Question: PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please Husain, Inc.'s income statement

PLEASE just put answer i dont understand it at all so an explanation will NOT help, just lines with answers please

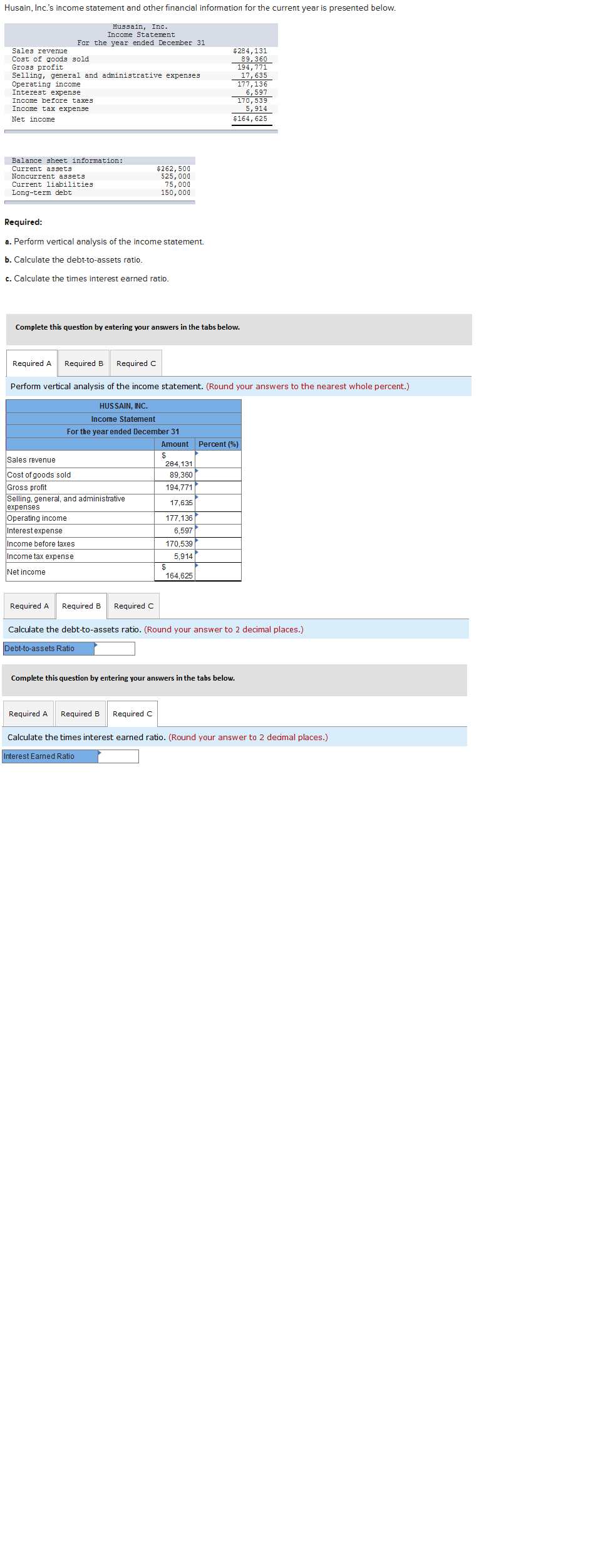

Husain, Inc.'s income statement and other financial information for the current year is presented below. Hussain, Inc. Income Statement For the year ended December 31 Sales revenue Cost of goods sold Gross profit Selling, general and administrative expenses Operating income Interest expense Income before taxes Income tax expense Net income $284, 131 89, 360 194,771 17,635 177,136 6,597 170,539 5,914 $164, 625 Balance sheet information: Current assets Noncurrent assets Current liabilities Long-term debt $262,500 525,000 75,000 150,000 Required: a. Perform vertical analysis of the income statement. b. Calculate the debt-to-assets ratio. c. Calculate the times interest earned ratio. Complete this question by entering your answers in the tabs below. Required A Required B Required C Perform vertical analysis of the income statement. (Round your answers to the nearest whole percent.) HUSSAIN, INC. Income Statement For the year ended December 31 Amount Percent (%) $ Sales revenue 284,131 Cost of goods sold 89,360 Gross profit 194,771 Selling, general, and administrative 17,635 expenses Operating income 177,136 Interest expense 6,597 Income before taxes 170.539 Income tax expense 5,914 Net income 164,625 Required A Required B Required c Calculate the debt-to-assets ratio. (Round your answer to 2 decimal places.) Debt-to-assets Ratio Complete this question by entering your answers in the tabs below. Required A Required B Required c Calculate the times interest earned ratio. (Round your answer ta 2 decimal places.) Interest Earned Ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts