Question: Please include steps and explanations, thank you We assume that the yield curves in Japan and the USA are flat. The interest rate in Japan

Please include steps and explanations, thank you

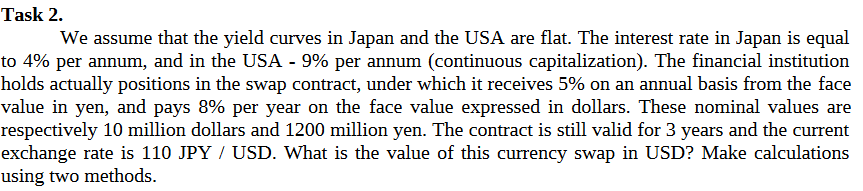

We assume that the yield curves in Japan and the USA are flat. The interest rate in Japan is equal to 4% per annum, and in the USA - 9\% per annum (continuous capitalization). The financial institution holds actually positions in the swap contract, under which it receives 5% on an annual basis from the face value in yen, and pays 8% per year on the face value expressed in dollars. These nominal values are respectively 10 million dollars and 1200 million yen. The contract is still valid for 3 years and the current exchange rate is 110 JPY / USD. What is the value of this currency swap in USD? Make calculations using two methods

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts