Question: PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please Required Information [The following

PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please

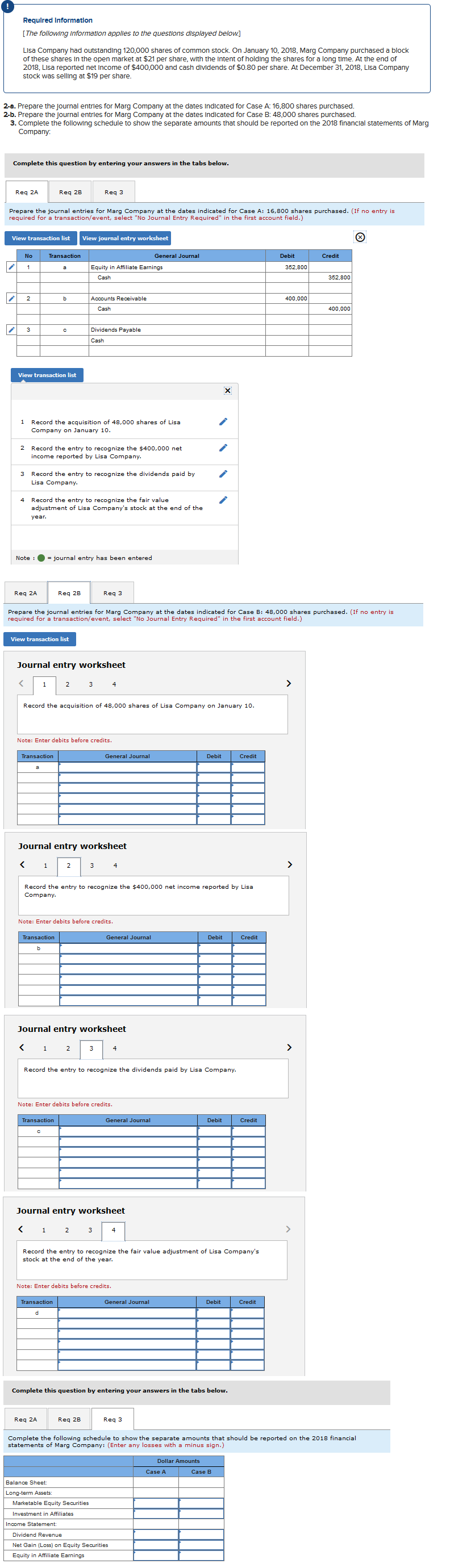

Required Information [The following information applies to the questions displayed below.] Lisa Company had outstanding 120,000 shares of common stock. On January 10, 2018, Marg Company purchased a block of these shares in the open market at $21 per share, with the intent of holding the shares for a long time. At the end of 2018, Lisa reported net Income of $400,000 and cash dividends of $0.80 per share. At December 31, 2018, Lisa Company stock was selling at $19 per share. 2-a. Prepare the journal entries for Marg Company at the dates Indicated for Case A: 16,800 shares purchased. 2-b. Prepare the journal entries for Marg Company at the dates Indicated for Case B: 48,000 shares purchased. 3. Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Marg Company: Complete this question by entering your answers in the tabs below. Reg 2A Reg 2B Reg 3 Prepare the journal entries for Marg Company at the dates indicated for Case A: 16,800 shares purchased. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list View journal entry worksheet X No Transaction Credit General Journal Equity in Affiliate Earnings Cash Debit 352,800 1 352,800 2 b 400.000 Accounts Receivable Cash 400,000 3 Dividends Payable Cash View transaction list 1 Record the acquisition of 48,000 shares of Lisa Company on January 10. 2 Record the entry to recognize the $400,000 net income reported by Lisa Company. 3 Record the entry to recognize the dividends paid by Lisa Company. Record the entry to recognize the fair value adjustment of Lisa Company's stock at the end of the year. Note : = journal entry has been entered Reg 2A Reg 2 Reg 3 Prepare the journal entries for Marg Company at the dates indicated for Case B: 48,000 shares purchased. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the acquisition of 48,000 shares of Lisa Company on January 10. Note: Enter debits before credits. Transaction General Journal Debit Credit Journal entry worksheet Record the entry to recognize the dividends paid by Lisa Company. Note: Enter debits before credits. Transaction General Journal Debit Credit Journal entry worksheet Record the entry to recognize the fair value adjustment of Lisa Company's stock at the end of the year. Note: Enter debits before credits. Transaction General Journal Debit Credit d Complete this question by entering your answers in the tabs below. Reg 2A Reg 2B Reg 3 Complete the following schedule to show the separate amounts that should be reported on the 2018 financial statements of Marg Company: (Enter any losses with a minus sign.) Dollar Amounts Case A Case B Balance Sheet: Long-term Assets Marketable Equity Securities Investment in Affiliates Income Statement: Dividend Revenue Net Gain (Loss) on Equity Securities Equity in Affiliate Earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts