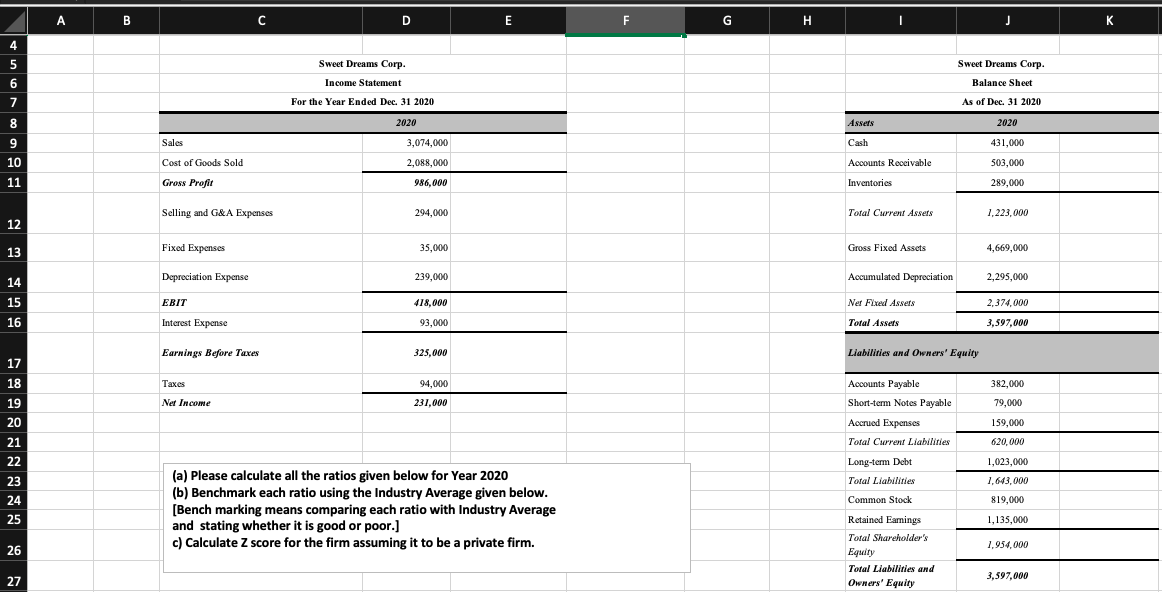

Question: Please include the Excel equations. thank you! A A B C D E F G H T j 4 4 5 Sweet Dreams Corp. 6

Please include the Excel equations. thank you!

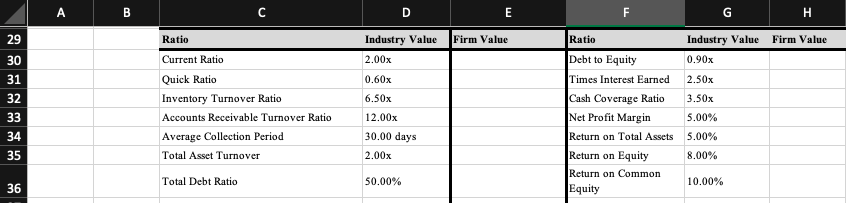

A A B C D E F G H T j 4 4 5 Sweet Dreams Corp. 6 Income Statement Sweet Dreams Corp Balance Sheet As of Dec. 31 2020 2020 7 For the Year Ended Dec 31 2020 2020 Asserts Sales 3,074,000 Cash 431,000 8 9 10 11 Cost of Goods Sold 2,088,000 Accounts Receivable 503,000 Gross Profit 986.000 Inventories 289,000 Selling and G&A Expenses 294,000 Total Current Assers 1,223,000 12 Fixed Expenses 35,000 13 Gross Fixed Assets 4,669,000 Depreciation Expense 239,000 Accumulated Depreciation 2,295.000 14 15 16 418,000 2,374,000 EBIT Interest Expense Net Fixed Assets Total Assers 93,000 3,597,000 Earnings Before Taxes 325,000 Liabilities and Owners' Equity 17 18 Taxes 94,000 382,000 Ner Income 237,000 79,000 19 20 Accounts Payable Short-term Notes Payable Accrued Expenses Total Current Liabilities 159.000 620,000 21 22 23 24 Long-term Debt Total Liabilities 1,023,000 1,643,000 Common Stock 819,000 (a) Please calculate all the ratios given below for Year 2020 (b) Benchmark each ratio using the Industry Average given below. (Bench marking means comparing each ratio with Industry Average and stating whether it is good or poor.) c) Calculate Z score for the firm assuming it to be a private firm. 25 1,135,000 1,954,000 26 Retained Earnings Total Shareholder's Equity Total Liabilities and Owners' Equity 3,597,000 27 A B C D E F G H 29 Ratio Firm Value Firm Value Industry Value 2.00x 30 Current Ratio 0.60x 6.50x 31 32 33 34 35 Quick Ratio Inventory Turnover Ratio Accounts Receivable Turnover Ratio Average Collection Period Total Asset Turnover 12.00x 30.00 days 2.00x Ratio Industry Value Debt to Equity 0.90x Times Interest Earned 2.50x Cash Coverage Ratio 3.50x Net Profit Margin 5.00% Return on Total Assets 5.00% Return on Equity 8.00% Return on Common 10.00% Equity Total Debt Ratio 50.00% 36

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts