Question: please include the calculations step by step Assume you have purchased a put option on Euro (EUR) for a premium of $0.0200 with an exercise

please include the calculations step by step

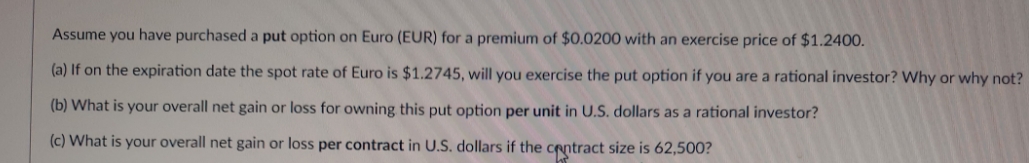

Assume you have purchased a put option on Euro (EUR) for a premium of $0.0200 with an exercise price of $1.2400. (a) If on the expiration date the spot rate of Euro is $1.2745, will you exercise the put option if you are a rational investor? Why or why not? (b) What is your overall net gain or loss for owning this put option per unit in U.S. dollars as a rational investor? (c) What is your overall net gain or loss per contract in U.S. dollars if the contract size is 62,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts