Question: Please just give me the answer for each, (a,b,c,d,e,f,g,h) I Don't need to see the work. Thank You FOR THE FOLLOWING PROBLEMS, USE EXHIBIT B

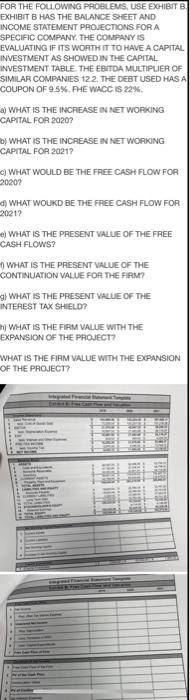

FOR THE FOLLOWING PROBLEMS, USE EXHIBIT B EXHIBIT B HAS THE BALANCE SHEET AND INCOME STATEMENT PROJECTIONS FOR A SPECIFIC COMPANY. THE COMPANY IS EVALUATING IF ITS WORTH IT TO HAVE A CAPITAL INVESTMENT AS SHOWED IN THE CAPITAL INVESTMENT TABLE THE EBITDA MULTIPLIER OF SIMILAR COMPANIES 122. THE DEBT USED HAS A COUPON OF 9.5%. HE WACC IS 22% a) WHAT IS THE INCREASE IN NETWORKING CAPITAL FOR 2020? WHAT IS THE INCREASE IN NETWORKING CAPITAL FOR 2021 a) WHAT WOULD BE THE FREE CASH FLOW FOR -2020? d) WHAT WOUKD BE THE FREE CASH FLOW FOR 2021? e) WHAT IS THE PRESENT VALUE OF THE FREE CASH FLOWS? WHAT IS THE PRESENT VALUE OF THE CONTINUATION VALUE FOR THE FIRM? g) WHAT IS THE PRESENT VALUE OF THE INTEREST TAX SHIELD? H WHAT IS THE FIRM VALUE WITH THE EXPANSION OF THE PROJECT? WHAT IS THE FIRM VALUE WITH THE EXPANSION OF THE PROJECT? FOR THE FOLLOWING PROBLEMS, USE EXHIBIT B EXHIBIT B HAS THE BALANCE SHEET AND INCOME STATEMENT PROJECTIONS FOR A SPECIFIC COMPANY. THE COMPANY IS EVALUATING IF ITS WORTH IT TO HAVE A CAPITAL INVESTMENT AS SHOWED IN THE CAPITAL INVESTMENT TABLE THE EBITDA MULTIPLIER OF SIMILAR COMPANIES 122. THE DEBT USED HAS A COUPON OF 9.5%. HE WACC IS 22% a) WHAT IS THE INCREASE IN NETWORKING CAPITAL FOR 2020? WHAT IS THE INCREASE IN NETWORKING CAPITAL FOR 2021 a) WHAT WOULD BE THE FREE CASH FLOW FOR -2020? d) WHAT WOUKD BE THE FREE CASH FLOW FOR 2021? e) WHAT IS THE PRESENT VALUE OF THE FREE CASH FLOWS? WHAT IS THE PRESENT VALUE OF THE CONTINUATION VALUE FOR THE FIRM? g) WHAT IS THE PRESENT VALUE OF THE INTEREST TAX SHIELD? H WHAT IS THE FIRM VALUE WITH THE EXPANSION OF THE PROJECT? WHAT IS THE FIRM VALUE WITH THE EXPANSION OF THE PROJECT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts