Question: please just answer S1-8. the question for the S1-8 is split in the 2 pics below. termine the best investment. What is the maximum amount

please just answer S1-8. the question for the S1-8 is split in the 2 pics below.

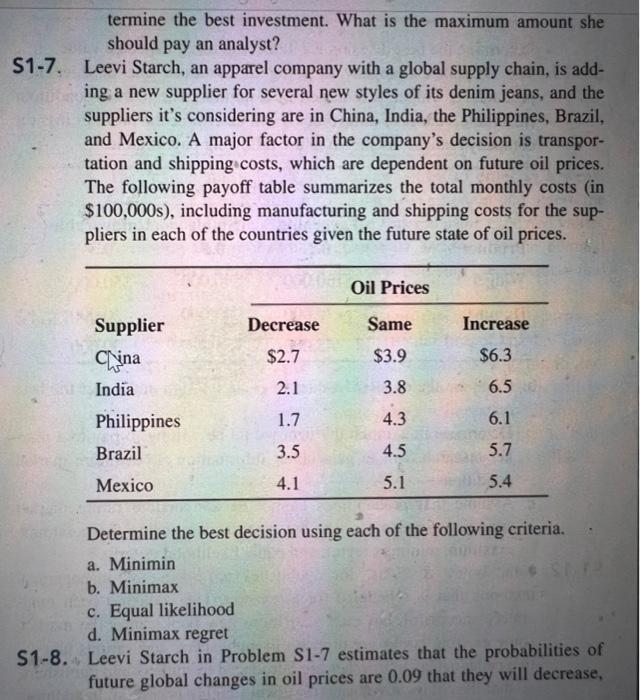

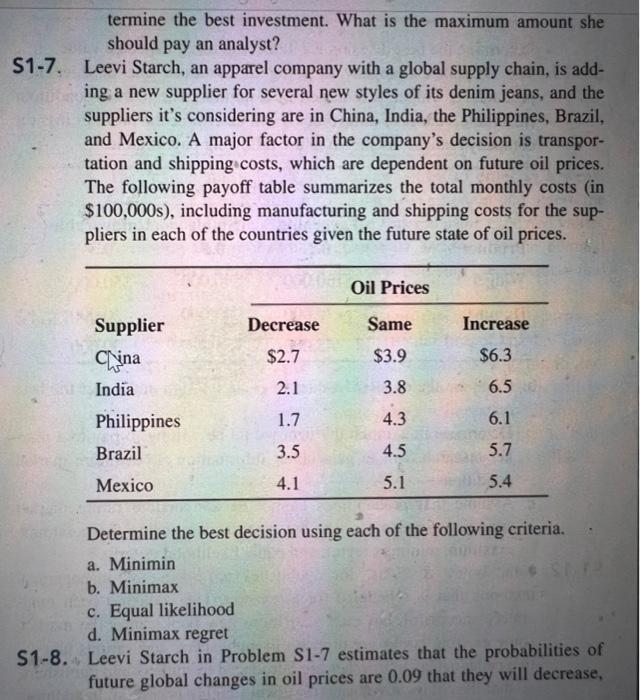

termine the best investment. What is the maximum amount she should pay an analyst? S1-7. Leevi Starch, an apparel company with a global supply chain, is adding a new supplier for several new styles of its denim jeans, and the suppliers it's considering are in China, India, the Philippines, Brazil, and Mexico. A major factor in the company's decision is transportation and shipping costs, which are dependent on future oil prices. The following payoff table summarizes the total monthly costs (in $100,000s ), including manufacturing and shipping costs for the suppliers in each of the countries given the future state of oil prices. Determine the best decision using each of the following criteria. a. Minimin b. Minimax c. Equal likelihood d. Minimax regret S1-8. Leevi Starch in Problem S1-7 estimates that the probabilities of future global changes in oil prices are 0.09 that they will decrease, 0.27 that they will remain the same, and 0.64 that they will decrease. a. Determine the best supplier for the company using expected value. b. If the company wants to hire an energy analyst to help it determine more accurately what future oil prices will do, what is the maximum amount it should pay the analyst

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock