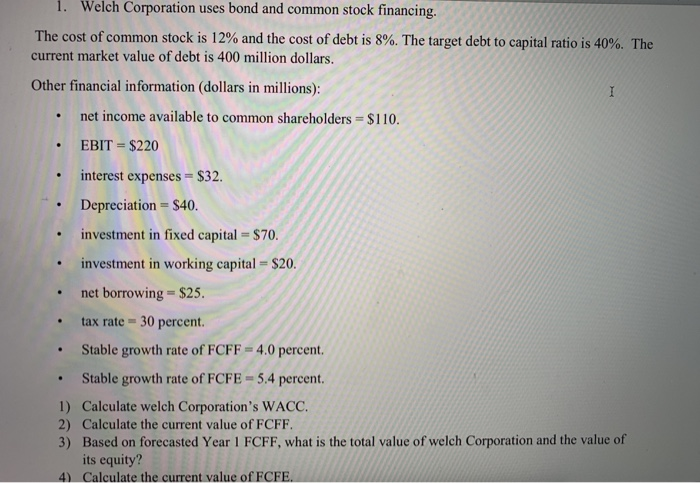

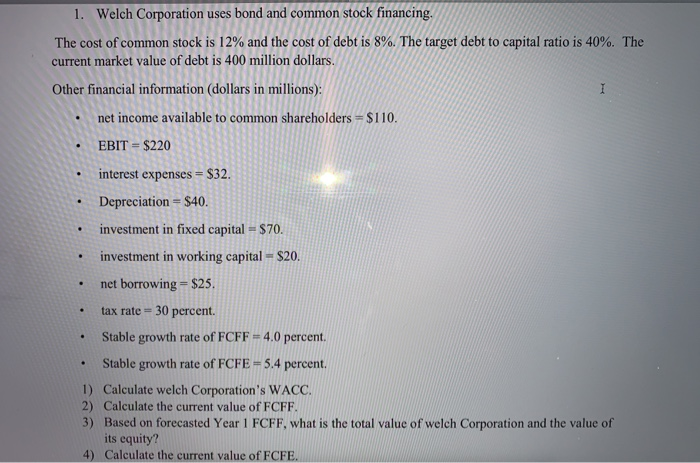

Question: THIS NEEDS TI BE DONE IN THE EXCEL PLEASE. please show me the formulas in excel 1. Welch Corporation uses bond and common stock financing.

THIS NEEDS TI BE DONE IN THE EXCEL PLEASE. please show me the formulas in excel

THIS NEEDS TI BE DONE IN THE EXCEL PLEASE. please show me the formulas in excel1. Welch Corporation uses bond and common stock financing. The cost of common stock is 12% and the cost of debt is 8%. The target debt to capital ratio is 40%. The current market value of debt is 400 million dollars. Other financial information (dollars in millions): net income available to common shareholders = $110. EBIT- $220 interest expenses S32 Depreciation -$40. investment in fixed capital = $70. investment in working capital $20. net borrowing = $25. tax rate- 30 percent Stable growth rate of FCFF -4.0 percent Stable growth rate of FCFE-5.4 percent. 1) Calculate welch Corporation's WACC 2) Calculate the current value of FCFF 3) Based on forecasted Year 1 FCFF, what is the total value of welch Corporation and the value of its equity? 4) Calculate the current value of FCFE 1. Welch Corporation uses bond and common stock financing. The cost of common stock is 12% and the cost of debt is 8%. The target debt to capital ratio is 40%. The current market value of debt is 400 million dollars. Other financial information (dollars in millions) net income available to common shareholders -$110. EBIT = $220 interest expenses-$32. Depreciation $40 investment in fixed capital $70 . investment in working capital $20 net borrowing= $25. tax rate 30 percent. Stable growth rate of FCFF -4.0 percent. . Stable growth rate of FCFE - 5.4 percent. 1) Calculate welch Corporation's WACC 2) Calculate the current value of FCFF. 3) Based on forecasted Year 1 FCFF, what is the total value of welch Corporation and the value of its equity? 4) Calculate the current value of FCFE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts