840 1,840 1,860 1,860 1,880 1,880 1,900 180 183 186 189 192 195 198 201 206 211 5 8 37 160 3 166 169 172 175 181 184 187 190 193 196 199 203 208 213 218 223 228 149 152 155 158 161 179 182 185 188 191 194 110 113 116 119 122 125 128 131 134 137 140 143 146 149 152 155 158 161 164 167 170 173 176 179 182 75 132 135 138 141 144 147 150 153 156 159 g%m3 A B5 7 92 585 0 58 SP91 3571 = 50% 06 222 2233 2223 25398 38865 00000 24680 2L680 3580 2 108 111 114 117 120 123 126 129 132 135 100 103 106 109 112 ONED 8 10 oooo Spring Company has five salaried employees. Your task is to use the following information to prepare a payroll register to calculate net pay for each employee: (Click the icon to view the information.) (Click the icon to view the assumptions.) (Click the icon to view the Single Persons -Biweekly Payroll Period Jederal income tax withholding table.) Prepare a payroll register to calculate net pay for each employee. (Prepare the register for the biweekly payroll period. Round each calculation to the nearest cent as needed. If a box is not used in the table leave the box empty; do not enter a zero. Abbreviations used: Allow. Allowances, YTD= Year to date, FIT = Federal Income Tax, SIT = State Income Tax, Exp. = Expense, Med. Ins. = Medical Insurance. For the purposes of this problem, we will ignore the "Taxable FUTA and SUTA Earnings as well as the "Expense Account Charged information.) Prior Current Earnings Employee W-4 Regular Overtime Earnings Gross Name | Allow (YTD) Salary Hours Rate Amount Hours Rate Amount Pay (YTD) S-0 S-1 S-2 S-3 S-0 Dixie, H. Griffith, K. Sears, H. Flaherty, B. Barclay, L Data table Allowance and Cumulative Earnings Marital Status Before This Payroll S-0 47,000. S-1 27,000 S-2 56,500 S-3 125,800 S-0 24,000 Assume the following: 1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings. 2. Each employee contributes $15 biweekly for medical insurance. 3. State income tax is 4% of gross pay. 4. FIT is calculated using the federal income tax withholding table included. Print Done Employee Dixie, Hannal Griffith, Katie Sears, Hope Flaherty, Barry Barclay, Luke More info $ $ Biweekly Salary 1,600 1,450 1,200 1,790 1,260 - X Department Customer Service Office Office Customer Service Customer Service - X And the wages are- At least But less than $820 840 860 880 900 1000 1,020 1,020 1.040 1.040 1,060 1.060 1,080 1,080 1,100 1,100 1,120 1,120 1,140 1,140 1,160 1.160 1,180 1,180 1,200 o 88| 102 105 108 111 114 117 120 123 126 129 132 135 138 141 145 147 1 $67 8138 19 115118 SINGLE Persons-BIWEEKLY Payroll Period (For Wages Paid through December 31, 201X) 2 And the number of withholding allowances claimed is 3 4 5 The amount of income tax to be withheld is $25 $10 50 $0 $0 12 0 o 14 0 16 n 10 18 2 200000 66323660 Gossel 2006 33665 66653 60666 60 6 6 1800 222AH oooo 3 9 11 15 17 0 0 o 0 1000 o 1 8 $0 0 o ooo 9 50 ... o ooooo ( 1,200 1,220 1,240 1,260 1,280 1,300 1,320 1,340 1.360 1,380 1,400 1,420 1,440 1,220 1,240 1.260 1,280 1,300 127 130 133 136 139 157 160 163 166 169 172 175 178 181 184 187 190 193 196 199 | S8,199 wm108 16 19818 1710 03% m058 3 15 11 1357 SH5 583 0 58 |3579H B5D9 357 = 358== 250355 5 58 116 119 122 111 114 117 120 123 126 129 132 135 138 21400 O FO 0 0 0 a coooo LN 00000 365 268 285 3258 65 62 10 www 1,560 1580 1,600 1.620 1.640 1.660 1.680 1,700 1,720 1,740 1,760 1,780 1,800 1,820 1,820 1.840 1.840 1,860 1,860 1.880 1,880 1.900 1.900 1,920 1,920 1.940 1,940 1,960 1,960 1.980 1,980 2.000 2,000 2.020 2.020 2,040 2.040 2,060 2,000 2.080 2.080 2,100 Tel 98888 IRRRRRSS SE200 8008 ( 69398 38898 174 177 180 183 186 189 : 83882 BEND BL nu p gmb mium616 EUGS SS 199 2202 R XX 057 33831

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts