Question: PLEASE just double check if are u sure about your answer? This is an email send by the lecturer to clarify: In regards to Homework

PLEASE just double check if are u sure about your answer? This is an email send by the lecturer to clarify:

"In regards to Homework Set 2, Question 2 (A) is it asking to calculate the current spot exchange rate? So divide GBP/EUR at 3-month forward rate? Also is Shrewsbury receiving foreign currency from Elton Peters?"

Answer:

- Yes, Question 2(A) of Homework Set 2 asks you to calculate the current spot exchange rate. Since there is no explicit spot rate available for GBP and EUR, you might recall the way the cross rate is calculated from lecture 3, which is S(j/k)=S(jn)S(nk). Similarly, you calculate 3-month forward rate using the cross rate calculation.

- Yes, Shrewsbury is receiving foreign currency (EUR) from its French importer.

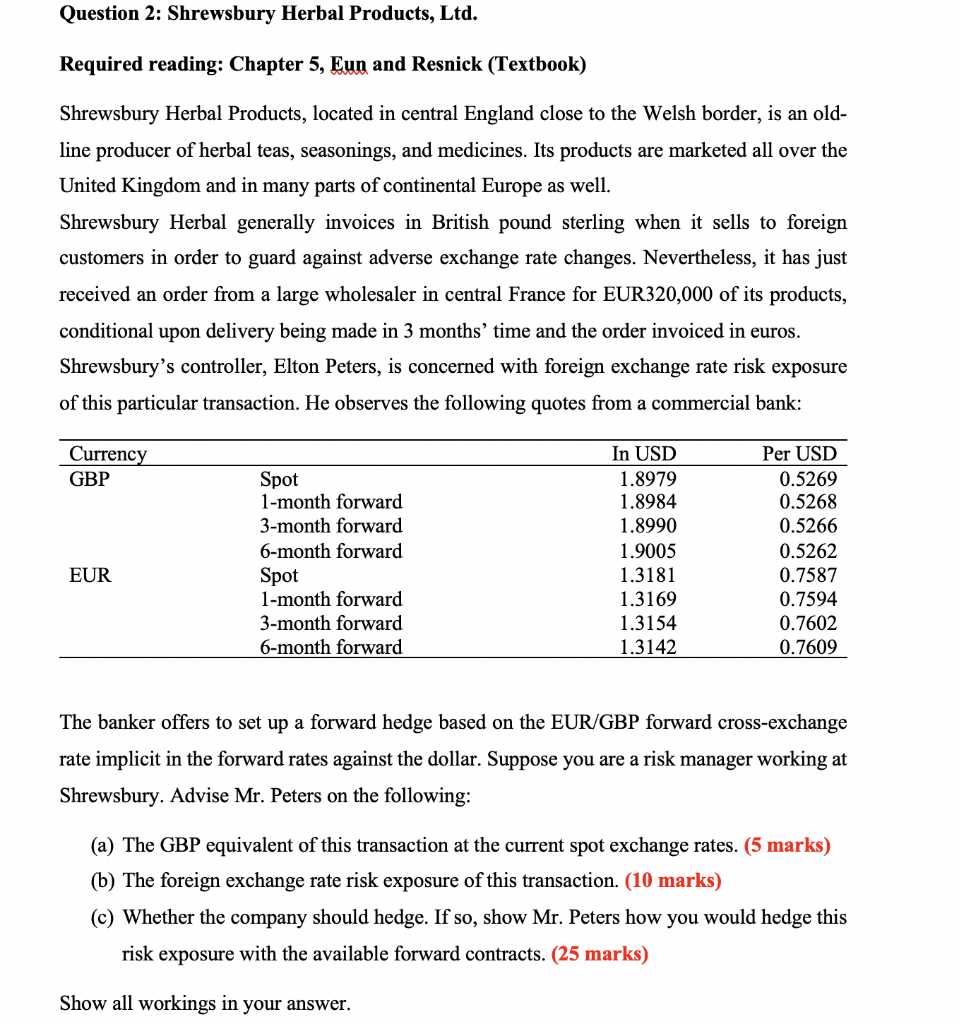

Question 2: Shrewsbury Herbal Products, Ltd. Required reading: Chapter 5, Eun and Resnick (Textbook) Shrewsbury Herbal Products, located in central England close to the Welsh border, is an old- line producer of herbal teas, seasonings, and medicines. Its products are marketed all over the United Kingdom and in many parts of continental Europe as well. Shrewsbury Herbal generally invoices in British pound sterling when it sells to foreign customers in order to guard against adverse exchange rate changes. Nevertheless, it has just received an order from a large wholesaler in central France for EUR320,000 of its products, conditional upon delivery being made in 3 months' time and the order invoiced in euros. Shrewsbury's controller, Elton Peters, is concerned with foreign exchange rate risk exposure of this particular transaction. He observes the following quotes from a commercial bank: Currency GBP Spot 1-month forward 3-month forward 6-month forward Spot 1-month forward 3-month forward 6-month forward In USD 1.8979 1.8984 1.8990 1.9005 1.3181 1.3169 1.3154 1.3142 Per USD 0.5269 0.5268 0.5266 0.5262 0.7587 0.7594 0.7602 0.7609 EUR The banker offers to set up a forward hedge based on the EUR/GBP forward cross-exchange rate implicit in the forward rates against the dollar. Suppose you are a risk manager working at Shrewsbury. Advise Mr. Peters on the following: (a) The GBP equivalent of this transaction at the current spot exchange rates. (5 marks) (b) The foreign exchange rate risk exposure of this transaction. (10 marks) (c) Whether the company should hedge. If so, show Mr. Peters how you would hedge this risk exposure with the available forward contracts. (25 marks) Show all workings in your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts