Question: Please just answer the last three and not the first one The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance

Please just answer the last three and not the first one

Please just answer the last three and not the first one

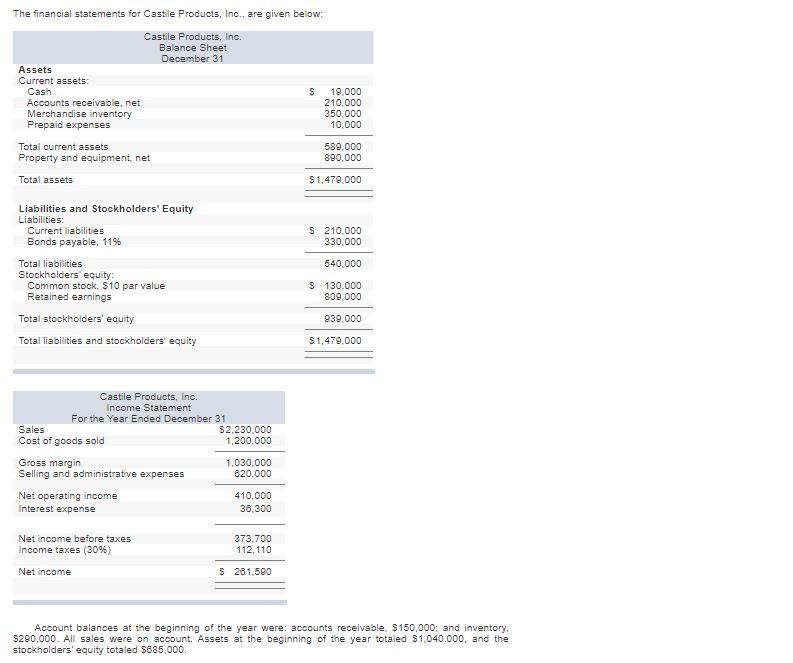

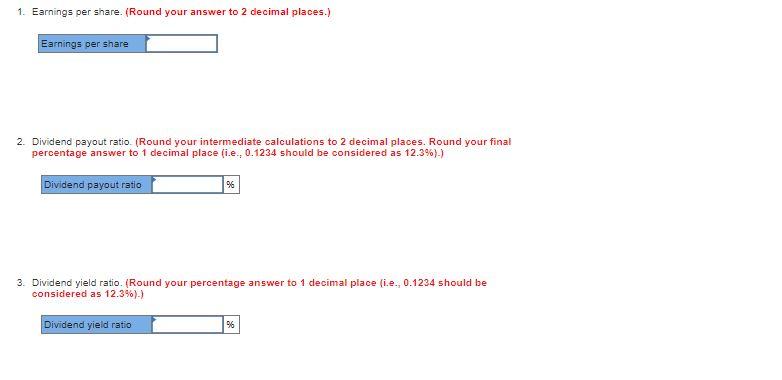

The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance Sheet December 31 Assets Current assets Cash s 19.000 Accounts receivable, net 210.000 Merchandise inventory 350.000 Prepaid expenses 10,000 Total current assets Property and equipment, net 589,000 890.000 Total assets $1,479.000 Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 11% $ 210.000 330.000 540,000 Total liabilities Stockholders' equity: Common stock. $10 par value Retained earnings Total stockholders' equity $ 130.000 809,000 939.000 Total liabilities and stockholders equity $1,470.000 Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $2.230,000 Cost of goods sold 1.200.000 1,030,000 820.000 Gross margin Selling and administrative expenses Net operating income Interest expense 410.000 36,300 Net income before taxes Income taxes (30%) 373.700 112, 110 Net income $ 281.590 Account balances at the beginning of the year were: accounts receivable $150,000: and inventory, $290,000. All sales were on account. Assets at the beginning of the year totaled $1.040,000, and the stockholders' equity totaled $685,000. 1. Earnings per share. (Round your answer to 2 decimal places.) Earnings per share 2. Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your final percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%).) Dividend payout ratio % 3. Dividend yield ratio. (Round your percentage answer to 1 decimal place (ie., 0.1234 should be considered as 12.3%).) Dividend yield ratio 9% The financial statements for Castile Products, Inc., are given below: Castile Products, Inc. Balance Sheet December 31 Assets Current assets Cash s 19.000 Accounts receivable, net 210.000 Merchandise inventory 350.000 Prepaid expenses 10,000 Total current assets Property and equipment, net 589,000 890.000 Total assets $1,479.000 Liabilities and Stockholders' Equity Liabilities: Current liabilities Bonds payable, 11% $ 210.000 330.000 540,000 Total liabilities Stockholders' equity: Common stock. $10 par value Retained earnings Total stockholders' equity $ 130.000 809,000 939.000 Total liabilities and stockholders equity $1,470.000 Castile Products, Inc. Income Statement For the Year Ended December 31 Sales $2.230,000 Cost of goods sold 1.200.000 1,030,000 820.000 Gross margin Selling and administrative expenses Net operating income Interest expense 410.000 36,300 Net income before taxes Income taxes (30%) 373.700 112, 110 Net income $ 281.590 Account balances at the beginning of the year were: accounts receivable $150,000: and inventory, $290,000. All sales were on account. Assets at the beginning of the year totaled $1.040,000, and the stockholders' equity totaled $685,000. 1. Earnings per share. (Round your answer to 2 decimal places.) Earnings per share 2. Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your final percentage answer to 1 decimal place (i.e., 0.1234 should be considered as 12.3%).) Dividend payout ratio % 3. Dividend yield ratio. (Round your percentage answer to 1 decimal place (ie., 0.1234 should be considered as 12.3%).) Dividend yield ratio 9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts