Question: Please include steps and explanations Propose a swap contract for example from materials No. 7 assuming that there is a financial intermediary and: a) flows

Please include steps and explanations

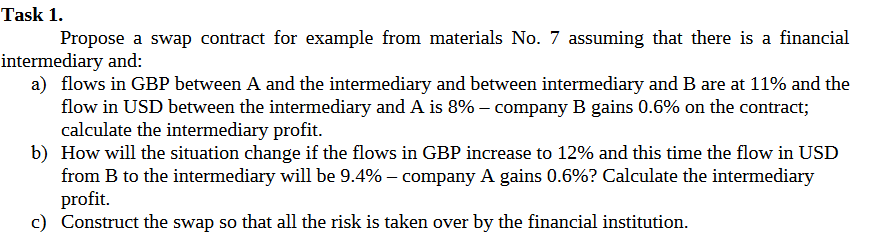

Propose a swap contract for example from materials No. 7 assuming that there is a financial intermediary and: a) flows in GBP between A and the intermediary and between intermediary and B are at 11% and the flow in USD between the intermediary and A is 8% - company B gains 0.6% on the contract; calculate the intermediary profit. b) How will the situation change if the flows in GBP increase to 12% and this time the flow in USD from B to the intermediary will be 9.4% - company A gains 0.6% ? Calculate the intermediary profit. c) Construct the swap so that all the risk is taken over by the financial institution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts