Question: Please include steps and explanations, thank you Task 3. Fifteen months remain until the currency swap expires. The contract is to exchange an interest rate

Please include steps and explanations, thank you

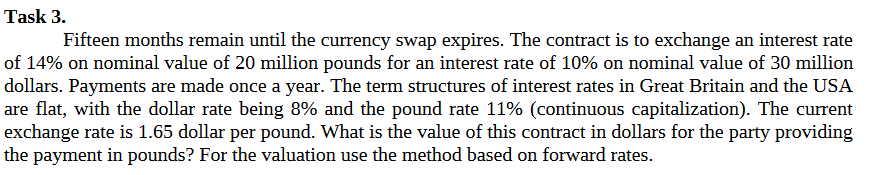

Task 3. Fifteen months remain until the currency swap expires. The contract is to exchange an interest rate of 14% on nominal value of 20 million pounds for an interest rate of 10% on nominal value of 30 million dollars. Payments are made once a year. The term structures of interest rates in Great Britain and the USA are flat, with the dollar rate being 8% and the pound rate 11% (continuous capitalization). The current exchange rate is 1.65 dollar per pound. What is the value of this contract in dollars for the party providing the payment in pounds? For the valuation use the method based on forward rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts