Question: Please just answer the 2 questions thoroughly :) 3. Take a deeper dive into the portfolio selected by the managers of Vanguard 500 Index Investor

Please just answer the 2 questions thoroughly :)

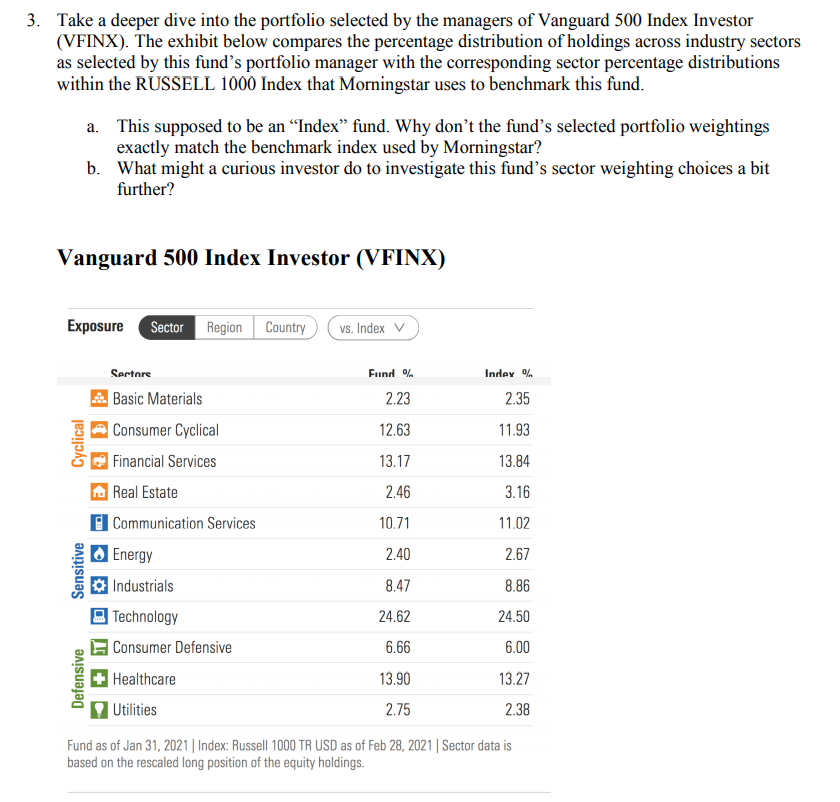

3. Take a deeper dive into the portfolio selected by the managers of Vanguard 500 Index Investor (VFINX). The exhibit below compares the percentage distribution of holdings across industry sectors as selected by this fund's portfolio manager with the corresponding sector percentage distributions within the RUSSELL 1000 Index that Morningstar uses to benchmark this fund. a. This supposed to be an Index fund. Why don't the fund's selected portfolio weightings exactly match the benchmark index used by Morningstar? b. What might a curious investor do to investigate this fund's sector weighting choices a bit further? Vanguard 500 Index Investor (VFINX) Exposure Sector Region Country vs. Index V Fund % Indey % 2.23 2.35 12.63 11.93 Cyclical 13.17 13.84 2.46 3.16 Sertare Basic Materials | Consumer Cyclical Financial Services Real Estate Communication Services Energy Industrials | Technology Consumer Defensive 10.71 11.02 2.40 2.67 Sensitive 8.47 8.86 Da 24.62 24.50 6.66 6.00 Defensive 13.90 13.27 Healthcare Utilities 2.75 2.38 Fund as of Jan 31, 2021 Index: Russell 1000 TR USD as of Feb 28, 2021 | Sector data is based on the rescaled long position of the equity holdings. 3. Take a deeper dive into the portfolio selected by the managers of Vanguard 500 Index Investor (VFINX). The exhibit below compares the percentage distribution of holdings across industry sectors as selected by this fund's portfolio manager with the corresponding sector percentage distributions within the RUSSELL 1000 Index that Morningstar uses to benchmark this fund. a. This supposed to be an Index fund. Why don't the fund's selected portfolio weightings exactly match the benchmark index used by Morningstar? b. What might a curious investor do to investigate this fund's sector weighting choices a bit further? Vanguard 500 Index Investor (VFINX) Exposure Sector Region Country vs. Index V Fund % Indey % 2.23 2.35 12.63 11.93 Cyclical 13.17 13.84 2.46 3.16 Sertare Basic Materials | Consumer Cyclical Financial Services Real Estate Communication Services Energy Industrials | Technology Consumer Defensive 10.71 11.02 2.40 2.67 Sensitive 8.47 8.86 Da 24.62 24.50 6.66 6.00 Defensive 13.90 13.27 Healthcare Utilities 2.75 2.38 Fund as of Jan 31, 2021 Index: Russell 1000 TR USD as of Feb 28, 2021 | Sector data is based on the rescaled long position of the equity holdings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts