Question: please include worked out solutions Question 3 1 pts A college received a contribution to its endowment fund of $2 million. It can never touch

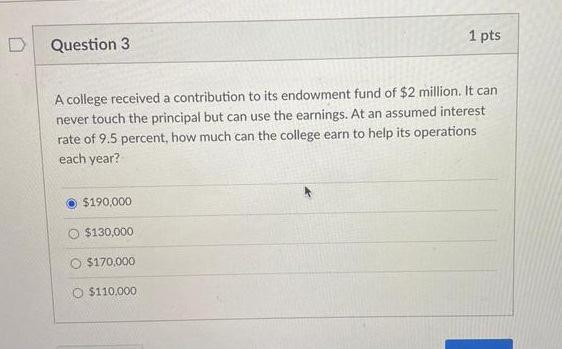

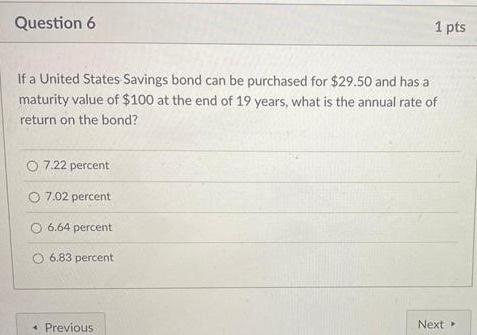

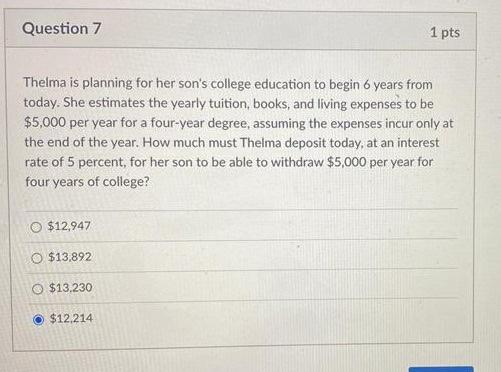

Question 3 1 pts A college received a contribution to its endowment fund of $2 million. It can never touch the principal but can use the earnings. At an assumed interest rate of 9.5 percent, how much can the college earn to help its operations each year? $190,000 $130,000 $170,000 O $110,000 Question 6 1 pts If a United States Savings bond can be purchased for $29.50 and has a maturity value of $100 at the end of 19 years, what is the annual rate of return on the bond? 7.22 percent O 7.02 percent 6.64 percent O 6.83 percent Next Previous Question 7 1 pts Thelma is planning for her son's college education to begin 6 years from today. She estimates the yearly tuition, books, and living expenses to be $5,000 per year for a four-year degree, assuming the expenses incur only at the end of the year. How much must Thelma deposit today, at an interest rate of 5 percent, for her son to be able to withdraw $5,000 per year for four years of college? $12,947 O $13,892 $13.230 $12,214

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts