Question: PLEASE IT NEEDS TO BE DONE IN THE EXCEL AND PLEASE SHOW THE FORMULAS 3. You are supposed to value a company. You are collecting

PLEASE IT NEEDS TO BE DONE IN THE EXCEL AND PLEASE SHOW THE FORMULAS

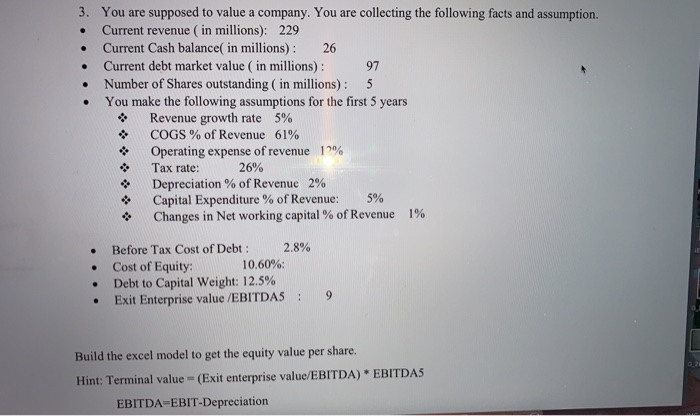

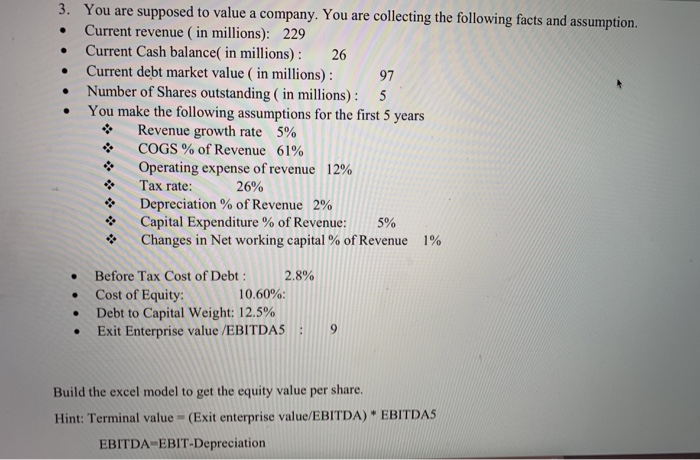

PLEASE IT NEEDS TO BE DONE IN THE EXCEL AND PLEASE SHOW THE FORMULAS3. You are supposed to value a company. You are collecting the following facts and assumption. . Current revenue ( in millions): 229 Current Cash balance( in millions): 26 Current debt market value ( in millions): Number of Shares outstanding ( in millions) 5 You make the following assumptions for the first 5 years 97 . Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 1706 Tax rate: Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 26% 1% . Before Tax Cost ofDebt : 2.890 .Cost of Equity: . Debt to Capital Weight: 12.5% Exit Enterprise value /EBITDAS 9 10.60%; Build the excel model to get the equity value per share Hint: Terminal value (Exit enterprise value/EBITDA) EBITDAS EBITDA-EBIT-Depreciation You are supposed to value a company. You are collecting the following facts and assumption. Current revenue ( in millions): 229 Current Cash balance( in millions): 26 Current debt market value ( in millions) 97 Number of Shares outstanding ( in millions): 5 . You make the following assumptions for the first 5 years Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 12% Tax rate: 26% Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 1% . Before Tax Cost of Debt: 2.8% 10.60%; Cost of Equity Debt to Capital Weight: 12.5% Exit Enterprise value/EBITDAS . Build the excel mode to get the equity value per share Hint: Terminal value = (Exit enterprise value/EBITDA) * EBITDA5 EBITDA-EBIT-Depreciation 3. You are supposed to value a company. You are collecting the following facts and assumption. . Current revenue ( in millions): 229 Current Cash balance( in millions): 26 Current debt market value ( in millions): Number of Shares outstanding ( in millions) 5 You make the following assumptions for the first 5 years 97 . Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 1706 Tax rate: Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 26% 1% . Before Tax Cost ofDebt : 2.890 .Cost of Equity: . Debt to Capital Weight: 12.5% Exit Enterprise value /EBITDAS 9 10.60%; Build the excel model to get the equity value per share Hint: Terminal value (Exit enterprise value/EBITDA) EBITDAS EBITDA-EBIT-Depreciation You are supposed to value a company. You are collecting the following facts and assumption. Current revenue ( in millions): 229 Current Cash balance( in millions): 26 Current debt market value ( in millions) 97 Number of Shares outstanding ( in millions): 5 . You make the following assumptions for the first 5 years Revenue growth rate 5% COGS % of Revenue 61% Operating expense of revenue 12% Tax rate: 26% Depreciation % of Revenue 2% Capital Expenditure % of Revenue: 5% Changes in Net working capital % of Revenue 1% . Before Tax Cost of Debt: 2.8% 10.60%; Cost of Equity Debt to Capital Weight: 12.5% Exit Enterprise value/EBITDAS . Build the excel mode to get the equity value per share Hint: Terminal value = (Exit enterprise value/EBITDA) * EBITDA5 EBITDA-EBIT-Depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts