Question: Please justify your work if possible. thanks! $ (4) As in Example (8.10.7), consider a European call option with expiration in one month and strike

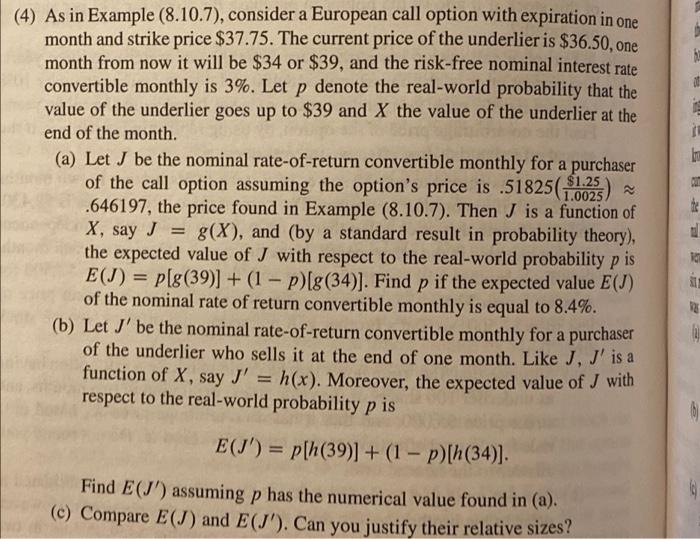

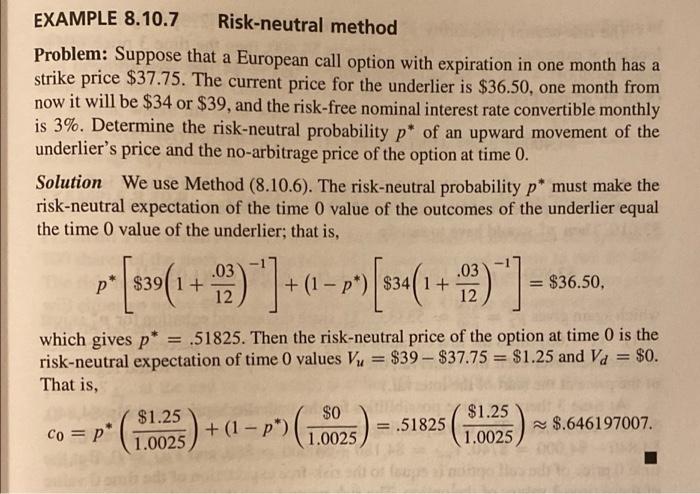

$ (4) As in Example (8.10.7), consider a European call option with expiration in one month and strike price $37.75. The current price of the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Let p denote the real-world probability that the value of the underlier goes up to $39 and X the value of the underlier at the end of the month. (a) Let J be the nominal rate-of-return convertible monthly for a purchaser of the call option assuming the option's price is .51825(1.0025) .646197, the price found in Example (8.10.7). Then J is a function of X, say J = g(x), and (by a standard result in probability theory), the expected value of J with respect to the real-world probability p is E(J) = p[g(39)] + (1 - p)[g(34)]. Find p if the expected value E(J) of the nominal rate of return convertible monthly is equal to 8.4%. (b) Let J' be the nominal rate-of-return convertible monthly for a purchaser of the underlier who sells it at the end of one month. Like J, J' is a function of X, say J' = h(x). Moreover, the expected value of J with . respect to the real-world probability p is = a E(J') = ph(39)] + (1 - p)[h(34)]. Find E(J') assuming p has the numerical value found in (a). (c) Compare E(I) and E(J'). Can you justify their relative sizes? EXAMPLE 8.10.7 Risk-neutral method Problem: Suppose that a European call option with expiration in one month has a strike price $37.75. The current price for the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Determine the risk-neutral probability p* of an upward movement of the underlier's price and the no-arbitrage price of the option at time 0. Solution We use Method (8.10.6). The risk-neutral probability p* must make the risk-neutral expectation of the time 0 value of the outcomes of the underlier equal the time 0 value of the underlier, that is, [s30(1+0) "1+0.--[s*(1 + )"} p" .03 1+ 12 + $34 1+ .03 12 $36.50, which gives p* = .51825. Then the risk-neutral price of the option at time 0 is the risk-neutral expectation of time 0 values V = $39 - $37.75 = $1.25 and Vd = $0. That is, $1.25 $0 $1.25 Co = p* .51825 $.646197007. 1.0025 1.0025 1.0025 1+(1p") ( $ (4) As in Example (8.10.7), consider a European call option with expiration in one month and strike price $37.75. The current price of the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Let p denote the real-world probability that the value of the underlier goes up to $39 and X the value of the underlier at the end of the month. (a) Let J be the nominal rate-of-return convertible monthly for a purchaser of the call option assuming the option's price is .51825(1.0025) .646197, the price found in Example (8.10.7). Then J is a function of X, say J = g(x), and (by a standard result in probability theory), the expected value of J with respect to the real-world probability p is E(J) = p[g(39)] + (1 - p)[g(34)]. Find p if the expected value E(J) of the nominal rate of return convertible monthly is equal to 8.4%. (b) Let J' be the nominal rate-of-return convertible monthly for a purchaser of the underlier who sells it at the end of one month. Like J, J' is a function of X, say J' = h(x). Moreover, the expected value of J with . respect to the real-world probability p is = a E(J') = ph(39)] + (1 - p)[h(34)]. Find E(J') assuming p has the numerical value found in (a). (c) Compare E(I) and E(J'). Can you justify their relative sizes? EXAMPLE 8.10.7 Risk-neutral method Problem: Suppose that a European call option with expiration in one month has a strike price $37.75. The current price for the underlier is $36.50, one month from now it will be $34 or $39, and the risk-free nominal interest rate convertible monthly is 3%. Determine the risk-neutral probability p* of an upward movement of the underlier's price and the no-arbitrage price of the option at time 0. Solution We use Method (8.10.6). The risk-neutral probability p* must make the risk-neutral expectation of the time 0 value of the outcomes of the underlier equal the time 0 value of the underlier, that is, [s30(1+0) "1+0.--[s*(1 + )"} p" .03 1+ 12 + $34 1+ .03 12 $36.50, which gives p* = .51825. Then the risk-neutral price of the option at time 0 is the risk-neutral expectation of time 0 values V = $39 - $37.75 = $1.25 and Vd = $0. That is, $1.25 $0 $1.25 Co = p* .51825 $.646197007. 1.0025 1.0025 1.0025 1+(1p") (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts